Survey reveals logistics sector’s uncertainty over recovery

08 / 02 / 2022

Image: Shutterstock

Logistics professionals are uncertain about the global economic outlook in 2022 but a majority feel air and ocean rates will begin to moderate by the end of the year.

The latest Emerging Markets Logistics Index from logistics firm Agility and consultant Transport Intelligence found the supply chain sector was split over global economic prospects in the year ahead.

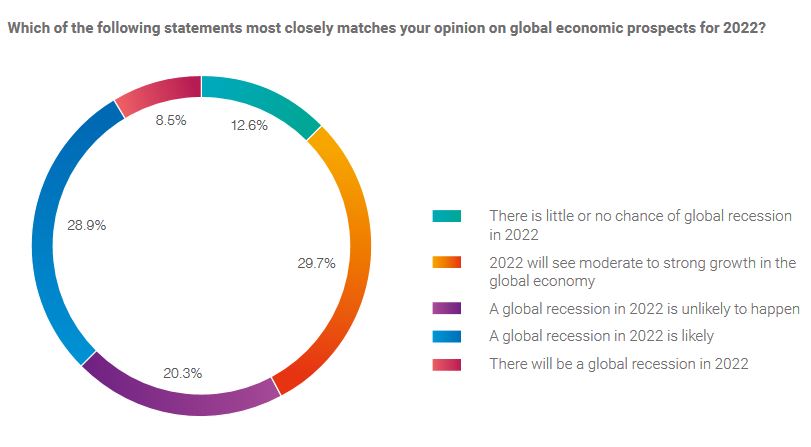

Of the 756 professionals in the logistics industry that took part, 29.7% felt 2022 will see moderate to strong growth in the global economy. However, 28.9% felt that a global recession in 2022 is likely.

“Uncertainty is the only certainty of the Covid-19 pandemic and recovery prospects,” the report stated. “The global economic outlook remains precarious, and this is reflected in survey responses.

“The lack of consensus about global economic prospects for 2022 among respondents is striking and underlines the continued uncertainty about the impact of Covid-19 on the global economy.”

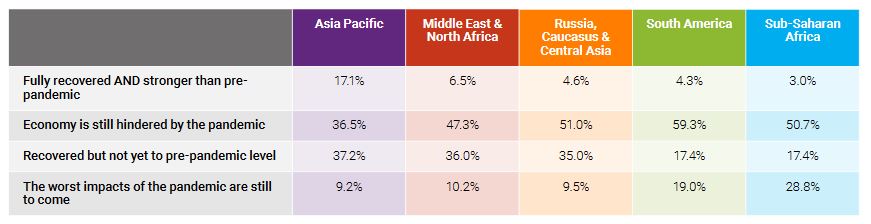

Looking at specific “emerging” regions, the general consensus was that economies are showing signs of recovery but have yet to reach pre-pandemic levels and were still hindered by the pandemic.

“Asia Pacific’s regional economy exhibits the strongest economic recovery from the Covid-19 pandemic of the five regions examined but is still below the pre-pandemic level, according to survey respondents,” the report stated.

“Although the pandemic has caused significant hardship, the region has remained relatively resilient and its GDP growth has been relatively stable during the pandemic.”

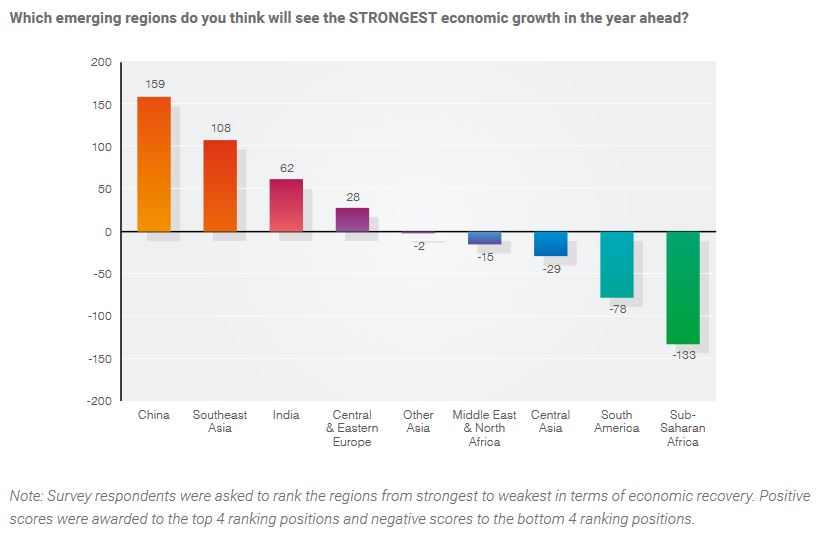

China, Southeast Asia and India (in that order) were expected to report the strongest recovery in 2022, while Sub-Saharan Africa, South America and Central Asia the weakest.

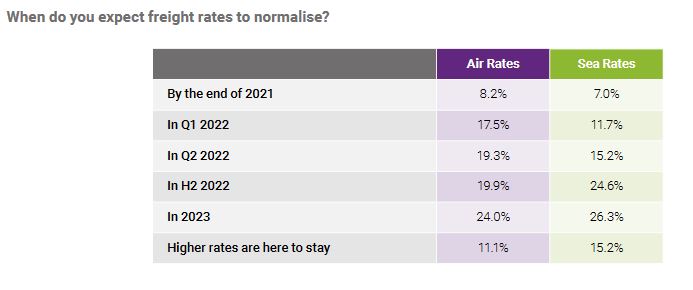

When it comes to freight rates, 19.9% expect airfreight prices to normalise in the second half of this year while 24% expect it to take until 2023. Just over 11% feel higher rates are here to stay.

“The imbalance of cargo flows, capacity constraints and supply chain bottlenecks have been a feature of the global logistics market in 2021,” the report stated.

“The pandemic disrupted global trade, driving up the cost of moving goods to historic levels. This of course begs the question: when will freight rates normalise? The majority of respondents believe that elevated air and sea freight rates are here to stay until at least the second half of 2022.

“Only a small proportion of respondents think that higher rates will become a permanent feature of global supply chains.”

Respondents were split on when container port congestion, which is one factor that has fuelled airfreight demand, would ease, with 29.2% expecting it to happen in the second quarter of 2022, 27.7% expecting improvements in the second half and 19.8% predicting next year or later.

The main aim of the survey is to rank the world’s 50 leading emerging markets. The Index ranks countries for overall competitiveness based on their logistics strengths, business climates and, for the first time, their digital readiness.

China and India, the world’s two largest countries in population terms, held their spots at number one and number two in the overall rankings.

UAE, Malaysia, Indonesia, Saudi Arabia, Qatar, Thailand, Mexico and Turkey rounded out the top 10. Vietnam, number eight in 2021, fell to 11, switching places with Thailand.

South Africa ranked number 24, highest among countries in Sub-Saharan Africa.