ACI: Airport volumes up in April but growth starting to subside versus 2017

01 / 08 / 2018

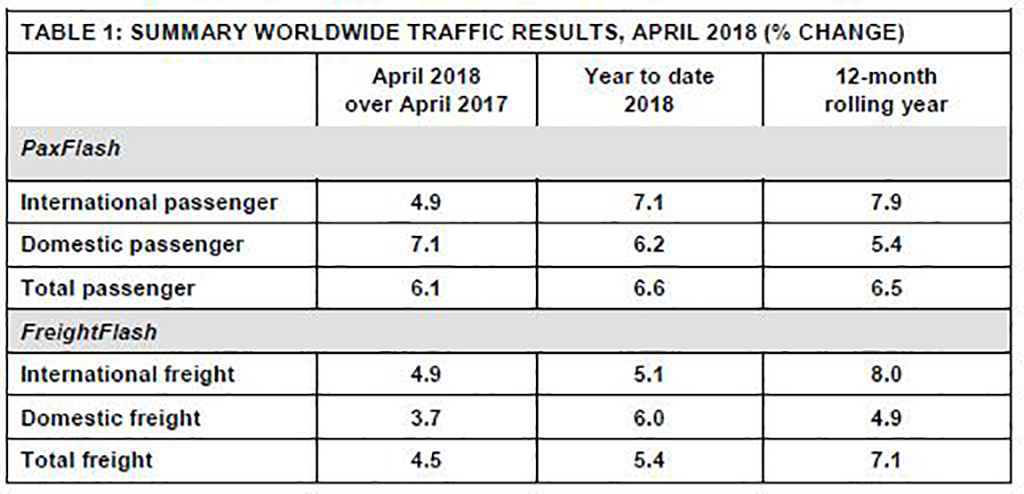

Airports Council International (ACI) World reported that April’s freight volumes increased 4.5%, outpacing a slow March, with the market displaying "some resilience" despite the threat of trade wars, although the high growth of 2017 is "starting to subside".

ACI’s month-by-month passenger and freight statistics are based on a significant sample of airports that provide regular reports.

"While passenger traffic has continued to follow the strong growth trend already established in 2018, we have seen the growth of freight volumes showing some signs of recovery from earlier in the year," said Angela Gittens, ACI World director general.

She added: "International freight was the main driver of the bounce in volumes in April, following a slower month of March, with the market showing some resilience in the face of the growing risk of increased protectionism trade wars. Although the 12-month rolling average remained strong at 7.1%, it appears the high growth trend observed throughout most of 2017 is starting to subside."

ACI World’s freight volume analysis:

Freight volumes regained momentum in April, following a slower month of March. International freight was the main driver of both shifts, representing around 70% of the global market. The segment’s year-over-year figure rose to 4.9% during the month, up from 1.9% in March.

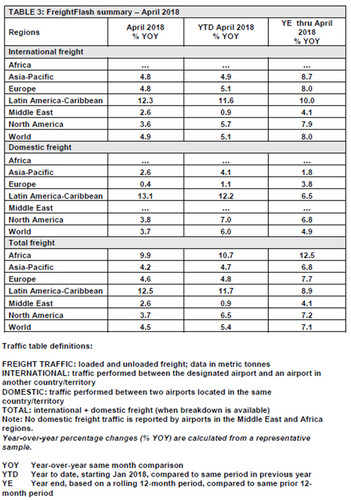

Europe and Asia-Pacific both accelerated in April, after suffering from slowdowns in March for overall freight volumes. On a year-over-year basis, Europe posted 4.6% growth, up from 0.9% one month prior, while Asia-Pacific posted 4.2%, up from 1.0%.

Europe’s freight growth was driven almost exclusively by its international segment, which represents more than 90% of the region’s volumes, and reached 4.8% during the period. As with its passenger market, the region displayed an unequal growth pattern for freight; while Belgium grew by 15.7% due to the success of Liège Airport (LGG).

The Netherlands posted a 6.3% decline, with Amsterdam-Schiphol (AMS) falling by a similar figure. France, Luxembourg and Italy all posted depressed figures, at -2.9%, -1.2% and 0.5% respectively on a year-over-year basis. Meanwhile, Spain grew by 18.4%, reaching 16.7% on a 12-months rolling average basis.

Freight volumes at Madrid-Barajas airport (MAD), the country’s major hub accounting for 53% of volumes in 2016, increased by 15.7% in April. Since May 2017, the airport’s freight market has benefitted from double-digit expansion in all but one month, where it grew by 9.8%.

Asia-Pacific displayed more homogeneous growth patterns. Of its major air freight markets, all but Thailand (9.0%) and South Korea (0.4%) posted year-over-year figures between 2.0% and 6.0%.

India (5.7%), Hong Kong (5.0%), China (4.9%), and Singapore (4.5%) all posted fairly strong growth. Taiwan and Japan, with 3.3% and 2.2% respectively, trailed behind slightly. Although the figures signal recovered momentum after a slower month of March, they may also hide a shift in freight trends for the region, which had been growing at a particularly fast rate until February 2018.

April year-to-date figures stood at 4.7%, with a 12-months rolling average of 6.8%. While secular trends in global trade and economic activity remain positive, trade tensions and tariff wars may result in an adverse impact to the region’s air freight industry in the coming months.

North America has already started to experience more subdued growth in April as year-over-year-volumes slowed down to 3.7% year-over-year. This comes after a strong run leading to a +7.1% figure on a 12-month rolling average basis. Geopolitical tensions related to trade have recently escalated into import tariffs between a number of major economies and the United States, which may lead to a substantial slowdown in the coming months.

The Middle East’s freight market had, until March, proven relatively resilient to the geopolitical tensions which loom over its passenger market.

Volumes declined by 2.1% in March, however, and the market’s 12-months rolling average is currently slipping, having reached 4.1% in April, down 0.2 percentage points after posting an increase of 2.6% year-over-year during the month. Given the general trends observed in the industry, a gradual slowdown may be in the region’s future in the coming months.

Latin America-Caribbean and Africa, the two smallest freight markets of the six ACI traffic regions, grew the fastest in April, at 12.5% and 9.9% respectively.

The two regions have benefitted from a strong early 2018, with both year-to-date freight figures reaching double digits, at 11.7% and 10.7% respectively. These gains were driven mostly by rising international freight volumes, however, and may leave their markets vulnerable to global trade shocks.

Read more Cargo Airport News news

Sign up to receive Air Cargo News direct to your inbox for free