Mixed outlook for airports but May’s cargo volumes pick up speed

07 / 08 / 2018

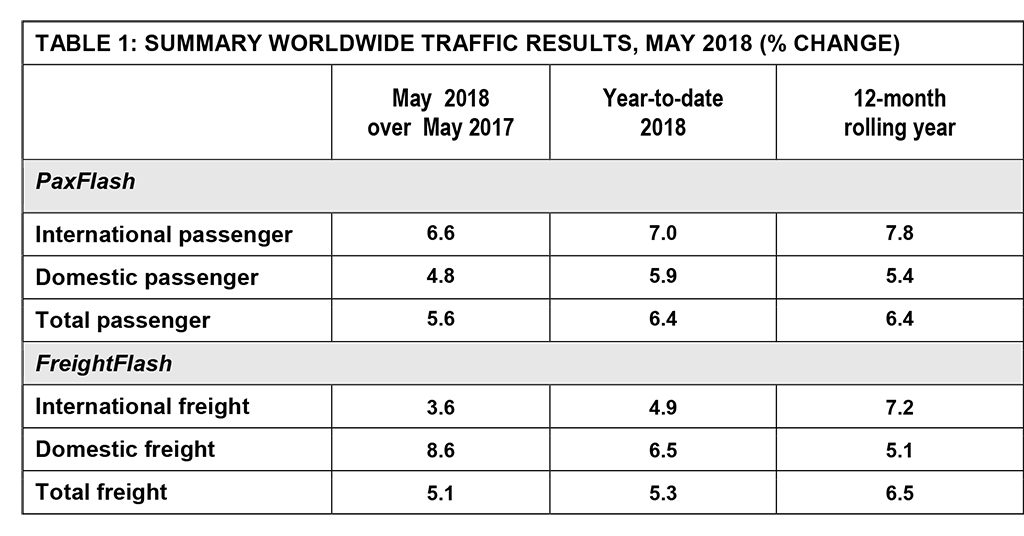

Global airfreight volumes “picked up speed” in May, registering a 5.1% year-on-year increase despite comparison with a high octane month in 2017.

The latest monthly statistics from Airports Council International (ACI) World warned that the outlook for global airfreight is “currently mixed”, with trade tensions and inflation up in May, but added that airfreight demand remains "robust in the near term”.

Global passenger traffic grew by 5.6% in May on a year-over-year basis.

The report stated: “Freight volumes picked up speed during the month despite comparing to a particularly favourable May 2017, reaching +5.1% year-over-year, close to their +5.3% year-to-date figures.

“While this was close to one percentage point below its year-to-date growth figure, it remains a robust demonstration of resilience considering the global climate of increasing geopolitical tension.”

ACI’s month-by-month passenger and freight statistics are based on a significant sample of airports that provide regular reports and form part of the world’s most comprehensive source for airport data.

“The air transport sector has shown remarkable resilience to the tense climate that has descended over international relations and trade," said Angela Gittens, director general, ACI World.

She continued: "Tensions include the ongoing Qatari blockade and the political challenges facing major Western powers including Brexit negotiations in Europe, and the shifting approach to international relations in the US.”

"The link between aviation and global macroeconomic conditions, however, remains strong, so a prolonged period of diplomatic and market instability could dampen the industry’s outlook for the near future."

Freight volumes analysis from ACI World:

Freight volumes continued on an upward curve in May, reaching +5.1% on a year-over-year basis, from +4.5% in April and +2.4% in March. May’s results were just below year-to-date figures, which stood at +5.3%.

For context, March and May 2017 figures were particularly high, with almost all regions reaching double-digit growth, leading to relatively slower figures this year. The domestic segment, particularly through North America’s high figures, drove a significant portion of that growth. It posted +8.6% for the period, compared to +3.6% for the international market.

On a year-to-date basis, international freight has been growing at a slower speed than domestic freight this year, a change of pace from 2017.

North America and Latin America-Caribbean performed particularly well during the period, both reaching +8.6% on a year-over-year basis. North America’s figures showed solid gains for both Canada and the United States, with 14.3% and 8.5% respectively on a year-over-year basis.

The US freight market was still going strong in May, with a year-to-date figure standing at +6.9%. These numbers were mostly driven by domestic freight, which gained 11.3% in May, compared to 4.6% for the international segment. At the airport level, Miami (MIA) and Memphis (MEM) benefitted from strong growth rates, with 9.0% and 8.7% respectively.

As with passenger traffic, Chile and Mexico contributed a significant portion of growth to the Latin America-Caribbean’s freight market in May. The former posted +36.6% on a year-over year-basis, with its year-to-date growth reaching +21.1%. Mexico posted +10.3%, pushing its year-to-date to +9.5%. Chile’s Santiago airport (SCL), which suffered a slowdown in freight traffic in the first quarter of 2017, has managed to recover the loss since and has been growing at double-digit figures in the last six months. The airport posted an increase of 38.0% in freight volumes in May on a year-over-year basis.

Affected by 2017 numbers, Europe‘s freight market suffered a relative slowdown during May, posting +1.3% after growing by 4.6% in April and 0.9% in March. Although year-to-date figures remain in moderate growth territory with 4% at the end of May, the region’s 12-months rolling average has been trending downwards in 2018.

As with Europe, Asia-Pacific’s growth, though still robust at +4.8% on a year-to-date basis, has been middling in recent months, its 12-months rolling average reaching +6.3% in May.

Year-over-year growth in freight volumes in the region’s major markets was relatively homogeneous, with figures ranging from +6.1% for India, to +3.1% for South Korea.

Chinese Taipei (+5.0%), Hong Kong (+4.7%), China (+4.4%) and Japan (+3.6%) all fell between this range. Asia-Pacific’s major air freight markets remain vulnerable to incoming tariffs from the United States through their consumer electronics exports. As such, this more moderate growth may remain for most of 2018.

The Middle East, where the freight market had long sustained growth despite local geopolitical tensions, fell for the second month this year, posting -0.9% for the month of May. Its year-to-date numbers stood at +0.4%, with a rolling 12-month average of +3.1%, which has been steadily declining.

The slowdown was mainly due to the United Arab Emirates, the largest freight market in the region, which fell by 5.4% during the month, bringing its year-to-date figures to -4.4%. Qatar’s Hamad International Airport (DOH), despite the blockade, managed to grow by 4.6% on a year-over-year basis. The airport’s year-to-date figures stood at 8.4% at the end of May.

Africa, though remaining the smallest freight market of the six ACI regions, has been growing at a strong rate in the last year. May figures stood at +13.5%, pushing year-to-date figures to +11.4%.

his is partly due to recovering figures in Nigeria and Egypt, which represent a major part of the region’s freight market and grew substantially during the month. Nigeria’s year-to-date figures stood at +10.2% in May.

Egypt, which has been oscillating between declines and low growth rates in recent months, achieved +19.1% growth for the month on a year-over-year basis, pushing up its year-to-date to +1.0%.

Read more Cargo Airport news

Sign up to receive Air Cargo News direct to your inbox for free