Subdued growth for cargo hubs in 2015

24 / 02 / 2016

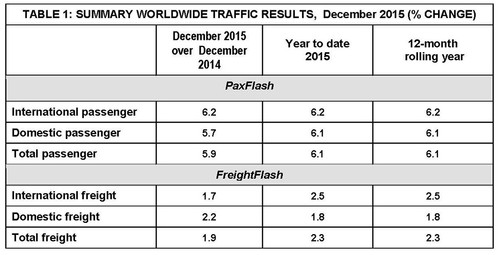

Subdued growth in emerging markets and developing economies, along with a lower recovery in advanced economies, saw airfreight markets “substantially weaker” in 2015 compared with passenger, reporting a “modest 2.3%” growth in total freight volumes.

That is the message from Airports Council International (ACI) in releasing its preliminary data for last year

ACI said that cargo’s growth components saw a 2.5% rise in international freight and a 1.8% increase for domestic freight on an annualised basis.

Said ACI: “The faster-than-expected slowdown in Chinese imports and exports reflects weaker capital investment and manufacturing activity, which were key drivers for global economy over the last two decades.

“Even though all regions remained in positive territory where airfreight growth is concerned, only the Middle East demonstrated a strong increase of 10.7% in 2015, whilst all other regions grew only marginally.”

In a breakdown of regional results, ACI gave the following summaries.

Africa

Total freight traffic in Africa increased by 1.7% in December 2015, as compared to the previous year and by 3.2% during the twelve months of 2015. On a country-by-country basis the results were mixed: even though the major airfreight markets of South Africa and Egypt grew by 11.3% and 6% respectively in 2015, a number of countries reported air freight declines, including Kenya (-5.1%) and Nigeria (-2.6%).

Geopolitical risks in Northern Africa coupled with lower commodity prices and high borrowing costs weighed heavily on several African economies, even though most countries are expected to see a gradual pickup of growth in the coming years.

Asia-Pacific

Total airfreight traffic in Asia-Pacific saw a marginal increase of 0.7% in December 2015, which is in line with weak freight growth over the course of the year (+1.5% on an annualised basis). International airfreight growth was especially weak during the twelve months, amounting to only 1%.

China, accounting for almost a third of airfreight traffic in the region, grew by a modest 3.3% in total traffic (+3.3% in domestic and +3.4% in international freight).

Japan grew by a marginal 0.9%, where a 5.2% decline in domestic freight was counterbalanced with 3.4% growth international freight.

Hong Kong remained flat at 0.1%, whilst India posted robust 6.4% in total freight, where both domestic and international traffic went up by 7.4% and 5.8% respectively.

Korea reported marginal growth of 0.4% in total freight, where the 0.9% growth in international freight was suppressed by a 3.7% decline in domestic freight traffic. Chinese Taipei went into negative territory with a 3.2% decline in international and total freight.

Europe

Even though airfreight in Europe grew by 2.8% in the sole month of December 2015, this performance was well above the growth rate for the full year: 0.7% due to weak growth of 0.9% in international freight and a 3.9% decline in domestic freight.

The largest European airfreight markets of Germany, France and the Netherlands saw declines in airfreight volumes of 0.2%, 0.5% and 0.7% respectively, whilst United Kingdom remained flat at 0.2%.

The marginal growth at the regional level was achieved with the help of Belgium, Italy, Luxembourg and Turkey, growing by 8.6%, 5%, 4.2% and 3.5% respectively.

The four largest European cargo hubs experienced airfreight declines in 2015: Frankfurt (FRA, -2.8%), Paris-Charles de Gaulle (CDG, -1.4%), Amsterdam (AMS, -0.7%) and London-Heathrow (LHR, -0.2%).

Latin America-Caribbean

Latin America-Caribbean was the only region that dipped into negative territory in terms of airfreight in the month of December, coming in at -0.4%. The performance was symptomatic of weak freight growth for the twelve months of the year (1.2%).

The region saw marginal growth in international freight (+2.2%) and a 1% decline in domestic freight over the course of the year.

Brazil—the largest air freight market in the region—experienced a major decline in airfreight traffic of 9.1%, with the decline in domestic freight being more pronounced than in international freight (-15.2% versus -3.8% respectively).

At the same time, Colombia (+4.9%) and Mexico (+7.8%) kept their momentum as the key airfreight growth drivers in the region.

Similar growth rates in domestic airfreight were achieved in the two countries (10.2% and 10.8% respectively), but a higher growth rate in international freight was seen in Mexico (6.5% versus 2.4% in Colombia).

The results for other significant airfreight players in the region are varied: while Peru and Argentina reported airfreight declines (-1.2% and -8.1% respectively), Ecuador boasted solid 8.3% growth.

On an individual airport level, the results are mixed: Some major airports experienced airfreight increases, such as Mexico City (MEX, +50,000 tonnes), San Juan (SJU, +50,000 tonnes) and Bogota (BOG, + 32,000 tonnes).

Others reported airfreight traffic losses, such as in Campinas (VCP, -40,000 tonnes), Manaus (-30,000 tonnes) and Sao Paulo-Guarulhos (GRU, – 25,000 tonnes).

Middle East

Middle Eastern airports posted an outstanding 9.1% growth in airfreight for the sole month of December and 10.7% growth on an annualised basis, which is over five times greater than the global growth rate.

In nine out of twelve months over the course of the year, the Middle East outstripped all other regions in international freight growth, and in ten out of twelve months the region outperformed the rest of the world in total freight.

At the country level, the United Arab Emirates reported a 4.4% growth in international and total airfreight, while the second largest airfreight market, Qatar, reported impressive growth of 47.3% in total freight.

Over the course of the year, Doha (DOH) added an additional 463,000 tonnes of airfreight, which represents an average of nearly 39,000 additional tonnes of airfreight every month.

Put differently, this impressive growth is equivalent to an additional 340 movements of a Boeing 747-400 freighter at maximum revenue payload every month.

North America

North America, the second largest air freight market after Asia-Pacific, reported a 1.4% growth in airfreight for the month of December and 2.4% for the full year.

A number of airports reported substantial increases in airfreight volumes on an annualised basis, including Chicago-O`Hare (ORD, +163,000 tonnes), Anchorage (ANC, + 132,000 tonnes), Los Angeles (LAX, + 98,000 tonnes) and Cincinnati (CVG, + 74,000 tonnes).

Houston (IAH) lost 33,000 tonnes of airfreight as compared to the previous year. With regard to Memphis (MEM) and Louisville (SDF), the two major cargo hubs in the region, both reported growth of 0.9% and 1.9% respectively.

Source: Airports Council International