Air cargo market improves in May but volatility remains

03 / 06 / 2020

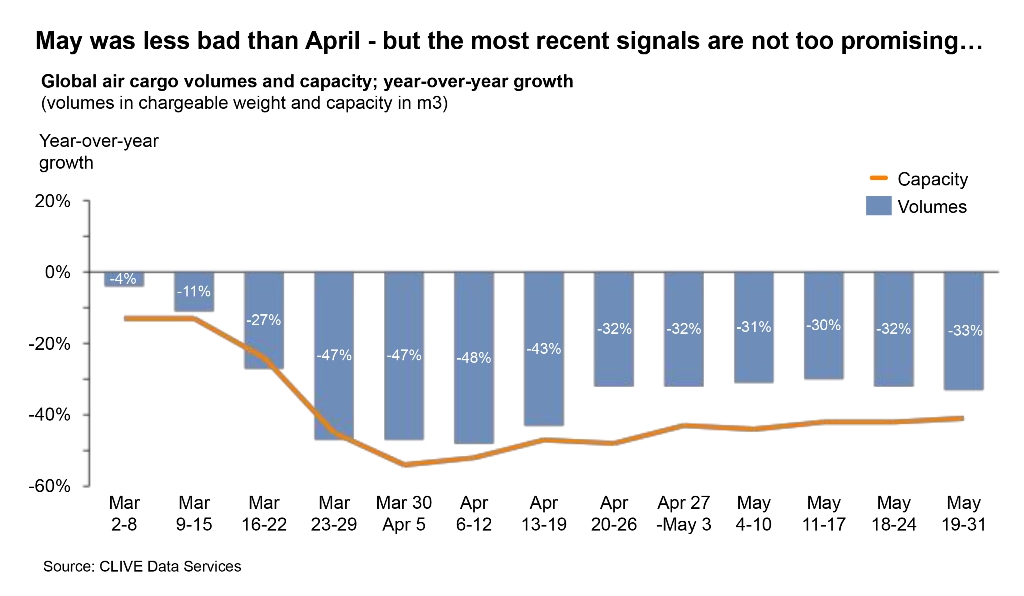

The month of May 2020 was not as bad for the global air cargo industry as April 2020, CLIVE Data Services has reported in its latest airfreight load factor analysis.

CLIVE explained that there was a “slight upward curve” in airfreight volumes, due to the reported -31% year-on-year decline in May compared with the -37% year-on-year decline in April.

Pressure on capacity in May remained high and consequently, CLIVE’s dynamic load factor, based on both the volume and weight perspectives of cargo flown and capacity available, increased month-on-month from 67% to 69%.

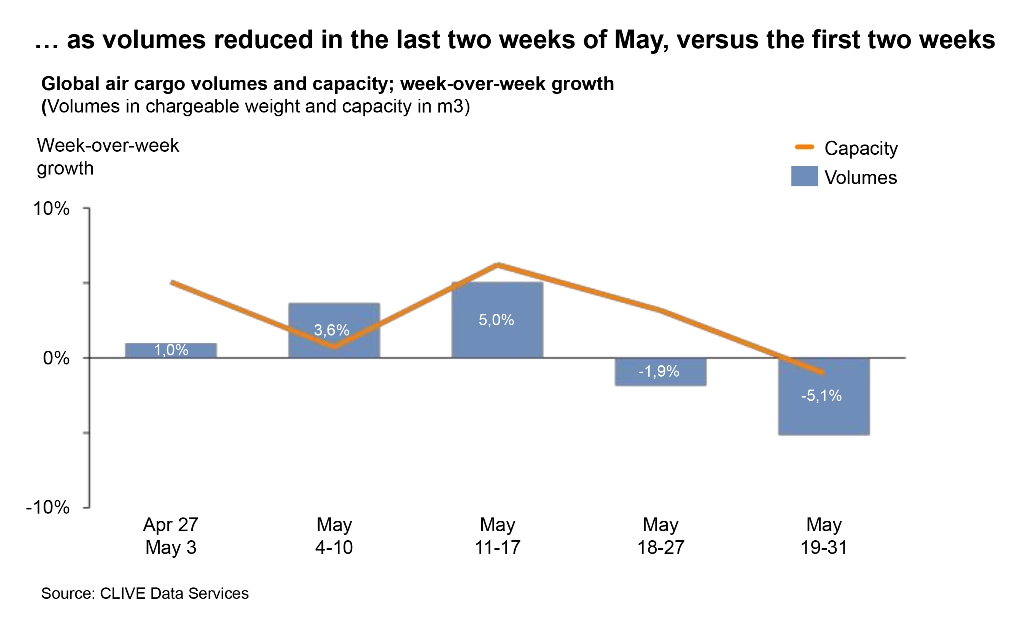

However, CLIVE noted that a fall in demand over the last two weeks May suggested that “more challenging times ahead as airlines return capacity to the market”.

Comparing airfreight demand over the last few months, CLIVE said that March ended far worse than it started, while for April it was the other way around. “Looking at the most recent weeks, it is clear that May ended weaker than it started,” CLIVE explained.

Exploring airfrieght trends in May in more detail, CLIVE reported: “After a series of week-over-week growth in volumes, a decline set in during the week of May 18-24, followed by an even stronger decline for the last week of May. During these last two weeks, the capacity growth rate versus the previous week was higher than the volume growth, thereby reducing the dynamic load factor for the first time in weeks by 0.5%.”

This easing of pressure on capacity had a downward impact on freight rates on major trade lanes, as recently reported by the TAC Index.

IATA: Air cargo demand records steepest ever decline in April

Airfreight rates continue to decline on key trades

Air cargo in stable condition following coronavirus crisis

Niall van de Wouw, managing directr at CLIVE Data Services, commented: “Looking at the last 12 weeks, it is clear to see that market volumes remain erratic and that this will continue for the foreseeable future. This is one of the few certainties we have at the moment.

“We can see some dark clouds gathering and this is a cause of concern for air cargo. This is why, in navigating these uncertain times, weekly data becomes not only relevant to decision-making, but crucial.

“Knowing what is happening each week gives the industry the clearest direction. We do not see signals yet that the increase in capacity is being met by growth in demand. With the announcements of increases in passenger schedules, global air cargo revenues may suffer ‘collateral damage’ of more capacity returning to the market.”