Cirium predicts annual freighter fleet growth of 2.6%

12 / 01 / 2024

Copyright: tratong/ Shutterstock

The freighter fleet will grow by 2.6% annually and 3,590 freighter aircraft will be supplied over the next 20 years, predicts the latest Cirium Fleet Forecast.

This includes 1,060 new build aircraft (30%) worth $140bn and 2,530 conversions from passenger aircraft (70%), said the the aviation analytics company.

“These numbers are similar to the last two forecasts, which already reflected the boom currently being experienced in conversions due to air cargo market dynamics emanating from the pandemic,

including e-commerce growth and feedstock availability,” noted the forecast for 2023-2042.

The report further stressed that “longer term freighter fleet growth will be driven by the ongoing rise of global e-commerce”.

Forecast to continue is the traditional 70% to 30% split in freighter markets between conversions and new deliveries.

However, the report stated that “conversion demand, driven by the ongoing rise of e-commerce along with increasing volumes of feedstock in the wake of the Covid-19 crisis, has seen modification numbers peak in 2023”.

Although the conversion boom has enabled the replacement of old, inefficient aircraft, in line with emissions-reduction goals.

The industry is now focused on conversion of newer generation aircraft. This includes “the A321ceo, 737-800, A330ceo and 777-300ER”.

Around 75% of the current freighter fleet will be retired during the 20-year period.

Looking at the freighter fleet from a geographical perspective, the report stated: “North America, home of the largest integrators and e-commerce providers, will maintain its leading share of the freighter fleet, albeit reduced from 47% to 37%, as the Chinese market grows its fleet by 10 percentage points to a share of 18%.

“This brings the country on a par with Europe as the second largest global cargo market. Long-term forecasting for Russia’s cargo market is uncertain given the current conflict and sanctions, but we currently envisage that the freighter market will contract through to 2042, reducing its global share from 2% to less than 1%.”

The forecast also predicts that freight capacity (available tonne kilometres or ATKs) is forecast to grow at 4.1% annually over 2022.

New widebody factory freighters from Airbus and Boeing are due to enter service in 2026 and 2027 respectively.

The Boeing 777-8F offers a maximum structural payload of 118 tonnes (revenue payload 112.3tonnes) and a range of 8,167 km, while its cargo door has a width of 3.72 m.

According to Airbus, the A350F has equal volume to the 747F, and +5t more payload compared to the 777F. The airframer said it has 40% lower fuel burn and CO2 emissions compared to the 747F.

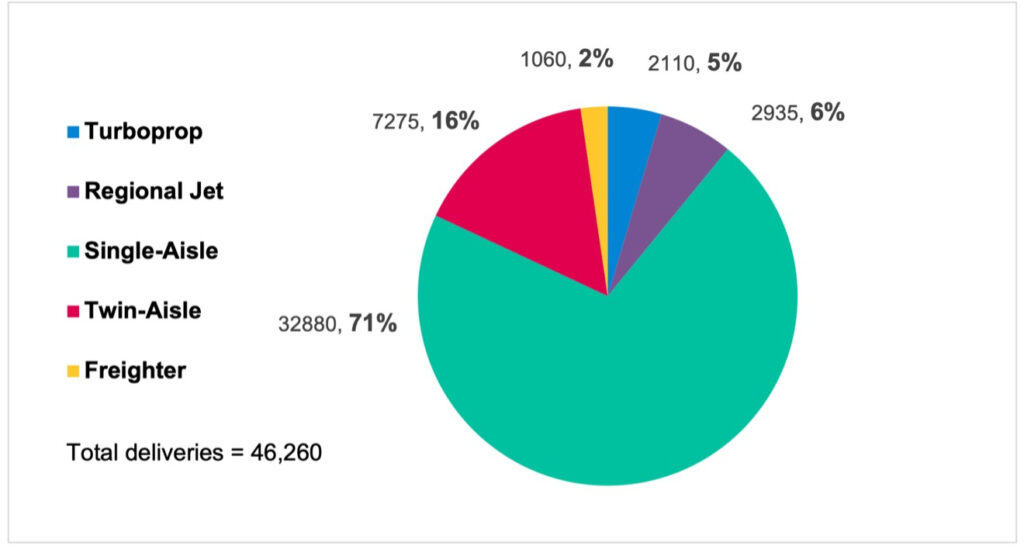

Figure 1: Forecast deliveries 2023-2042 (Graphic: Business Wire)