CLIVE points to continued uncertainty in the air cargo market

02 / 02 / 2023

Credit: tratong/ Shutterstock

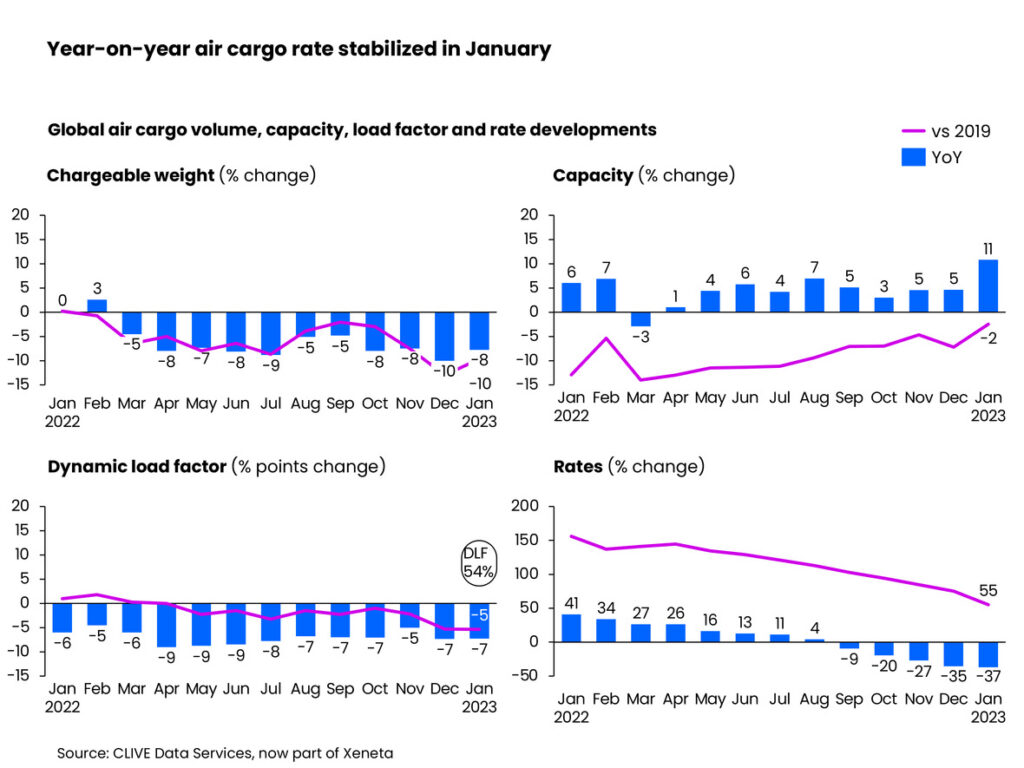

Industry analyst CLIVE Data Services has said that global air cargo demand continued to fall in January, down 8% year on year, partly the result of an earlier than normal Chinese New Year and partly due to global economic headwinds.

The 8% year on year fall in global airfreight demand in January also represented a fall of 10% on the same month of pre-Covid 2019.

There was a 37% decline in the global airfreight spot rate to $2.89 per kg, narrowing the gap to the pre-pandemic level to an increase of 55%.

Global air cargo capacity rose a noticeable 11% year on year, but available capacity was still 2% below its 2019 level.

The global average dynamic load factor, which Xeneta-owned CLIVE uses to measure cargo load factors by considering both the volume and weight perspectives of cargo flown and capacity available, reached 54% in the first month of this year.

Because of the airfreight industry’s capacity increase but volume decrease, the load factor fell by 7 percentage points. Compared to 2019, it was down by 5 percentage points as the demand/supply balance started to lean towards oversupply.

“The early Chinese New Year might be causing some noise in the January air cargo data with factories there closing ahead of the New Year, contributing further to a weak global market producing load factors at a level we haven’t seen for some time,” commented Niall van de Wouw, chief airfreight officer at Xeneta.

“So, there is still a high level of uncertainty but, if rates haven’t yet reached the 2019 level in value in the current climate, and with an expectation that inventory levels will need restocking at the end of Q2 and Q3, then it’s unlikely we will see spot rates return to the pre-pandemic level unless this happens soon.

“But this, of course, partly depends on consumers spending in a similar fashion as we have seen recently,” he added.

Shrinking volumes characterised the air cargo picture out of the Asia Pacific (APAC) region as well as the inbound Europe trade, but there was better news on some other trades.

Despite high inflation and falling US retail sales, westbound air cargo volumes between Europe and North America were up 6% year on year in January.

The Europe to North America corridor stood out in terms of growth, CLIVE observed, although its average spot rate of $3.09 per kg was down 4% from the previous month.

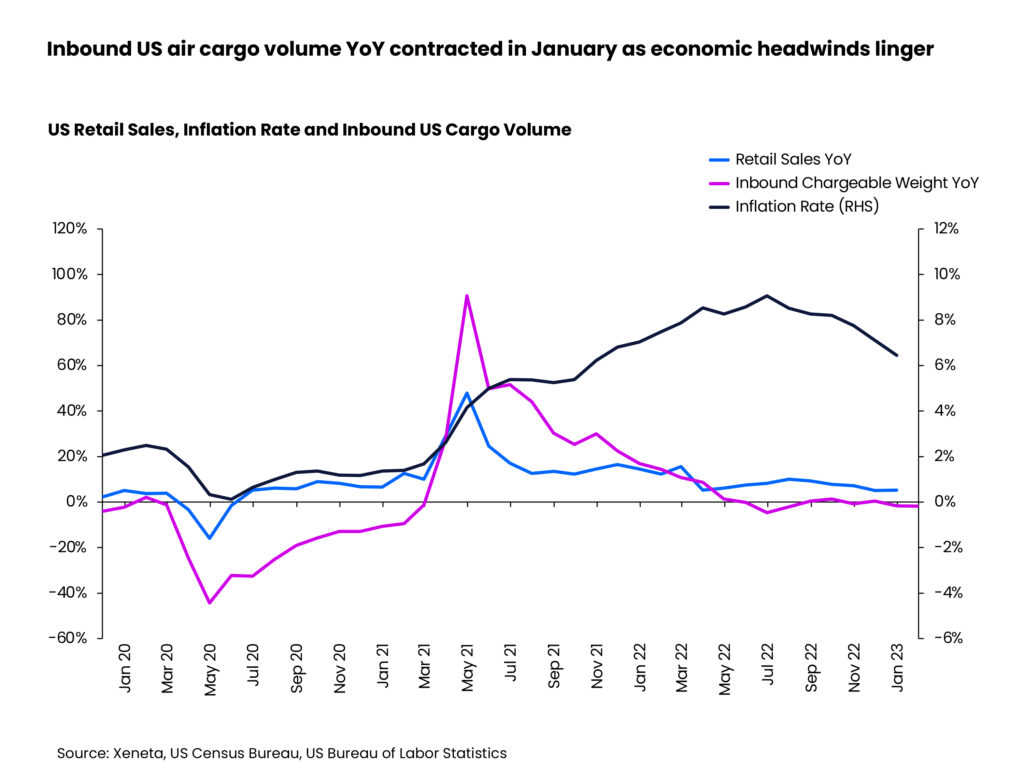

The resilience in westbound transatlantic volumes was achieved despite pressures facing consumers in the US, CLIVE pointed out.

For instance, US inflation rose above target again in December 2022 for a 21st consecutive month. The inflation rate reached 6.5%, though this was down 2.6 percentage points from its peak in June last year.

And the US market outlook remains uncertain, according to the analyst. The inbound US air cargo market registered its first negative growth in May 2022 and then stayed in negative territory for five out of the seven remaining months of last year.

In January 2023, global air cargo volumes into the US continued to fall, down 2% from a year ago.

The transatlantic eastbound ocean freight spot rate was up by 230% in January compared to its 2019 level. In comparison, the January air freight spot rate was only 41% above pre-pandemic levels, and 14% points below the ratio for the global average air spot rate.

Economic headwinds blew even harder on the European market, CLIVE reported. Due to the knock-on effects of the Ukraine war, inflation rates there have seen double-digit growth since August 2022.

Although European inflation rates might have reached their peak, they remain highly elevated (up by 10.4%) compared to the immediate pre-pandemic period.

Inbound Europe chargeable weight fell for a 13th consecutive month year on year in the first month of 2023, with January air cargo volumes down 9% from a year previously.

Given the earlier than usual Lunar New Year in 2023, January does not the best month to judge APAC market performance. But, while the average spot rate from APAC to Europe dropped 11% month on month to $4.18 per kg, it remained 72% above pre-pandemic levels, partly due to the rate impact of rising operating costs caused by the Ukraine war.

The average spot rates on the APAC to North America corridor was $4.74 per kg in January, 48% above pre-pandemic levels.