Hopes diminish for an air cargo peak season boost

01 / 11 / 2023

Photo: Shutterstock

Hopes of a surge in air cargo demand towards the end of the year diminished in October as the latest data showed only a slight uplift in demand.

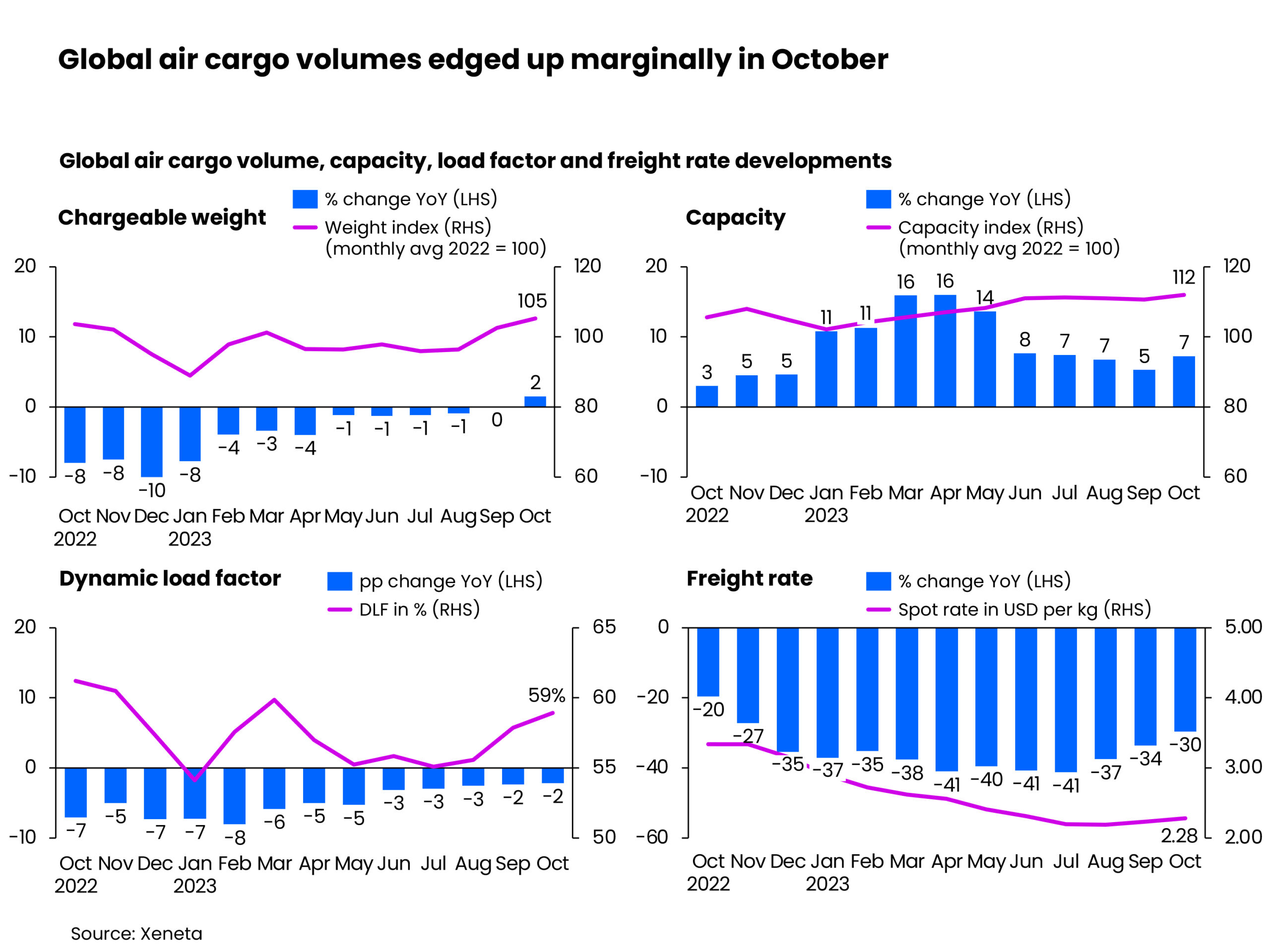

The latest figures from data provider Xeneta show that air cargo demand increased 2% in October compared with September which is described as “sub-seasonal” compared with the previous five years.

General air cargo spot market rates were also up by around 2% over the two months, reaching $2.28 per kg.

Compared with a year ago, demand was up 2% in October while rates were down 30%, although this is the lowest rate of decline registered this year.

Rates also remain above pre-Covid 2019 levels, supported by premium and special cargoes, while general cargo rates have “nearly gone back to their pre-pandemic levels”.

“This is attributed to the slight uptick in global cargo volumes as well as a slowdown of cargo capacity growth in a month in which global belly capacity returned to its pre-pandemic level, albeit this recovery is varied across major lanes,” said Xeneta in a press release.

Source: Xeneta

The dynamic load factor reached 59% in October, which is its second-highest level of the year, but still down two percentage points on October 2022 levels.

Xeneta chief airfreight officer Niall van de Wouw said: “October’s market performance is what we expected to see.

“It was a marginally busier month but not a cause for much optimism, nor pessimism. Carriers and forwarders are not expecting the market situation to improve significantly until well into the second half of 2024.

“The ongoing situation in Ukraine and now the conflict in Israel and Gaza will only add to these concerns.

“This is a volatile market. Freight forwarders are still procuring capacity on a short-term basis but are selling more long-term.

“That’s a risk, but clearly forwarders are not willing to commit to capacity because of so much uncertainty.”

Rate performance also varied between regions.

“Cargo spot rates from Europe to the US stood at $1.85 per kg in October, up 7% from a month ago,” Xeneta said.

“This is because the market anticipates declines in cargo capacity as space availability on this corridor is highly influenced by carriers’ seasonal passenger schedule adjustments, which began on 29 October this year.”

The data provider said that China to Europe rates in October climbed 14% month-over-month to $3.66 per kg, while Southeast Asia to Europe spot rates rose at 9% to $2.51 per kg.

Spot rates from China to the US increased 10% from a month ago to $4.00 per kg, while spot rates from Southeast Asia to the US were up 15% to $3.61 per kg.

“The rise in spot rate for the latter corridor is mainly driven by a sharp growth in chargeable weight month-on-month,” Xeneta said.