IATA: Strongest half-year cargo demand since 2017 but capacity remains constrained

29 / 07 / 2021

Image: IATA director general Willie Walsh. Live at IATA's media update.

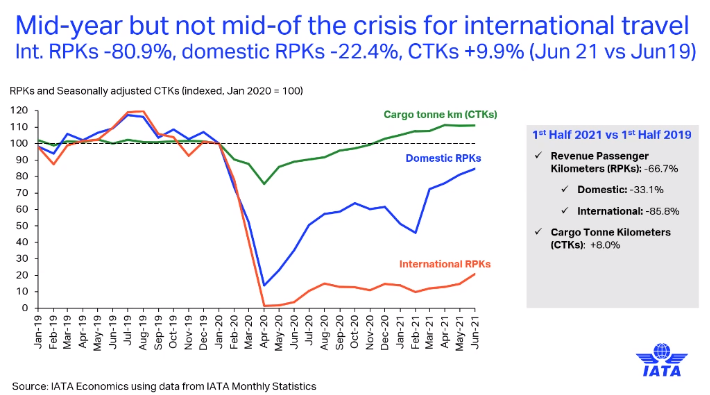

IATA has highlighted the need to re-establish passenger network connectivity to boost bellyhold capacity and ultimately airline revenues, as cargo demand remains strong.

Speaking at a media update this week, Ezgi Gulbas (pictured below), senior economist at IATA, said overall cargo demand in the first half of this year was 8% higher than pre-crisis levels — the strongest performance seen since 2017.

However, she said, there is a persistent weakness on the passenger side.

“As we know, cargo has been strong since the start of this year with the support of the global economic recovery,” she said.

“Re-establishing connectivity across the Atlantic is critical for the airline industry. The US and Europe are each other’s most important passenger markets in terms of revenue.”

She added: “We’re seeing slow improvements as passenger aircraft fleets come back. In the following months, we expect the slow recovery [of passenger] to continue, but on the flip side, cargo demand is very strong.

“Indicators, like the PMI and stock levels of companies in the supply chain, are very low. We think that the recovery for demand will be much stronger than the recovery for capacity, so the yields will be higher.”

Image source: IATA media update. Image shows cargo demand vs passenger demand.

IATA director general Willie Walsh said: “There are signs of things improving [for passenger services] — restrictions are being relaxed. We’ve got to take positives from that.”

Walsh is also optimistic for cargo’s performance in the second half of this year.

He said: “Cargo is leading the way in recovery, demonstrating how critical it is to keep global supply chains moving.

“Again, I think you’ve got to give credit to airlines who have been able to pivot their passenger operations to supply cargo capacity, particularly at a time when cargo travelling by sea has seen significant disruption.

“I fully expect the period after this to represent a freight opportunity in the industry. We’ve seen airlines undertake restructuring that probably is more significant than anything they’ve done in the past.”

Image: Ezgi Gulbas, senior economist, IATA. Live at IATA’s media update.

Gulbas and Walsh’s comments are supported by IATA’s latest airfreight market analysis, which reports that global air cargo demand in June 2021, measured in cargo-tonne kms (CTKs), was 9.9% higher than pre-Covid levels (June 2019).

Global capacity in June 2021, measured in available cargo tonne-kilometers (ACTKs), was constrained, at 10.8% below pre-Covid levels (June 2019).

“Belly capacity was down 38.9% on June 2019 levels, partially offset by a 29.7% increase in dedicated freighter capacity,” the association said.

Meanwhile, the cargo load factor remained “exceptionally high” in June (56.5%) — 25.3 percentage points higher than pre-Covid levels.

IATA commented: “Underlying economic conditions and favourable supply chain dynamics remain highly supportive for cargo.

“The cost-competitiveness and reliability of air cargo relative to that of container shipping has improved. ”

IATA appoints new head of cargo

IATA: Volumes outperform pre-Covid levels, but pace slows in May

CLIVE: Air cargo back on track for recovery

Looking at regional performance in June 2021, Africa-based airlines recorded volumes 32% higher than in the same period of 2019. Capacity in the region was 7% lower than June 2019.

Cargo demand for North America-based airlines was 24% higher than June 2019. Capacity was also higher — by 3.7%.

The region was the only one in June 2021 to record capacity exceeding pre-Covid levels.

IATA noted: “The US inventory to sales ratio is at a record low. This means that businesses have to quickly refill their stocks, and typically use air cargo to do so.”

Europe-based airlines posted volumes 6.7% higher than in June 2019, while capacity was 15% lower.

“Manufacturing PMIs are notably strong in the region, and persistent Covid outbreaks mean that a shift to services is not a big risk to air cargo,” IATA observed.

Carriers based in the Middle East achieved volumes that were 17.1% higher than in June 2019. Capacity in the region was down 8.9% on pre-Covid levels.

IATA said the region was “boosted by strong performance on the Middle East-Asia and Middle East-North America trade lanes”.

Air cargo demand for Asia Pacific-based airlines was 0.9% higher than in June 2019. Meanwhile, capacity was 21.6% lower than pre-Covid levels.

IATA noted: “Even though demand for the goods [the region] crafts is still high, [it] faces moderate headwinds from the lack of international capacity and manufacturing PMIs that are not as strong as in Europe and the US.”

Latin America-based carriers recorded cargo volumes in June 2021 that were 19.9% lower than pre-Covid levels. Capacity in the region was also lower than June 2019 — by 23%.