Top 25 air forwarders: K+N extends its lead on DHL

06 / 07 / 2023

Photo: Atlas Air Worldwide

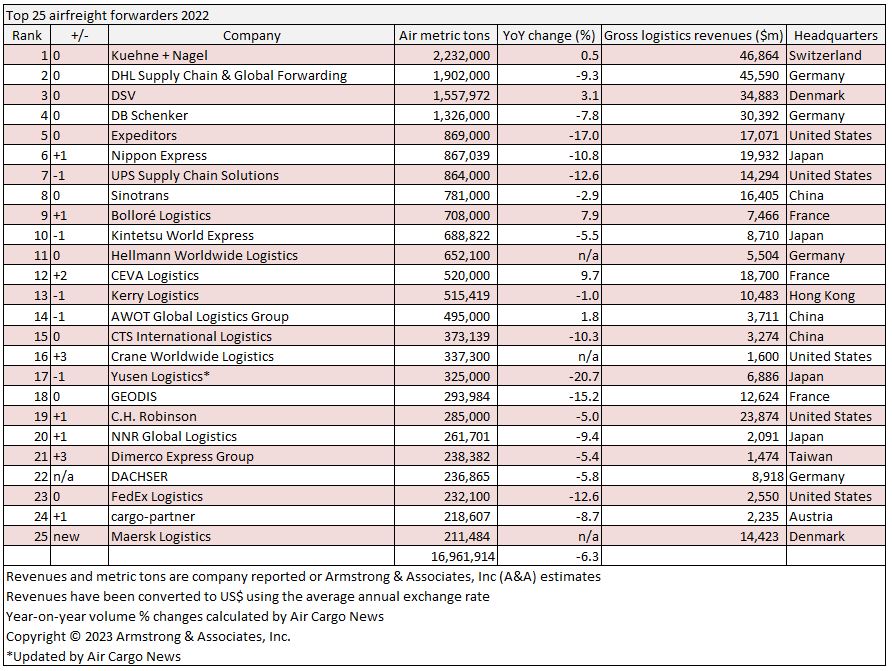

Kuehne+Nagel (K+N) last year extended its lead over DHL as the world’s busiest airfreight forwarder while market conditions took their toll on overall forwarder volumes (see chart at end of article).

The leading 25 airfreight forwarders saw total volumes decline 6.3% year on year in 2022 to 16.9m tonnes as lockdowns continued in China, the war in Ukraine put pressure on supply chains and inflation began to affect consumer spending.

However, it was not all bad news for the sector; forwarders’ revenues and profits were buoyed by ongoing high prices that more than offset the demand declines.

While the overall top 25 saw demand fall, leading airfreight forwarder K+N bucked the downward trend as it reported a 0.5% increase in demand to a record 2.2m tonnes.

See full table below. Copyright Armstrong & Associates

For the first five months of the year, the leading airfreight forwarder’s year-on-year comparisons were boosted by the inclusion of Apex Logistics, which began to be included in results from May 2021 following its acquisition by K+N.

However, as the year progressed K+N’s airfreight volumes were increasingly affected by overall market performance and by the fourth quarter, demand fell by 15% compared with a year earlier.

Second-placed DHL Global Forwarding saw its air cargo volumes fall by 9.3% year on year last year to 1.9m tonnes, reflecting market conditions – the overall airfreight forwarding market was estimated to have declined by around 10% last year.

Parent Deutsche Post DHL said in its annual report said that the market had been characterised by volatility in 2022 and that volumes had slowed down over the course of the year in line with the development of the macro environment.

Third-placed DSV was another company to benefit from acquisitions as its volumes increased by 3.1% year on year to 1.6m tonnes. The volume improvement is thanks to the inclusion of Agility Global Integrated Logistic’s (Agility GIL) results, which the company purchased in 2021.

The company registering the largest increase in demand for the year was CMA CGM-owned CEVA Logistics as its volumes increased 9.7% to 520,000 tonnes following a series of acquisitions.

During the year, the company purchased Gefco, Spedag Interfreight, Ingram Micro’s former Commerce & Lifecycle Services business and Colis Privé, a France-based last-mile provider.

Another notable change to the list is the entry of Maersk Logistics in 25th position.

The AP Moller Maersk-owned forwarder saw its volumes grow through a series of acquisitions including Senator International, Pilot Freight Services and LF Logistics.

Read the full report in the Autumn issue of Air Cargo News