WorldACD: Airfreight rates pushed up by capacity crunch in H1 2020

20 / 07 / 2020

The latest figures from WorldACD show that although airfreight demand decreased by 18% year on year in the first six months of this year, the capacity shortage from mid-march caused revenues to increase by almost 21%.

WorldACD said the capacity crunch led to the average airfreight rate for transporting 1km of cargo to increase by 48% worldwide. Asia Pacific experienced the largest increase in airfreight rates (76%) and Latin America posted the smallest increase (10%).

Looking back on the year, the analyst said: “Since the start of Covid-19, the nature of air cargo developments has changed dramatically. All sorts of changes, unheard of up till 2020, could be seen in the past four months.

“We have reported on the market meltdown. We have noted the dramatic drops in capacity. We have shown the enormous impact on air cargo cost of the sudden need for goods, essential for combating the virus. We have seen weekly changes hitherto unknown (in capacity, in load factors, in ‘new’ aircraft types, in airline yields, etc.). ”

The Covid-19 outbreak caused a surge in demand for personal protective equipment, which in turn led to a 136% year-on-year increase in airfreight charges from China during the first half of this year.

The pandemic also led to an 8% year-on-year increase in demand for pharma goods. Meanwhile, global demand for flowers fell by 16% and volumes for high tech goods decreased by 6%.

Looking at airfreight volumes, the Middle East and South Asia (MESA) was the hardest hit, with a 32% year-on-year decline. Europe posted the second-largest regional decline of -22%.

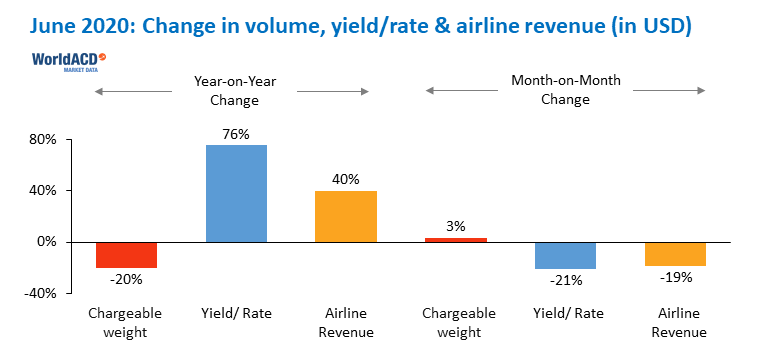

In June, airfreight volumes were 20% down year on year, yields were 76% up on last year and airline revenues were 40% ahead of a year ago.

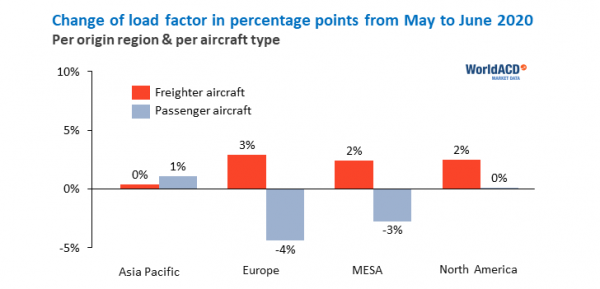

Meanwhile, air cargo volume increased month on month, from May to June this year, by 3.5%.

WordACD said: “Coupled with a decrease in US$ yields of 21%, this resulted in a month-on-month revenue decrease for airlines of 19% measured in US$.

“In other words, the extreme results of April and May (great volume loss coupled with a large revenue increase) diminished somewhat. However, the sector is still far from what it used to be, as June worldwide showed a year-on-year volume decrease of 20% and a yield increase of 76%.”

WorldACD also noted that July airfreight figures “do not seem to change the present picture very much” because “yields have not returned to pre-Covid levels”. However, the analyst’s provisional figures, which it said should be looked at with caution, show that global yields decreased by “no more than 2.4%” from the last two weeks of June to the first two weeks of July, while weekly volumes were lower by mid-July, compared with the two weeks prior.

“Understandably, given the high market volatility, we have recently seen a flurry of weekly air cargo figures being reported,” the analyst said. “At WorldACD, we have learned over many years that part of the data on air cargo transactions are subject to some degree of correction when data for the full month are assembled and finalised. Data may also be based on too small a sample to be truly representative, or may be just anecdotal evidence.”