WorldACD: January and February figures show air cargo is in recovery mode

08 / 03 / 2024

Photo: Jaromir Chalabala/ Shutterstock

The strong demand growth levels recorded over the first two months of the year are evidence of an improvement in air cargo demand after a weak 2023.

Data analyst WorldACD said that it is hard to gain a true understanding of demand trends by looking at January and February individually due to the changing timing of the Lunar New Year – this year the two-week holiday was in February and in 2023 it took place in January.

However, statistics for the first two months combined show a 13% year-on-year increase in cargo demand (or 11% if the extra leap year day is stripped out of the figures).

WorldACD said that demand in January was up 17% year on year and February was ahead by 8% (4% with the extra day removed).

“Worldwide air cargo demand was up by 13% in the first two months of this year, compared with the equivalent period last year, with demand continuing to surge from Middle East & South Asia (MESA) origins, and tonnages recovering from the normal Lunar New Year (LNY) seasonal dip,” WorldACD said in its latest market summary.

“Many of the patterns so far this year are similar to those of last year, although delayed by three weeks because of the later LNY, and with demand somewhat stronger this year than in the equivalent weeks last year.

“Like last year, three weeks on from LNY, demand has more or less recovered from the post-LNY dip, including from the key Asia Pacific origin region.

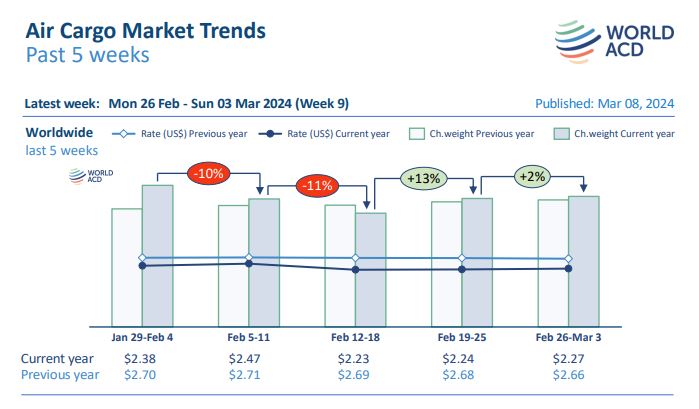

“Looking specifically at the last full week, total worldwide tonnages were up 2% in week nine (February 26 to March 3), compared with the previous week, following a 13% rebound in week eight. That followed declines of 11% and 10% the previous two weeks, immediately before and after LNY.”

The data firm said that post LNY, Asia-Europe sea-air hubs were continuing to record demand surges as a result of container vessels diverting around Africa to avoid missile attacks in the Red Sea.

WorldACD said it expects the elevated demand for sea-air services to continue as the situation in the Red Sea has worsened, although there are some signs of a softening in demand.

Its latest figures show that Dubai-Europe air cargo traffic in week nine was 154% up on this time last year, but was down 23% on week eight “suggesting a possible softening in demand”.

On rates, WorldACD said that average prices of $2.27 per kg for week nine were 16% down on a year ago, but are 27% up on pre-Covid levels.