WorldACD: March, a month like no other in air cargo history

15 / 04 / 2020

WorldACD has outlined that after the 2.7% drop in airfreight demand that it reported in January/February, March saw a decrease in chargeable weight of 17.7%, despite the first week of March being the best-performing this year so far.

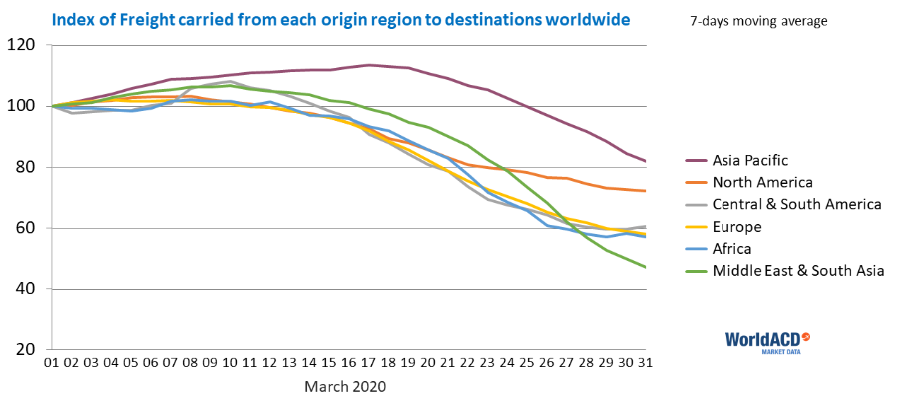

The Asia Pacific and the Americas regions fell least, with -12% and -17% decreases respectively. Meanwhile, Africa and the MESA (Middle East and South Asia) were hardest hit, with -28% and -32% declines respectively.

The 2% increase in freighter capacity was more than offset by the steep drop (-39%) in cargo on passenger aircraft, which caused yields to go up in most regions, most notably for cargo originating in the Asia Pacific.

In that region, unit prices in US dollars increased year on year by more than a third. For cargo from China in particular, unit prices rose by two thirds, up to an average of $3.58 per kg.

Revenues for the market from China to destinations in the Asia Pacific increased by 91% in terms of US dollars.

Comparing February with March

Between February and March, freighter capacity increased by 29%, whilst cargo capacity on passenger aircraft dropped by the same percentage.

In March, airlines that only flew freighter aircraft carried 42% more cargo than in February, while airlines that solely operated passenger aircraft carried 22% less cargo. Airlines that operated a mix of passenger aircraft and freighters did not see a change in cargo volumes between February and March.

Cargo-only airlines improved their market share and recorded a 81% growth in US dollar revenues.

Freight forwarders from the World’s Top 20 had different experiences. The Top 10 as a group saw volumes increase volumes by 3%. However, their individual performances ranged between -9% and 16%. Meanwhile, individual performances for forwarders in tier two were more divergent, ranging from -40% to 117%.

March: Week by week

For the first two weeks of March, freight capacity declined by 28%.

Cargo capacity on freighters was 3.5% higher in the second half of March than in the first half. Freight capacity on passenger aircraft decreased by 50%, causing the total freight carried to drop by 22% from the first half in March to the second half.

Cargo carried from Africa and MESA fell by more than 30% from the first half to the second half of March, and by 10% in the Asia Pacific.

Cargo carried in the last week of March was 31% lower worldwide than in the first week. Middle East based airlines were hardest hit with a volume decrease of 49%. With a 92% decrease, cargo capacity on passenger aircraft virtually disappeared in the MESA region. With a 10% decrease, Asia Pacific airlines dropped the least. Meanwhile, North America based airlines lost 53% in European markets, but Europe based carriers only saw a only 28% decline in North American markets.

Volumes of fish and seafood, fruit and vegetables, and flowers declined between the first and the last week of March — by 41%, 53% and 58% respectively.