Xeneta doubts air cargo demand improvements will be long lived

07 / 12 / 2023

Credit: tratong/ Shutterstock

Air cargo volumes were boosted by seasonal e-commerce demand from Asia in November, but Xeneta is doubtful the industry will see sustained stronger demand.

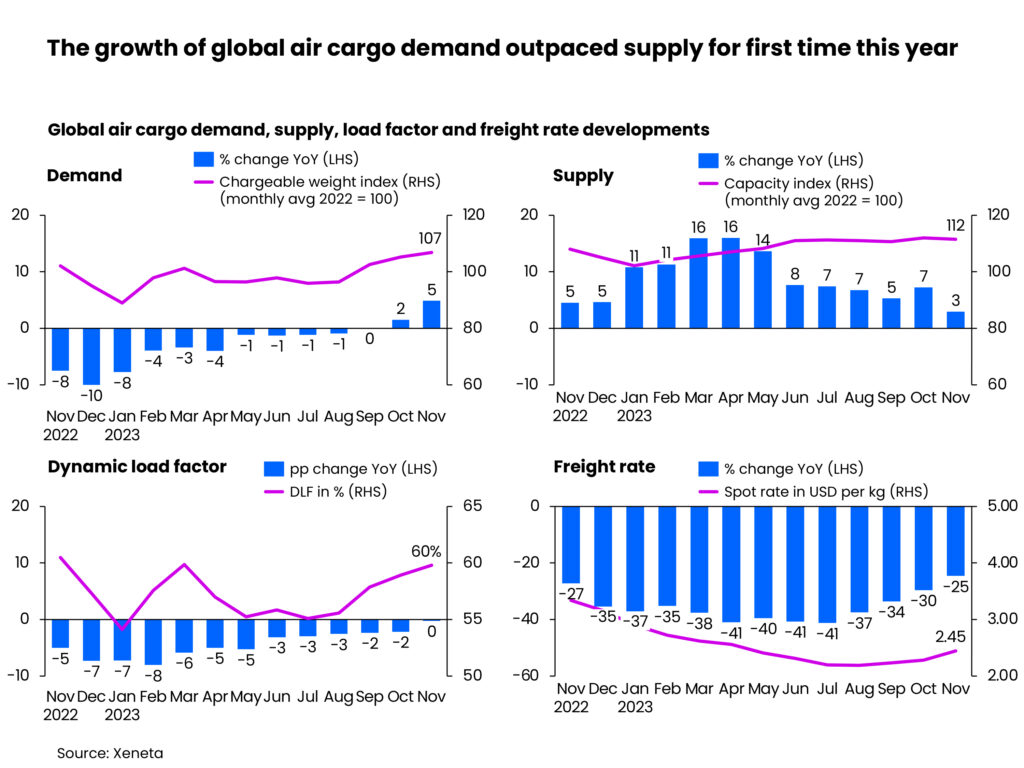

November was the first month this year that saw demand outstrip supply, but, echoing IATA’s concerns, the rate analytics platform said global airfreight capacity will likely continue to outpace market demand next year.

“This is due to anticipated weak consumer spending at least in H1 2024 and a continuing recovery in belly capacity for certain markets next year, boosted by improving passenger travel,” said the company.

E-commerce demand from Asia to Europe and the US has seen air cargo volumes rise, but this shouldn’t be relied on to see air cargo demand, in what is already a subdued market, sustained into next year, explained Xeneta.

Increased e-commerce volumes from Hong Kong and China to the US and Europe inflated global air cargo demand by 5% year over year in November.

Retail brands Shein and Temu accounted for most of the rise in air cargo volumes and rates out of Hong Kong and China last month.

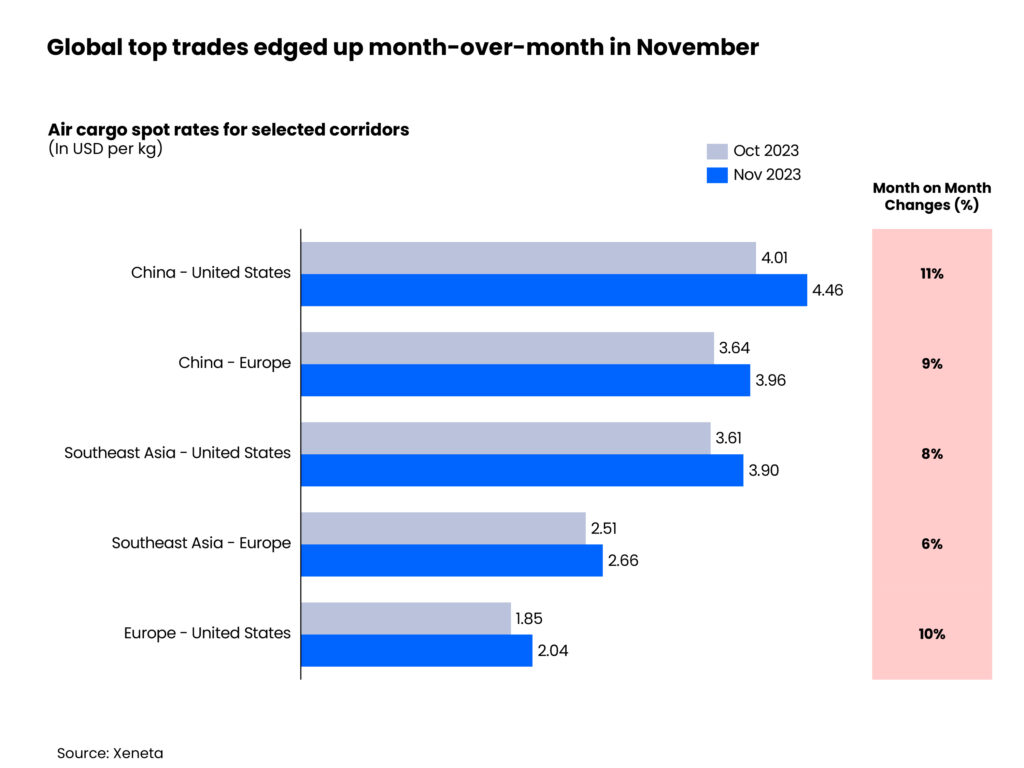

China to the US spot rates outpaced their October growth of +10%, climbing +11% month-over-month to $4.46 per kg. Air cargo spot rates from China to Europe followed a similar upward trend, rising to $3.96 per kg, up 9% from a month ago.

These increases contributed to an overall 7% month-on-month improvement in the global air cargo spot rate, which averaged $2.45 per kg in November, compared to +2% in October.

Demand slightly outpacing supply helped to push the global dynamic load factor to 60%, based on both volume and weight perspectives of cargo flown and capacity available.

Source: Xeneta

However, Xeneta’s chief airfreight officer Niall van de Wouw pointed out that the market appears healthier than it is because, in comparison, the market performed badly in November last year.

“We don’t see November’s data as a fundamental shift in the economy nor the outlook for 2024 for the global air cargo market,” he said.

“Seasonality means volumes are up, admittedly slightly more than we expected, but the figures also look better than they really are because November last year was disappointing for airlines and forwarders alike. More than anything else, what we saw this November was air cargo’s growing dependency on e-commerce.”

He added: “In a tight market, you only need a slight imbalance to push rates up because of the ‘fear of missing out’ that we have referenced previously. This seems to be happening out of China and Hong Kong, which are experiencing quite a boost in rates.”

Airfreight demand driven by e-commerce is not sustainable, said van de Wouw. While the vertical is fuelling the need for capacity, “this is a local shift and not a bellwether for a changing global economic tide”.

Looking at the longer term, Xeneta’s latest analysis of the general cargo market shows continuing weak demand, extending a downward trend since the last week of September this year.

Aligned with this, global general cargo spot rates (valid for up to one month) have been staying below seasonal rates (valid for over one month).

Under the backdrop of a still-subdued general cargo market, air cargo spot rates for outbound Asia markets grew at slower paces compared to their October levels, while the growth of Southeast Asia to both Europe and the US air cargo spot rates slowed down to 6% and 8%, reaching $2.66 per kg and $3.90 per kg respectively.

While air cargo spot rates from Europe to the US rose – up 10% month over month to $2.04 per kg in November – the increase was mainly driven by the reduction of belly capacity during carriers’ winter season.

As already noted, capacity will return. The Civil Aviation Administration of China, for example, expects international passenger flights to restore to 70% of their 2019 level in this winter season ending in March 2024, from the October level of 51%, said Xeneta.

And, the temporary visa exemption for citizens of five European countries starting from December 1 may accelerate passenger travel further and fuel the recovery of belly capacity between China and Europe, the organisation added.

Source: Xeneta