Apex acquisition set to make K+N the leading airfreight forwarder

22 / 02 / 2021

Kuehne+Nagel (K+N) has entered into a binding agreement to acquire Apex International Corporation as it looks to expand its presence in Asia.

Terms of the deal were not disclosed, but Reuters quotes people familiar with the matter as stating that the transaction is valued at around $1.5bn-$2bn.

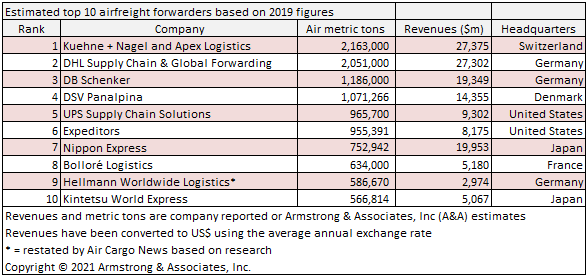

The deal is the largest acquisition in K+N’s history and will make the company the largest forwarder in the airfreight market (see chart below), surpassing current market leader DHL Global Forwarding (GF).

Apex generates yearly turnover in excess of $2.3bn and in 2020, the company handled total airfreight volume of approximately 750,000 tons and sea freight volume of 190,000 20ft container equivalent units (TEU).

Based on 2019 data from Armstrong & Associates, the combined entity would handle 2.2m tons of airfreight each year, surpassing current market leader DHL GF’s 2m tons (see table at end of article).

The forwarding market looks as if it could be shaping up for a year of large M&A deals. earlier this month, DSV said it was also looking to make an acquisition that would expand its presence in Asia.

Apex was founded in China in 2001 and has expanded throughout Asia and beyond over the years of its growth history. K+N said that Apex is one of Asia’s leading freight forwarders, especially in the transpacific and intra-Asia trades.

The acquisition is subject to customary closing conditions, including merger clearance by the competent competition authorities.

The purchase price will be financed by available liquid sources and, if needed, by available credit lines, K+N said.

Following closing of the transaction, a minor stake of Apex is to remain with the management of Apex and the company will then continue to operate separately within the K+N Group.

K+N will purchase its stake from north Asia private equity firm MBK Partners.

Kuehne+Nagel chief executive Detlef Trefzger said: “The combination of Apex and Kuehne+Nagel provides us with an opportunity to offer our customers a compelling proposition in the competitive Asian logistics industry, especially in e-commerce fulfilment, hi-tech and e-mobility. We are looking forward to welcoming the Apex colleagues to the Kuehne+Nagel family.”

Apex chairman of the board of directors and chief executive Tony Song added: “With Kuehne+Nagel, we have found a strategic shareholder and logistics group with more than 130 years of heritage.

“We are sure that with this transaction, we will be able to add value for our customers’ supply chains and expand our global logistics network. We will complement Kuehne+Nagel’s existing global air logistics team while offering our management and key talents unique career opportunities.”

Joerg Wolle, chairman of the board of directors K+N said: “In the past years, Kuehne+Nagel strategically and with great efforts expanded and developed its business in Asia Pacific. Today we are one of the leading players and are further accelerating our growth and impact in this region. Asia Pacific has consistently proven to be one of the most important drivers of global trade. The acquisition of Apex is a further important cornerstone in our strategy and significant fulfilment of the Group’s Asia Pacific ambition.”

In a research note, Jefferies International analyst David Kerstens said: “The planned acquisition of Apex International in China will add 9% to Kuehne+Nagel’s revenues and increase Asia Pacific exposure from 11% to 19% of revenues.

“The acquisition marks a large step towards fulfilling the ambitions in Asia, but we think expectations were higher, after earlier talk about transformative M&A.”