DSV airfreight volumes fall 20% in first quarter 2023

27 / 04 / 2023

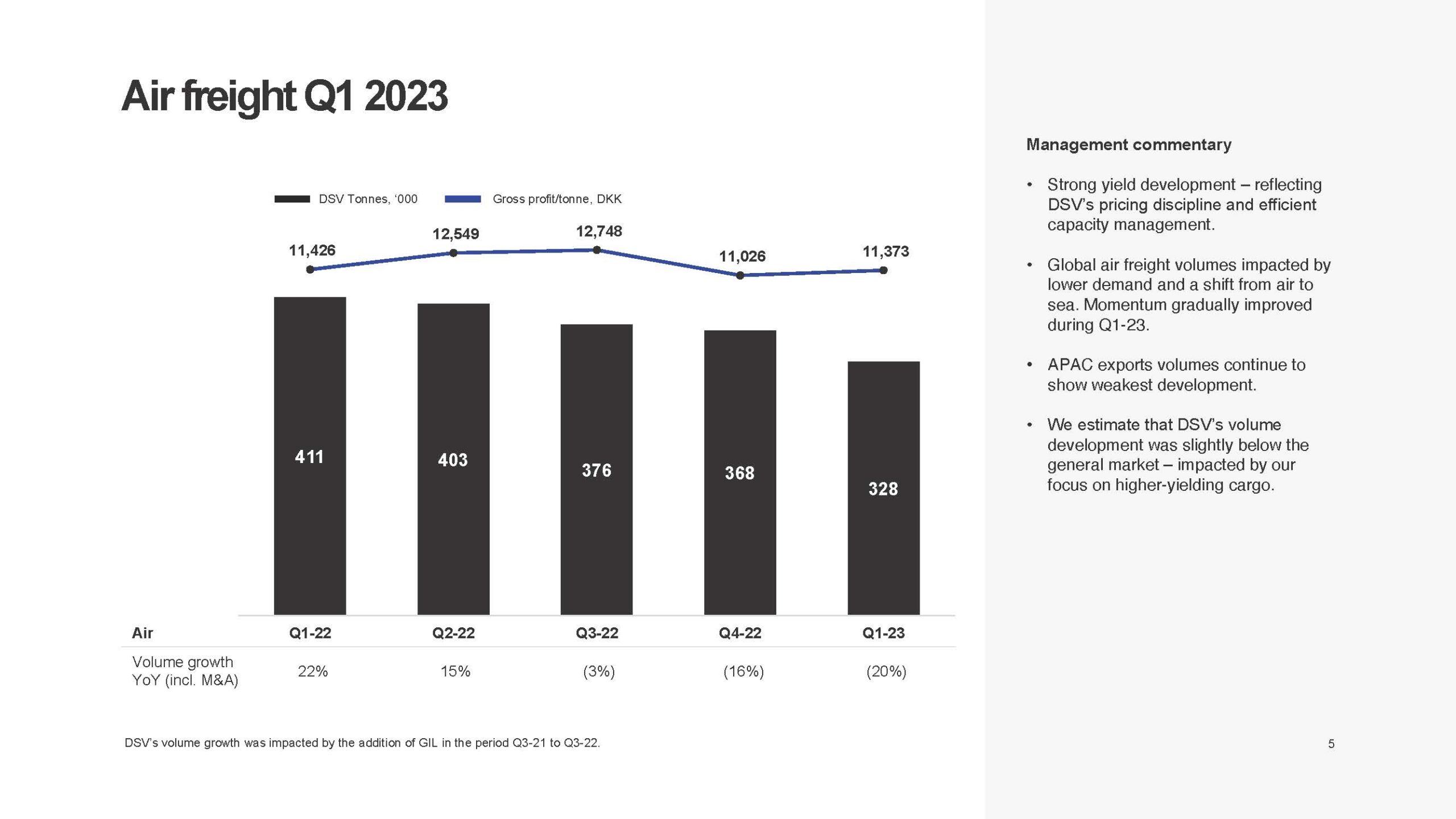

DSV’s air cargo volumes fell 20.2% in the first quarter of 2023 to 327,712 tons, with the weakest development on export volumes from the Asia-Pacific region. Seafreight volumes measured in teus were also down, by 12%.

The Denmark-based forwarder said that the global air and sea freight markets in the first quarter were characterised by lower demand, driven by “the general macroeconomic slowdown, reduction of inventory levels and continued normalisation of consumer behaviour after the pandemic,” meaning a shift towards services and less material goods.

The volume decline in airfreight tonnages was most significant at the beginning of the quarter, said DSV, adding that momentum gradually improved towards the end.

“Airfreight rates dropped further during the quarter and measured, excluding fuel rates, are now close to pre-pandemic levels on most trade lanes.”

In a market with lower volumes and freight rates, DSV’s Air & Sea division saw a 18.7% decrease in gross profit and 30.7% decrease in EBIT before special items for the first quarter compared to the same period last year.

This development was in line with expectations, said DSV, and reflects the gradual normalisation of global supply chains after the pandemic.

For both air and sea freight, DSV estimates that its volume development was slightly below the general market in Q1 2023, based on preliminary market data.

The Air & Sea division’s revenue amounted to DKK26,213m for Q1 2023, compared to DKK45,887m for the same period last year, and was down 43.0% in constant currencies.

The development was driven by the decline in volumes and lower freight rates. The division’s average revenue per unit was 26% below last year for air, and 37% below last year for sea.

Said DSV: “Under the current highly competitive market conditions, the underperformance can partly be attributed to our continued pricing discipline and focus on higher-yielding cargo.

“Still, we will reinforce our commercial efforts, and we maintain our long-term ambition of outgrowing the general market.”

In Q1 2023, the Sea&Air division strengthened its position within the semiconductor industry with the acquisition of two US-based transport and logistics companies, S&M Moving Systems West and Global Diversity Logistics.

The acquisitions are expected to add annual revenue of approximately $80m, and closing took place on 24 April 2023.

DSV expects that gross profit yields will gradually decline in the coming quarters, as the “normalisation of freight markets continues and contracts are renewed”.

DSV expects global trade volumes to gradually improve in the coming quarters and stands by its full-year EBIT for 2023.

DSV Group CEO Jens Bjørn Andersen said: “As anticipated, the demand for transport services and freight rates declined during the first quarter of 2023. Nonetheless, we achieved good results and strong cash flow in all our business areas by providing good customer service and efficiently managing our capacity.

“We expect that global trade volumes will improve gradually in the upcoming quarters, and we stand by our full-year EBIT guidance for 2023.”