DSV reports on a strong year

03 / 02 / 2023

Denmark-headquartered supply chain services provider DSV has revealed strong results for 2022, which it said had been driven by “good performance across all our business areas”.

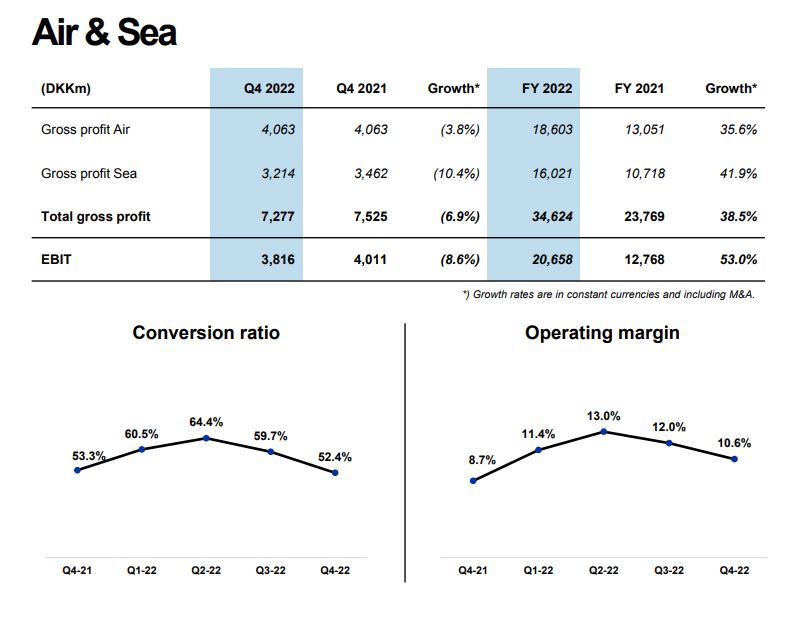

Over 2022, its gross profit increased by 33%, while earnings before interest and taxes (EBIT) before accounting for special items rose by 48%.

DSV’s Air & Sea transport division achieved a 53% increase in EBIT before special items, Solutions achieved a 47% EBIT increase, and Road achieved a 9% EBIT increase for 2022.

“DSV delivered a strong set of results for 2022,” said Jens Bjørn Andersen, group chief executive.

“We achieved EBIT growth of 48% and a strong cash flow, driven by good performances across all divisions.

“Towards the end of the year, our performance was impacted by the general macroeconomic slowdown and a gradual normalisation of the freight markets. We expect this trend will continue into 2023 and this is reflected in our financial guidance.”

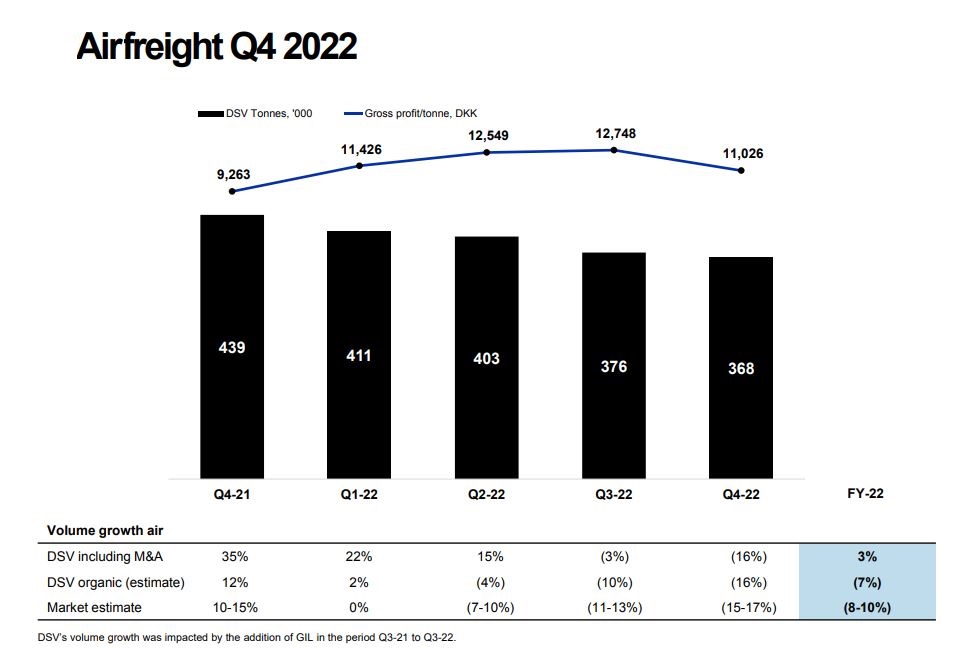

Looking at the airfreight business, revenues climbed 27.9% year on year to DKr90.6bn, while volumes improved by 3.1% year on year to 1.6m tonnes.

The volume improvement comes despite a market decline of around 10% thanks to the inclusion of Agility Global Integrated Logistic’s (Agility GIL) results, which the company purchased in 2021.

If Agility’s figures were removed from the result the company expects that it would have reported a demand decline of 7% for the year.

The higher revenues were supported by an increase in rates.

While the year started strongly, the company did see its performance weaken as the year progressed in line with the overall market.

In the fourth quarter, DSV’s airfreight volumes declined by 16% year on year with the overall market estimated to have declined by the same amount.

“Global air cargo tonnages have been in decline since February 2022 – with export from Asia as the weakest market,” DSV said.

“Normal peak season did not materialise in Q4-22.”

The company added that there was also a gradual yield decline as supply chain congestion eases and belly-space capacity returned.

Source: DSV

Amongst the highlights of its year was the completion of DSV’s integration of Agility GIL within a year of its acquisition in the summer of 2021.

That acquisition made the company a top three player in the transport an logistics industry, DSV noted; adding that mergers and acquisitions (M&A) “remains an important part of DSV’s strategy, and the company continues to monitor the market in search of value creation opportunities”.

The company has also confirmed that DSV has raised its ambitions and committed to reach net-zero carbon emissions across its operations by 2050.

Looking forward

Meanwhile, while geopolitical and macroeconomic uncertainty persist, DSV said that it will continue to focus on providing high quality customer service and adapting to changing market conditions.

Its outlook for this year assumes a global economic growth in the region of 2-3%, with the lowest growth rates in the world’s advanced economies.

Normally, it said, DSV would expect transport volumes to grow in line with the economy, but in the second half of 2022, volumes declined more than GDP due to reduction of inventory levels and normalisation of consumer behaviour following the Covid-19 crisis.

“DSV expects this negative development in freight volumes to continue in the first part of 2023, but with a recovery in the second half of the year,” it declared.

“We have assumed declines in air and sea freight volumes of 2-5% for the full year. As supply chain disruptions ease, we expect a decline in gross profit yields of around 20-25% compared to the average level in 2022.”

Source: DSV