DSV reports record results on higher rates and GIL takeover

09 / 02 / 2022

Jens Bjørn Andersen. Image source: DSV Panalpina.

DSV reported record revenues and profits last year thanks to higher freight rates and acquistions.

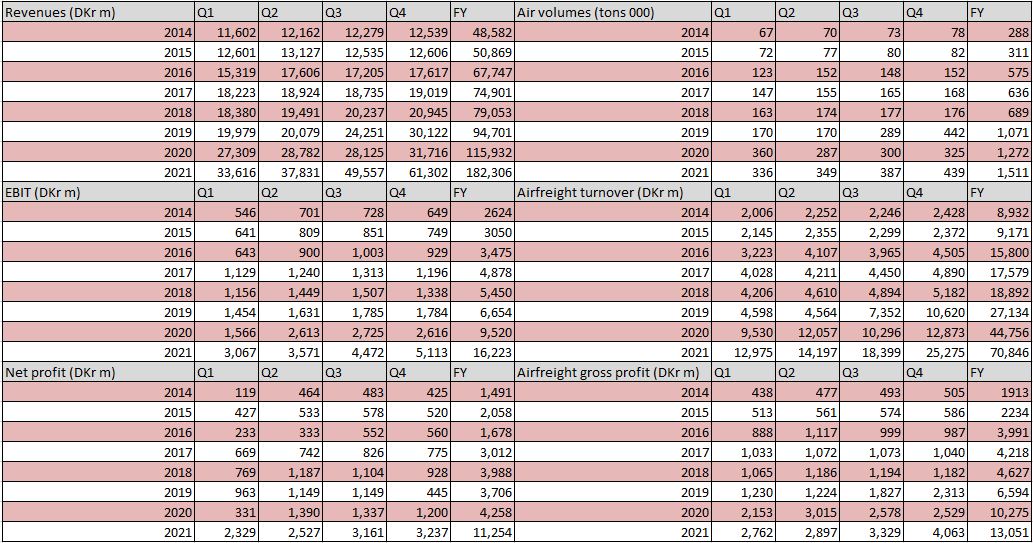

The Danish forwarder reported a 57.2% year-on-year increase in revenues for the year of DKr182.3bn, while earnings before interest and tax (ebit) were up 70.4% to DKr16.2bn and net profit climbed 164.3% to DKr11.2bn.

Results were boosted by the DKr30bn acquisition of Agility’s Global Integrated Logistics (GIL) business, a recovery in trade volumes and higher freight rates as a result of supply chain disruption.

GIL’s results were included from the third quarter of the year.

“In the past year, we saw several unprecedented factors conspiring across global supply chains,” said chief executive Jens Bjorn Andersen. “Beyond the continuous pandemic lockdowns and restrictions, a surging demand for goods strained transport capacity, equipment, infrastructure and labour across the supply chain. Bottlenecks persist and have led to record-high freight rates in 2021.

“These disruptions continue to impact the global economy, raising difficult questions for the logistics industry and exposing global supply chain vulnerabilities.”

DSV estimates that bringing GIL into the company will increase annual revenue by more than 20%. Once fully integrated in 2023, GIL is expected to contribute around DKr3bn to combined ebit before special items annually.

Looking ahead, DSV expects ebit to reach DKr18-20bn based on an economic growth rate of 4% and the ongoing integration of GIL.

“The outlook is based on the assumption that the current situation in transport markets – with congestion, tight capacity and high rate levels – will continue in the first half of 2022,” the forwarder said.

“A gradual improvement could start during the second half of the year and this could have a positive impact on transport volumes and our productivity but also a negative impact on our gross profit yields. We assume that the integration of GIL will continue as planned.”

The airfreight division saw its volumes for the year increase 18.8% to reach 1.5m tonnes, revenue was up 58.3% to DKr70.9bn and gross profits improved by 27% to DKr13.1bn.

“The global airfreight market continues to be affected by high demand and limited belly space in passenger planes, meaning less available cargo capacity and high rates,” DSV said.

“Passenger traffic did gradually return in 2021, but the associated belly capacity increase has mainly been on domestic and regional passenger flights, not long-haul intercontinental routes.

“Lockdowns and congestion at airports in different parts of the world caused significant disruptions for airfreight during 2021. Additionally, sea freight challenges added more volume to airfreight, with delays forcing shippers to find alternatives.”

Click to enlarge