E-commerce boom and trade growth fuel DP DHL Group revenues in 2018

07 / 03 / 2019

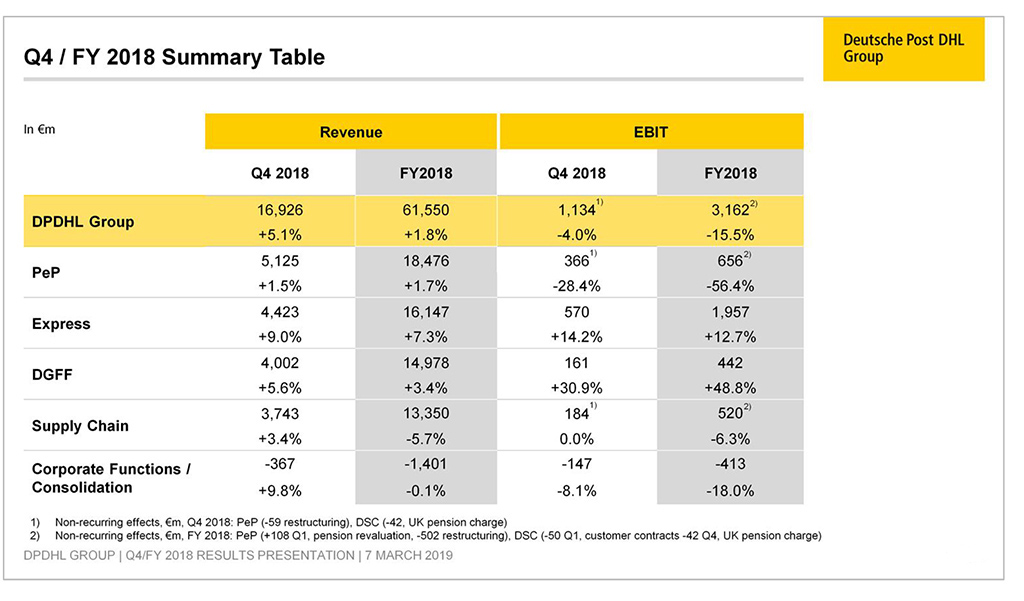

The boom in e-commerce and sustained growth in international trade flows saw Deutsche Post DHL Group’s (DPDHL) 2018 group revenue rise 1.8% to €61.6bn in a “challenging year” or a 6% rise after adjusting for currency effects and portfolio changes.

The German logistics giant said that all four divisions – post, express, forwarding and supply chain – contributed to the financial year 2018 positive trend, although group operating profit from activities (EBIT) fell 15.% to €3.2bn and “thus reached the adjusted earnings target communicated in June 2018”.

DPDHL Frank Appel chief executive said: “2018 was a challenging year for Deutsche Post DHL Group, which we closed with a successful Christmas business. Despite rising geopolitical uncertainties, global trade continued to register growth.

“This benefitted our DHL divisions in particular. In our German post and parcel business, we initiated measures to secure the division’s long-term EBIT growth – and we consciously accept that this comes with a short-term burden on EBIT.

“We have thus created the conditions for reaching our 2020 targets and for continuing to grow profitably in the years thereafter.”

The company is projecting an increase in operating profit from €3.9bn to 4.3bn in 2019. It has also prepared strategic plans for all four divisions in case of a global economic downturn (see graphic below).

Announcing its 2018 results, the company stated: “Growth was driven by the ongoing boom in e-commerce as well as sustained growth in international trade flows.”

DPDHL said that its Global Forwarding, Freight division “can look back on a successful year in 2018”.

The division increased revenue by 3.4% to €15.0bn “despite focusing on only high-margin business”.

Adjusted for negative currency effects, revenue improved by “an even more substantial” 6.7%.

Gross profit, an important performance indicator for the forwarding arm, also “performed strongly” with an increase of 3.9% over the prior year to €3.6bn.

The Post-eCommerce – Parcel (PeP) division reported revenue growth of 1.7% to €18.5bn in 2018. The upward trend was primarily attributable to higher revenue in the eCommerce – Parcel business unit. Parcel Germany, for example, posted a revenue increase of 7.1%. In full-year 2018, PeP delivered 1.5bn parcels in Germany, an increase of 7.5% compared to 2017 as well as a new record.

Revenue at DHL eCommerce climbed by 6.9%, adjusted for negative currency effects even by 12.0%. Parcel Europe reported an increase of 10.6%.

The company stated that “these dynamic trends” reflect DPDHL’s strong positioning in international e-commerce. The Group intends to use its new DHL eCommerce Solutions division, headed up by Ken Allen, to take even better advantage of the potential offered by the e-commerce market.

The “longstanding upward revenue and earnings trend” continued in the Express division in 2018. Revenue climbed by 7.3% to €16.1bn. The increase on an organic basis at 11%.

Added the company: “Particularly encouraging was the fact that the division again registered growth across all regions. This dynamic performance was once again driven by strong growth in the international time-definite (TDI) delivery business, where daily volumes rose by 7.4% compared with the prior-year period.

Revenue in the Supply Chain division came in at €13.4bn in the past financial year (2017: €14.2bn). In addition to negative currency effects, the revenue decline mainly reflects the sale of the subsidiary Williams Lea Tag. After adjusting for those factors, revenue for the division increased by 4.3%. DHL Supply Chain continued to generate additional new business, closing additional contracts worth €1.3bn with both new and existing customers in financial year 2018.

In the fourth quarter, DPDHL registered an increase of 5.1% in total revenue to €16.9bn. All four divisions contributed to the improvement in revenue. Operating profit declined by 4.0% to €1.1bn, due above all to restructuring costs at PeP.

Consolidated net profit after non-controlling interests decreased by 2.9% to €813m, mainly as a result of the lower EBIT at PeP and the implementation of IFRS 16.