Forwarders up their digital offering but there’s more work to be done

19 / 12 / 2019

The leading freight forwarders are making progress in improving their digital services, but there is still more work to be done if the industry wants to capitalise on the opportunity.

The fourth annual Freightos Mystery Shopper Survey revealed that 11 of the top 20 freight forwarders now provide a dedicated request for quotation form online, up from just three in 2015.

As a result, only seven forwarders now expect their customers to use a general inquiry form, down from 11 in 2015. At the other end of the scale, two forwarders still do not provide an online form, although one of these provided an email address, down from six in 2015.

Looking specifically at the air mode, Agility this year joined DHL Global Forwarding, Kuehne+Nagel and UPS in providing an instant online quote.

Freightos pointed out that Kuehne+Nagel even breaks its online airfreight offering down into three different service levels: KN Express, KN Expert and KN Extend.

Another – unnamed forwarder – was able to respond within a day, three more provided a manual quote taking between two hours and 19 days, with an average response time of 122 hours, and 12 did not issue a response at all.

“Though response rates have improved, 60% of the time forwarders still fail to respond to a potential new customer, effectively passing up on a red-hot lead,” Freightos said.

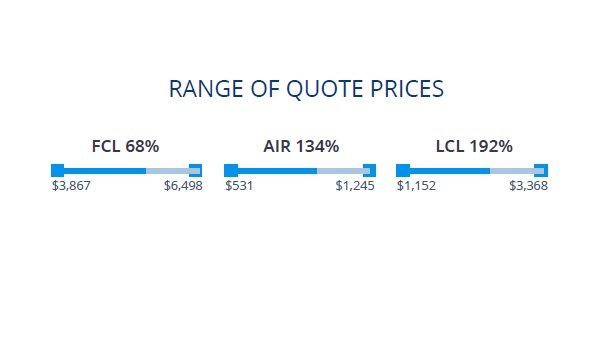

Freightos said there was “still a massive range” of prices when the quotes do come through.

In air, there was a 134% spread between the highest and lowest quote, ranging from $531 to $1,245 for a shipment from China to the US.

Freightos said that those forwarders that can offer an easy-to-use online sales tool will be able to capture new SME customers and others face losing out to new digital entrants and e-commerce companies that are expanding their logistics offering.

“With sales automation, the burgeoning but previously mostly overlooked SME market becomes a lucrative growth market for global forwarders,” it said.

“We’re confident that in less than five years the majority of global forwarders will be selling freight online.

“A conceptual leap is still required to see a full industry transition.

“Forwarders must take this new channel seriously, rather than as a side bet, offering competitive prices that reflect the cheaper cost to serve, improving sales and operations efficiency, and adopting a mindset of digital support to customers, whether related to a specific shipment or a broader supply chain.”