Freight forwarders continue the hunt for market share

07 / 06 / 2023

Copyright: Jaromir Chalabala/ Shutterstock

Freight forwarders are on the lookout to expand their customer base as market volumes dwindle.

Niall van de Wouw, Xeneta’s chief airfreight officer, said freight forwarders are becoming restless with continued reduced demand.

“There are a lot of ambitious forwarders in the market that want to grow – but they cannot grow with their current customer bases because the airfreight demand is not there, so, as we highlighted in April, they are looking to take a bigger share from someone else,” said van de Wouw.

This follows the conclusion in April of Xeneta’s CLIVE Data Services that forwarders aimed to secure air cargo volumes after a growth in longer-term contracts with shippers.

However, van de Wouw added that freight forwarders bargaining for business are facing stiff contract talks with shippers in control of the market.

“At the same time, we see a lot of shippers going to market now because they want to refresh their rates and benefit from the different conditions to 3-6 months ago. Challengers for their business – not the incumbent freight forwarders – smell a chance to buy volumes and are going in and offering low rates.

“And, whether they get the business or not, the overall rates drop because shippers often stick with their current provider but expect them to adjust their rates accordingly to this lower market level,” he said.

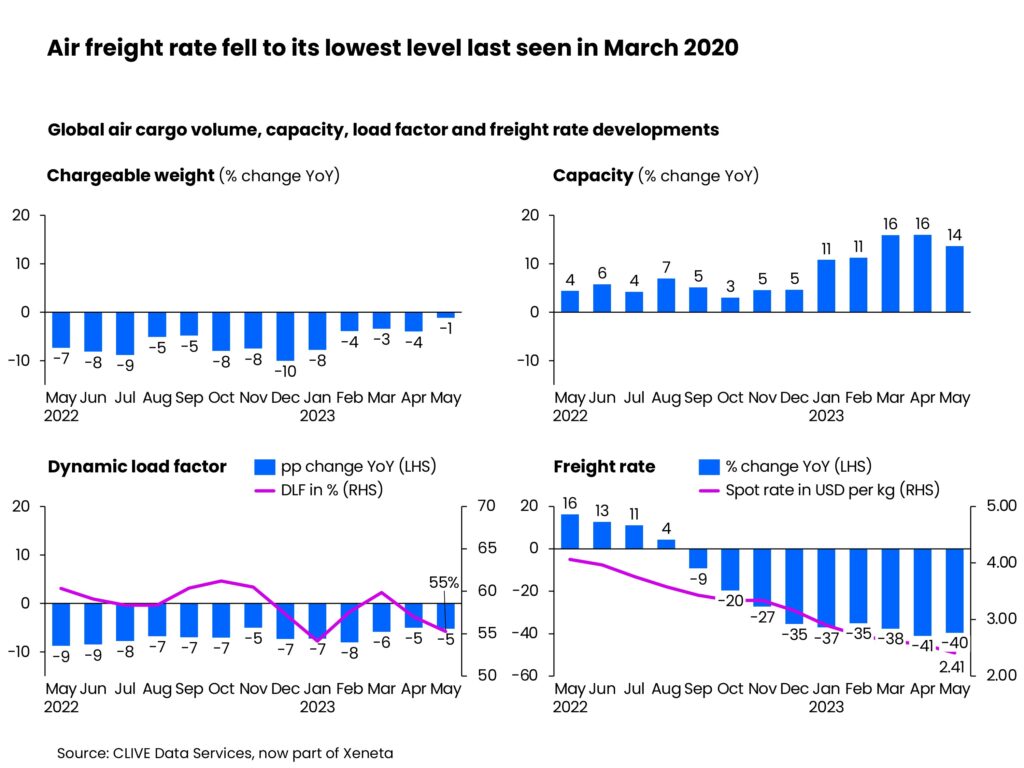

General airfreight rates fell in May to their lowest level since March 2020, found market analysis by CLIVE Data Services.

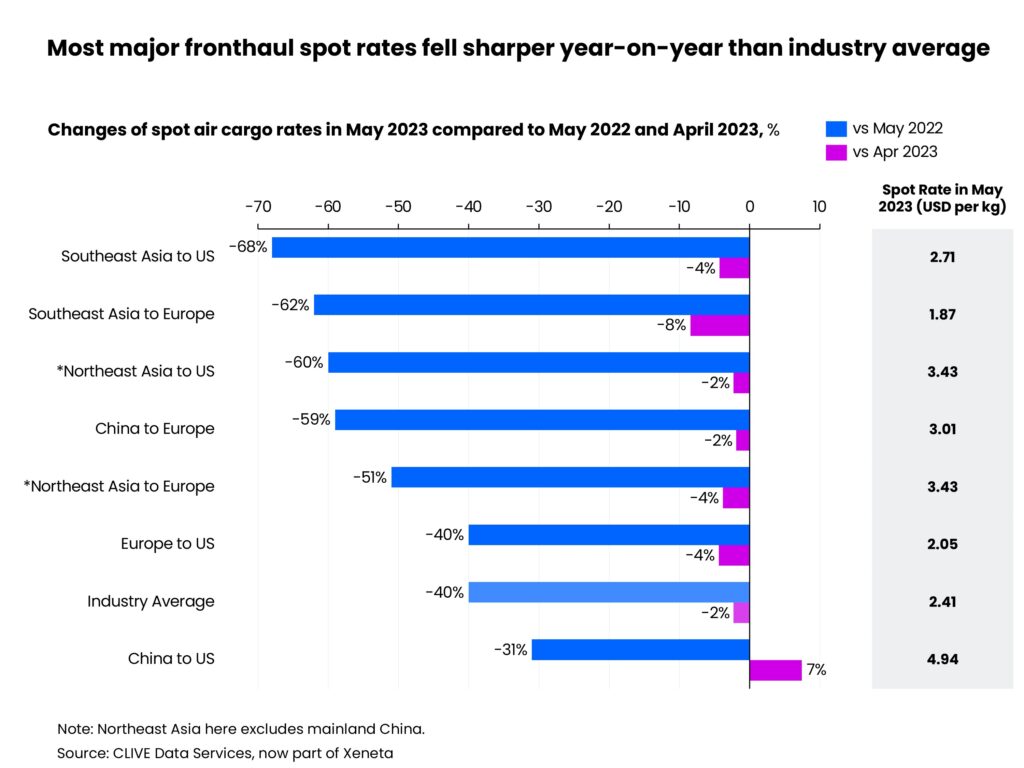

The analyst reported the global airfreight spot rate fell 40% in May from a year earlier, reaching its lowest level in over three years of $2.41 per kg.

Source: CLIVE Data Services

This follow’s IATA’S prediction that airline cargo revenues and yields could fall by more than 31% and 29% respectively in 2023.

Softening global air cargo demand saw a less severe year-over-year drop of -1% in chargeable weight in May, the smallest monthly decline in the past 12 months, but the belly capacity increase for the peak summer leisure travel market has put more pressure on rates.

Global air cargo capacity in May continued its double-digit increase, up 14% year-on-year.

Less demand and more capacity led to an inevitable fall in the dynamic load factor, CLIVE’s measurement of global volume and weight perspectives of cargo flown and capacity available.

It was -5% pts lower vs. May 2022 at 55%.

Source: CLIVE Data Services

In addition to a challenging outlook for rates, demand and capacity, the potential for US west coast labour strikes and Panama Canal restrictions to benefit air cargo is unlikely, van de Wouw added.

He stressed that “with ocean freight demand matching the fortunes of air cargo, any benefit of some goods switching from ocean to air is likely to be short-lived and have little meaningful impact at a global level”.

“Shippers are the dominant players in the market right now, as freight forwarders and airlines are nervous of missing/losing the volumes that are actually offered in the market,” van de Wouw said.

“It’s a time of ‘stick or twist’ for airlines and forwarders. Do they become more short-term driven and flick the ‘let’s-just-buy-the-volumes’ switch or do they sit it out?

“Do they take drastic action or hold their course? If companies become trigger happy in using such tactics, we could see more downward pressure on the air cargo market than the actual changes in demand/supply.”

Concern about the market is growing warned van de Wouw, with more airlines and forwarders “clearly getting nervous”, while “hopes of an uptick in peak season demand later in the year are dwindling”.

CLIVE: Forwarders seek longer term contracts to secure volumes