K+N grabs air market share in Q1 on pharma and perishables

20 / 04 / 2017

Kuehne+Nagel (K+N) continued to see strong improvements in its airfreight volumes during the first quarter of the year as it grabbed market share, but profitability was flat.

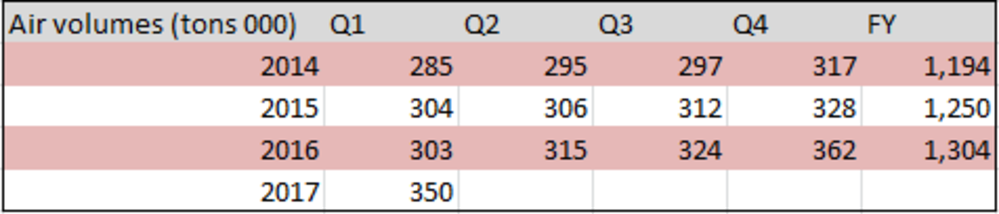

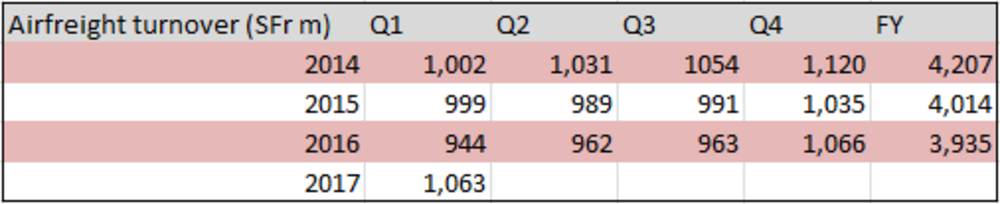

The Switzerland-headquartered freight forwarder saw first-quarter air volumes improve by 15.5% year on year to 350,000 tons, while airfreight turnover increased by 12.6% on a year earlier to Sfr1.1bn.

Growth was particularly strong in pharma, perishables and e-commerce, the company said.

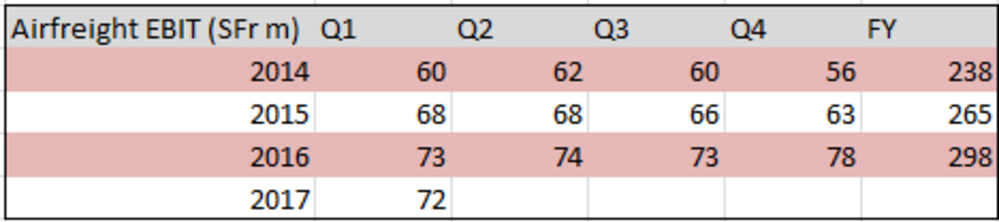

While volumes and turnover improved, air cargo profitability was flat as margins were stable. Airfreight earnings before interest and tax (EBIT) for the period were down 1.4% on a year earlier to Sfr72m.

To mitigate the flat profits in air, the company had managed cost control and digitised internal processes.

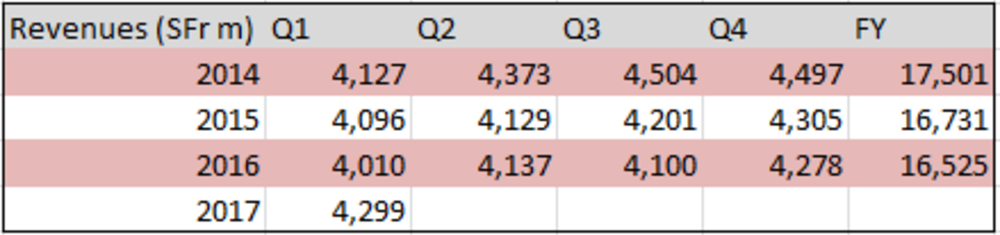

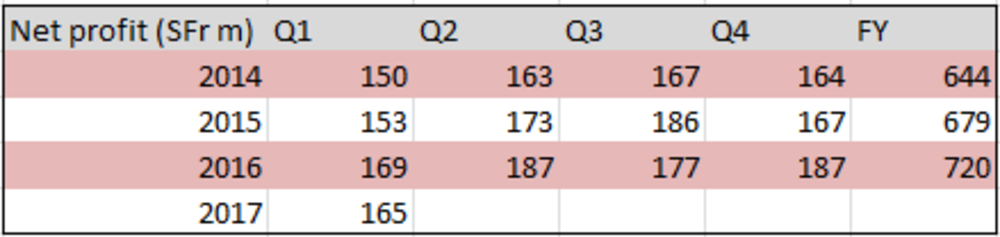

There was a similar picture at the overall company, with net turnover for the first quarter increasing by 7.2% year on year to Sfr4.3bn but net earnings decreased by 2.4% to Sfr165m and EBIT was down by 3.7% to Sfr209m.

As well as margin pressure, earnings were affected by exchange rates and the sale of real estate which boosted first quarter earnings last year.

Seafreight volumes also improved but margins came under pressure, the company said. Forwarders tend to record margin pressure when prices form their suppliers increase as there is some lag in passing these extra costs through to customers.

K+N chief executive Detlef Trefzger said: “The good result in the first quarter 2017 supports our optimistic outlook for a continued successful business development this year.

In seafreight and airfreight we are experiencing strong growth and have gained significant market shares.

“This increase in volume and productivity as well as cost control mitigated the ongoing pressure on margins.

“Our strategic approach for overland and contract logistics led to a further improvement of results. We have established a good basis for the second half of 2017.”

Looking at the airfreight division’s performance last year, there was a 4.3% improvement in demand to 1.3m tons, while revenues for the mode declined 2% to SFr3.9bn and EBIT increased 12.4% on 2015 to SFr298m.

K+N’s rival global logistics operator, Switzerland-based Panalpina, is due to report its first quarter results tomorrow (Friday).