Close menu

- Home

- News

- IATA WCS

- Digital Issues

- Data Hub

- ACN Awards

- Events

- Advertising

- Register

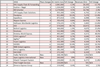

Top 25 air forwarders 2016 revealed: DHL maintains top spot

By Air Cargo News (Admin)2017-06-28T16:02:22

DHL Global Forwarding, Kuehne+Nagel (K+N), DB Schenker and UPS maintained their position as the leading four airfreight forwarders in 2016, while DSV’s acquisition of UTi propelled it up the list (scroll to end for full list).

Air Cargo News is the leading provider of news, information, interviews, analyses and reports to the global airfreight industry.

Site powered by Webvision Cloud