Mixed H1 for European airfreight forwarders

15 / 10 / 2015

It has been a mixed first half of the year for Europe’s leading airfreight forwarders, with some reporting strong volumes increases while others have continued to struggle with restructuring.

One company that has had a difficult start to the year is the world’s largest airfreight forwarder DHL Global Forwarding.

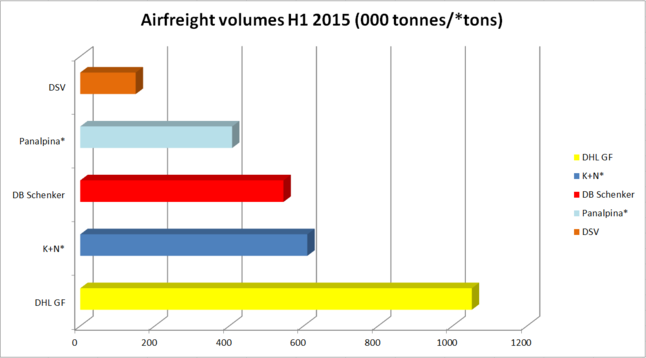

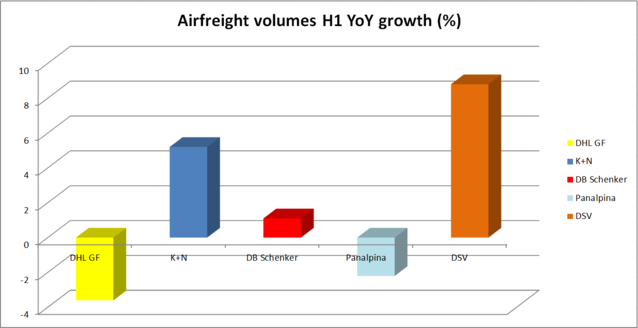

The Deutsche Post DHL-owned forwarder recorded the largest decline in airfreight traffic of the companies analysed, as its first-half volumes dropped by 3.6% on a year earlier to just over 1m tonnes.

The airfreight forwarding market is estimated to have increased by 1-2% during the period.

The performance comes in the context of a difficult and well publicised reorganisation centering on implementation of new forwarding and enterprise resource planning software.

The new software was recently described as rigid compared with the existing system and its roll-out was too aspirational by Deutsche Post DHL chief executive Frank Appel.

Its implementation has therefore been put on hold and could be scrapped completely in favour of a different system. An announcement is expected at the end of the third quarter.

Also, in late April, the company announced that Roger Crook, chief executive of the global freight forwarding arm, had stepped down for personal reasons, although industry rumours suggest his departure was linked to the roll-out of the transformation programme.

Since then, Appel has taken over as interim chief executive of DHL Global Forwarding, freight, and Renato Chiavi has been appointed interim chief executive of DHL Global Forwarding.

On announcing its second-quarter results the company said airfreight volumes had declined as a result of its decision to turn away unprofitable business to protect margins.

There is a suggestion that further business could be turned down as it said margins were still low compared with the historical average.

Chief financial officer Larry Rosen said the decision on whether to "pass out further on loss making routes and customers" in the second half depended on market developments.

The move certainly seemed to improve airfreight gross profits at the forwarder, which saw a half-year increase of 1.1% against a year earlier. Airfreight revenues for the first half increased by 7.3% to €2.6bn.

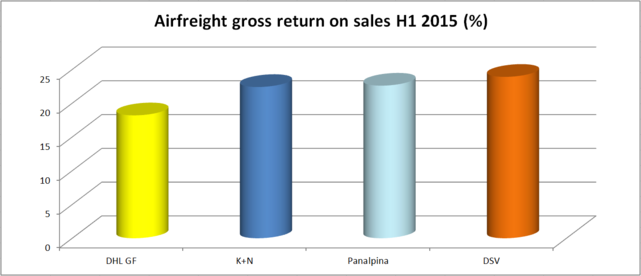

However, DHL reported an airfreight gross return on sales margin of 18.2%, which was the lowest of the four companies analysed and suggests there is further work to be done to catch up with rivals.

The number two airfreight forwarder, Kuehne+Nagel, recorded a 5.2% half year volume increase to 610,000 tons as export increases from Europe, North America and Asia helped the logistics giant outpace the airfreight market.

In addition, said K+N, the expansion of services for customers from the perishables, pharma and industrial goods segments contributed to the "favourable development" for the first six months of this year.

The increase was the second highest percentage gain recorded by the forwarders analysed.

However, its airfreight revenues declined by 2.2% to Sfr2bn largely as a result of exchange rate effects.

At the start of the year the Swiss government took the decision to uncouple the currency from the Euro, creating a surge in demand and pushing up its value.

The move towards higher margin areas of the business helped push up airfreight gross profits at K+N, with a 1.4% year-on-year increase registered for the first six months to Sfr445m.

But its airfreight gross return on sales margin was the second lowest at 22.4%.

Meanwhile, K+N’s Switzerland-based rival Panalpina recorded a 2.2% first half decline in volumes to 408,000 tons, compared with a year ago.

It said this decline was the result of weakness in the key markets of automotive and energy.

As a result of the volume decline and currency effects, Panalpina’s airfreight revenues for the period also slid, but by the higher amount of 13.9% against last year to Sfr1.3bn.

Airfreight gross profits for the period were down by 5.5% on a year earlier to Sfr294m. On a brighter note it had the second best gross return on sales rate of 22.6%.

While Panalpina had a tough start to the year, airfreight volumes took off at DSV Sea & Air, which recorded the largest increase of the companies analysed.

The Danish forwarder registered a first-half increase in airfreight tonnage of 8.8% on 2014 to 149,000 tonnes.

As a result of the increased volumes, revenues increased by 5.7% on a year earlier to Dkk4.5bn, while gross profits were up by 17.4% for the half year at Dkk1bn.

It also recorded the highest gross return on sales margin of 23.9%. Interestingly, the larger of four companies’ gross return on sales margin was lower than the smaller players, suggesting that bigger is not always better when it comes to gross profitability.

Finally, although it does not provide airfreight financial figures, DB Schenker Logistics grew roughly in line with the market as its airfreight volumes increased by 1.1% during the first half of the year to 546,000 tonnes.

But most of the headlines regarding DB Schenker’s performance centred on news that parent company Deutsche Bahn was considering part-privatisation of its logistics subsidiary, along with DB Arriva.

“We are keeping open the option of a partial privatisation of DB Arriva und DB Schenker Logistics in order to utilise growth potential on the international markets as effectively as possible," said Deutsche Bahn chief executive and chairman of the management board Rüdiger Grube.

“Nothing has been decided here yet. And I would like to make it perfectly clear that we are not considering selling off these companies.

“On the contrary, we will retain business management control of both DB Arriva and DB Schenker Logistics.

"Should partial privatisation take place at a later point, it is of key importance to us that we be able to further consolidate both businesses.