E-commerce to become a third of air cargo volumes

13 / 03 / 2024

Source: McKinsey

E-commerce will likely stabilise as a third of total air cargo volumes, delegates were told at IATA World Cargo Symposium (WCS).

Speaking about how e-commerce is rapidly gaining value in the air cargo sector as it grows in volume, Ludwig Hausmann, senior partner at consulting firm McKinsey said that the percentage of e-commerce air cargo had jumped 10% in the space of five years, with further growth expected.

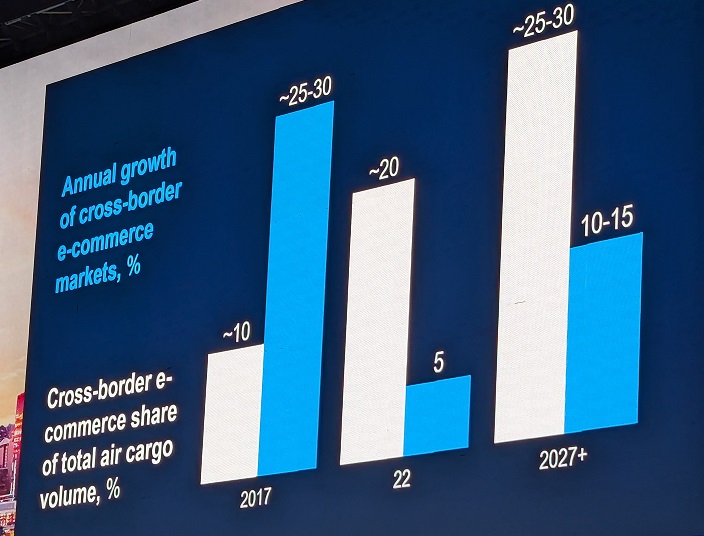

During the ‘Air Cargo Market Dynamics 2024 and the E-commerce Opportunity’ session, Hausmann said that in 2017, the cross-border e-commerce share of total air cargo volume was 10%.

In 2022, this had jumped to 20% and in 2027 this percentage is expected to be between 20-25%.

E-commerce picked up at the start of the pandemic and decreased again in 2022 because capacity was so low, but now it is rising again.

“This is a fundamental shift in how this industry operates. And we’re not seeing a decline. It’s likely going to level out at a third or so,” Hausmann said.

E-commerce volumes are being transported using capacity that amounts to 70 widebody freighter departures (a day), he explained. He added that for context there are “200 widebody freighter departures in China per day in total”.

E-commerce companies are rapidly growing, which is fuelling demand for e-commerce air cargo. Temu now has a 7% share in cross-border e-commerce orders, versus 0% in 2022.

“There is no single cargo airline that has 7% of the market share on a global scale,” noted Hausmann.

Transporting cross-border e-commerce parcels today draws around $100bn in revenue, almost half of this is commercial parcel forwarding.

China is leading e-commerce exports. In 2023, 37% of cross-border e-commerce shipping originated in China after fluctuating over the preceeding years.

However, Hausmann said there are no proper statistics around cross-border e-commerce because not all of it travels using normal airfreight customs cleared shipments as there are also postal and parcels volumes.

Therefore, McKinsey’s own cross-border e-commerce data looks at estimated order volumes. For 2022, there were an estimated 8.2bn orders that crossed borders, and 6m air cargo tons related to cross-border e-commerce.

Hausmann pointed out that e-commerce air cargo has different geographical strengths than general air cargo.

“Intra-Asia has a huge 18% share of this volume. It’s much less on the general air cargo side.”

Examples include outbound China to Southeast Asia and in recent times India outbound.

“Outbound North America is also growing which could help the balance of lanes,” he added.

Overall, Hausmann said: “More than 60% of these orders are on the intercontinental lane and therefore clearly requiring air logistics.”

Plus, speed continues to be a requirement in e-commerce. “If you are a Click to Door shipper (as opposed to those that ship to regional warehouses) then you have to fly stuff because you need to be quick.”

But he warned that cargo carriers must become more flexible to meet the specific logistics, transportation, last mile and paperwork needs in e-commerce.

“E-commerce air cargo requires a bit of a new business mindset,” he concluded.