Far East- North America cargo trade lane fuelled by e-commerce

12 / 03 / 2024

Photo: Air Cargo News

E-commerce is driving the growth of the Far East – North America air cargo trade lane, according to IATA’S chief economist.

International cargo tonne-kilometers (CTKs) were up 3% in 2023 for the Far East – North America trade lane, notably above other trade lanes, said Marie Owens Thomsen, IATA’s senior vice president sustainability and chief economist at the 2024 IATA World Cargo Symposium (WCS).

“We would naturally think that this must have something to do with the e-commerce evolution, and the direction and expansion of the trade lane probably comes from this direction towards the Americas,” Thomsen told Air Cargo News. “In a nutshell, I think that’s the answer.”

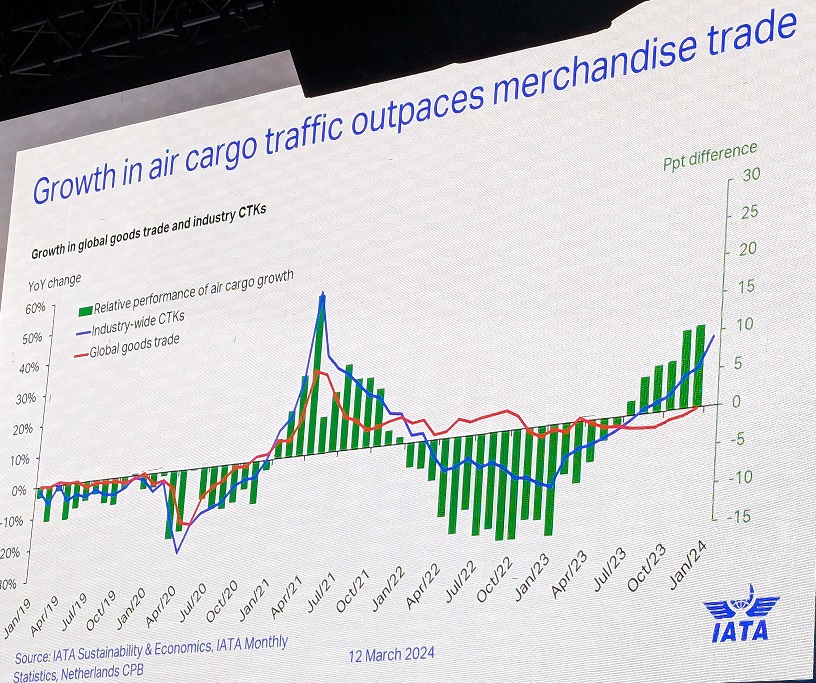

Reflecting on the overall air cargo industry performance during a sustainability and economic outlook session at WCS, Thomsen also noted that air cargo is holding its own in the world trade arena.

“Growth in air cargo is outpacing merchandised trade growth,” she said. “We are capturing market share in the trade space.”

Cargo is expected to continue to be a major part of growth in the aviation sector. This is despite cargo climbing to around 30% of the share of airlines’ total earnings during the pandemic, and now returning back to 12%. Thomsen pointed out that air cargo rates were given a big boost in January due to the Red Sea shipping crisis.

“I hope for building robustness that we can continue to treat cargo (with) strategic importance,” Thomsen said.

One challenge for cargo is the continued return of passenger aircraft, which is increasing belly capacity and driving air cargo capacity up, although for some air cargo businesses, this is not bad news. Recently there has also been an increase in dedicated freighter capacity.

Turning to the risk factors in the general economy, Thomsen said there is much political instability which can impact the stability of policies, and therefore air cargo trade.

Additionally, inflation has increased more than expected, and borrowing costs have risen and are likely to increase further as inflation comes down and central banks delay their nominal rate cuts.

This all has a “drag on growth”, said Thomsen.

Inflation in the aviation industry is felt more acutely because the industry’s cost base is 30% fuel, and jet fuel costs more than Brent crude oil. According to Thomsen, this isn’t likely to change due to a structural lack of refining capacity.

Meanwhile, the US dollar is strong and this is also a drag on growth.

But global GDP is around 3%, which is “ a remarkable performance”, with unemployment rates at or near historic lows.

This is a “very unusual low unemployment scenario”, she said.

On a positive note, despite all the extra costs aviation faces, the overall aviation industry is back to profitability, Thomsen said. However, profits are slim and the industry needs to become more robust.

“All regions should deliver a positive operating margin in 2024,” she added. Growth is expected to be highest in Asia, with central Asia leading the way.