Survey: Air cargo optimistic for the year ahead

02 / 02 / 2024

Credit: tratong/ Shutterstock

Air Cargo News recently carried out a survey of airfreight professionals and found the majority are expecting market conditions to improve this year.

The air cargo industry is optimistic the market will improve in the coming year, with expectations that both volumes and rates will increase in 2024.

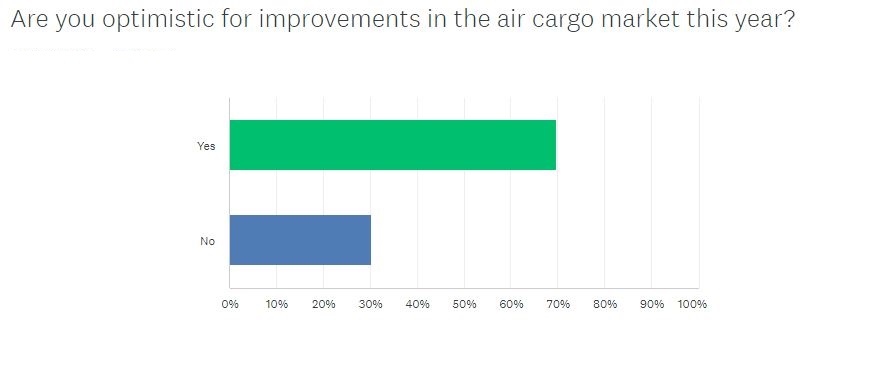

A survey of more than 130 airfreight professionals carried out by Air Cargo News during January found that 70% of respondents felt optimistic for improvements in the air cargo market this year.

Source: Air Cargo News

People taking part said that geopolitical issues will drive the use of airfreight with many pointing to issues in ocean shipping caused by the Red Sea crisis as being likely to push companies to utilise air.

There was also a feeling that the market would improve more in the second half of the year.

“The global economy should perform well in 2024,” said one. “There will be no record result, but there will also be no decline in global production.”

Those who were less optimistic cited concerns about overcapacity and declining yields, while others felt the geopolitical issues would hold the market back.

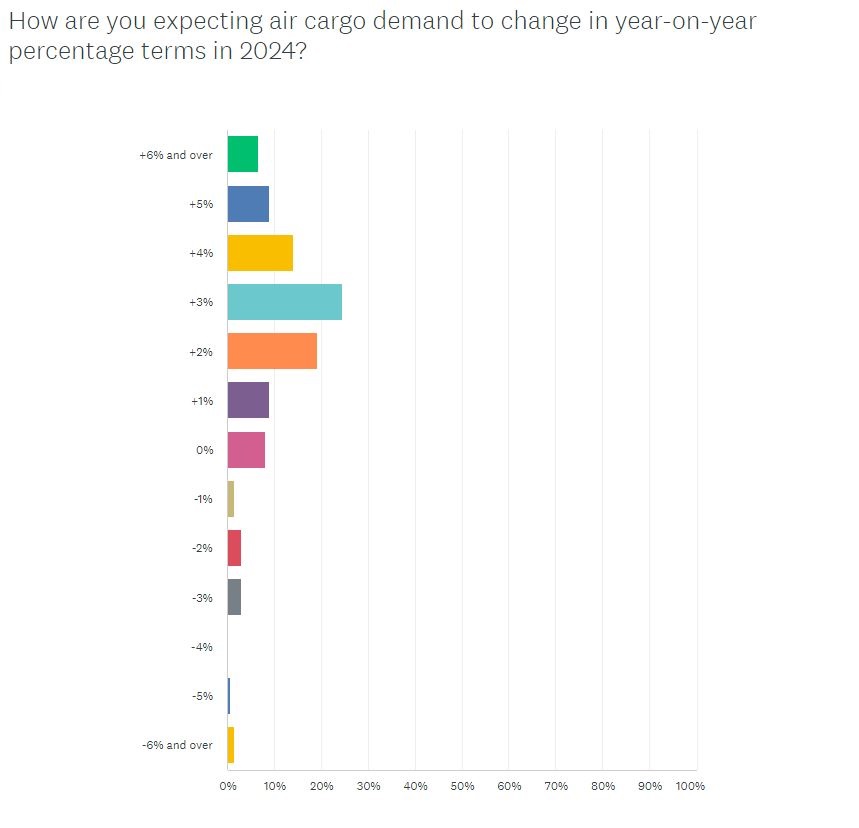

Diving deeper into how volumes might progress this year, the survey asked what respondents’ expectations were for year-on-year demand growth.

The option with the most responses was 3% – taking just over 24% of the vote, while 2% was second with 19% of the vote, and 4% third with 14%.

Source: Air Cargo News

One person pointed out that growth this year would in part be caused by the weak performance in 2023 rather than because 2024 is expected to be particularly strong.

Others reiterated thoughts that issues in ocean shipping would push forwarders to air and that the economy would improve on last year.

Respondents to our survey landed somewhere in between the expectations of analysts, with Xeneta predicting a 1-2% increase in demand for the year and IATA a 4-5% increase.

Meanwhile, initial WorldACD figures for the year show that in the two weeks running to January 21, air cargo demand was up 5% year on year. However, this may reflect the timing of the Lunar New Year holiday in Asia, the analyst pointed out.

Growth projections

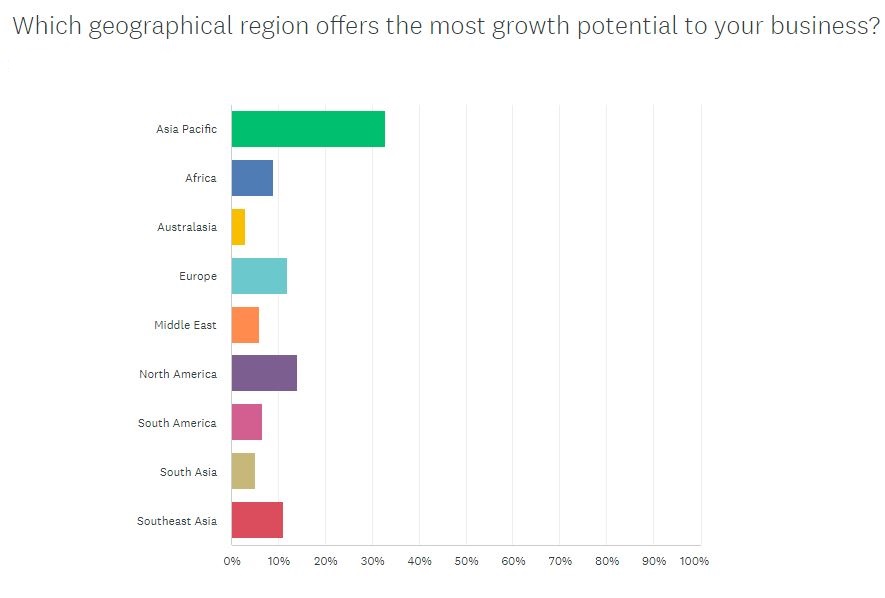

Source: Air Cargo News

Asked which region would fuel growth, Asia Pacific took 32.8% of the vote, with North America taking 14.2%, Europe 11.9% and Southeast Asia 11.2%.

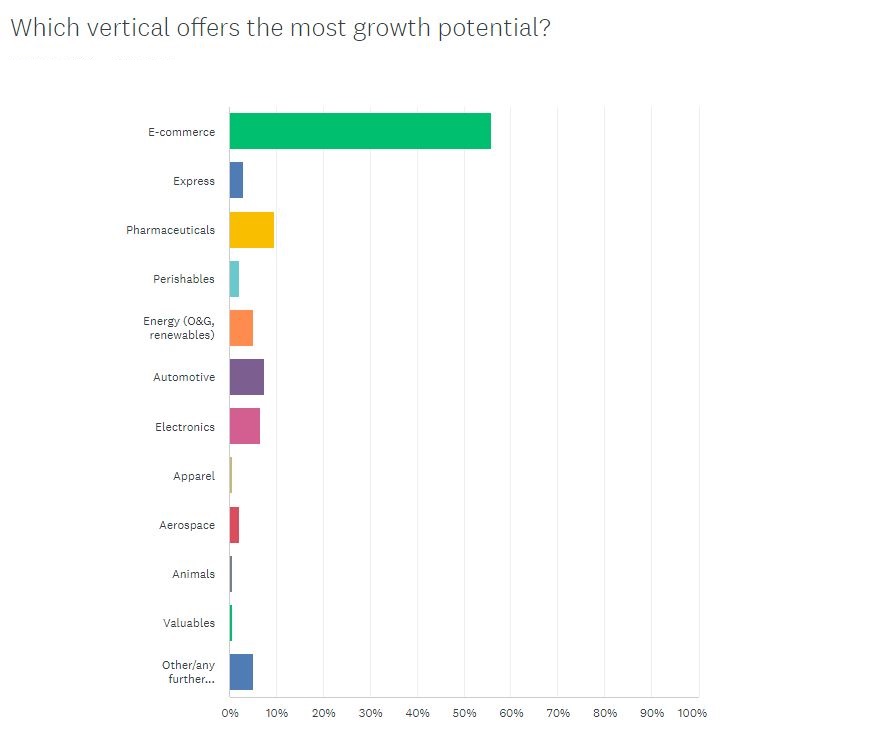

While there was a relatively even split on which region would fuel growth, e-commerce dominated the rankings for the commodity that would grow the fastest, taking 55.9% of the vote compared with pharma in second on 9.7% and automotive in third on 7.5%.

Source: Air Cargo News

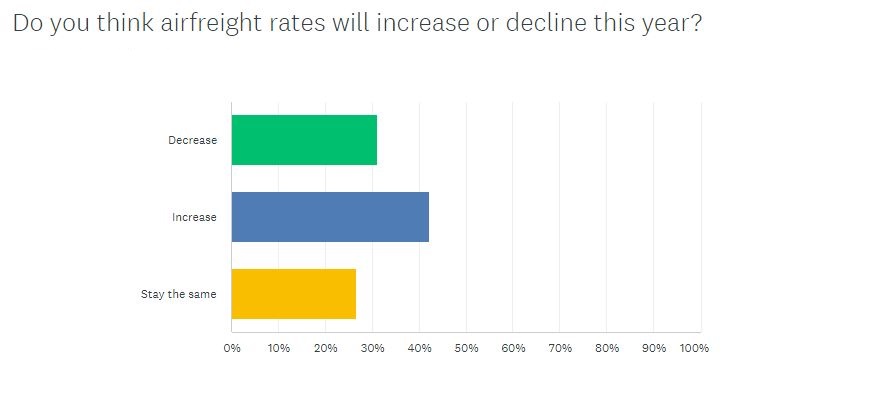

Staying on market expectations, there was a divide on expectations for airfreight rates for the year.

Of the respondents, 42.2% predicted an increase, 31.1% a decrease and 26.7% were expecting prices to stay the same.

Source: Air Cargo News

This deviates from expectations of market pundits with IATA predicting a 20.9% fall in yields. The airline association reasons that airfreight rates will continue to settle as the market returns to normal following the Covid pandemic and belly capacity returns to the market.

Over the first few weeks of the year – at least – rates were on the slide with the overall Baltic Air Freight Index being just over 28.8% down year on year in mid-January.

Respondents pointed out that fuel prices were currently low and could increase as the year progresses to push up overall rates.

“I think [rates] will stay steady but fuel costs are always the real driver,” said one respondent.

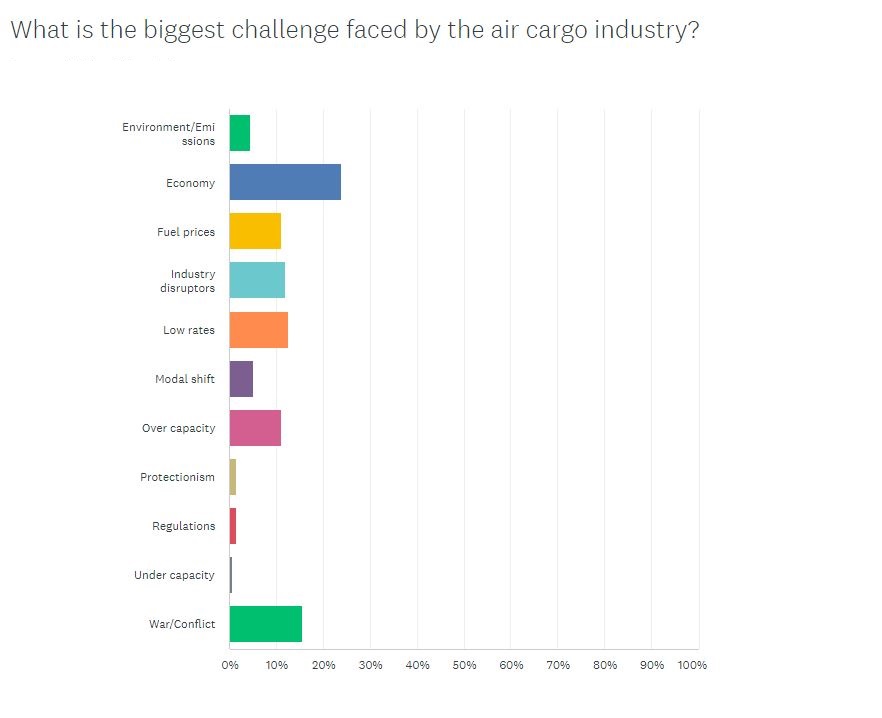

Biggest challenges

Source: Air Cargo News

Moving onto challenges faced by the industry, the economy was the biggest concern with 23.9% of the votes but then a fairly even split across the other options.

“It’s always the economy,” one respondent remarked.

Second was war/conflict with 15.7% of the vote and third was low rates with 12.7%. There were also concerns about fuel prices and CO2 emissions.

“As an operator, fuel prices remain our greatest operational challenge, however, the economy plays a large part overall,” said one person.

Consistency of service and a lack of capacity during the peak season were also mentioned in the comments.

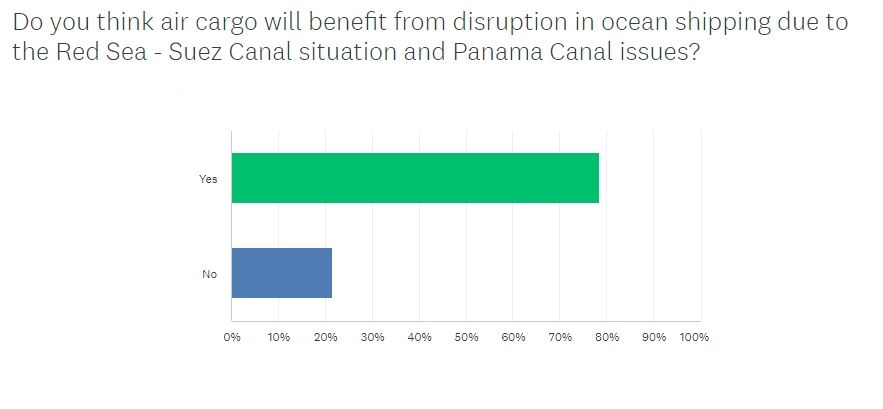

One of the hot topics of the moment is to what extent air cargo will benefit from container vessels needing to divert around the Cape of Good Hope due to attacks in the Red Sea.

The diversion adds between 10-14 days to Asia-Europe transit times and there have been reports of shippers looking to air cargo and sea-air as an alternative.

The vast majority of respondents (78.5%) are expecting air cargo to benefit from the situation, although it may only be a short-lived boost.

“The volumes may not be that huge,” said one person. “Some shift for specific commodities might happen.”

“The benefit will be minimal, but there will be a shift of some products to move air versus ocean due to risk of extended transit times,” said another.

One respondent remarked that any increase will only be for a short period of time “until shippers adjust their schedule”.

Source: Air Cargo News

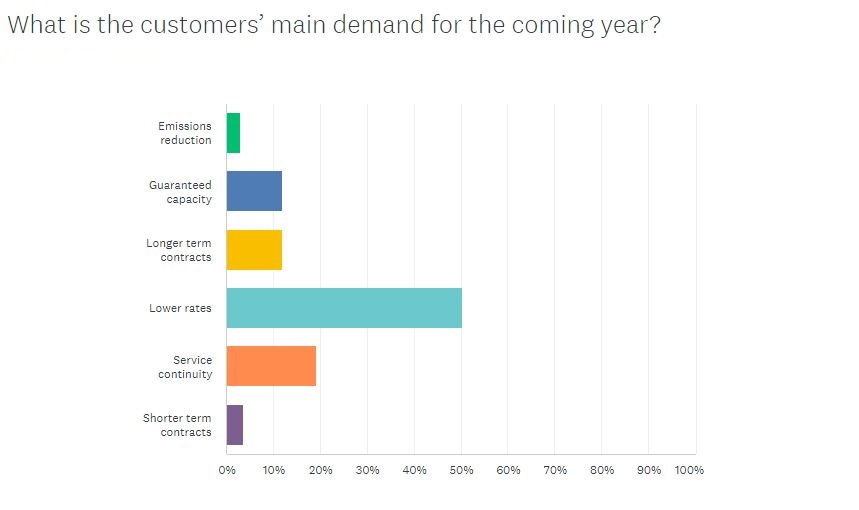

Lower rates was the main thing that customers were asking for this year, according to the survey, with 50.4% of respondents saying this was the priority.

Service continuity (19.3%) was second, while guaranteed capacity (11.9%) and longer term contracts (11.9%) took joint third.

Source: Air Cargo News

“With multi-year [rate] increases due to under capacity and inflation, companies are still focused on reducing costs,” explained one respondent.

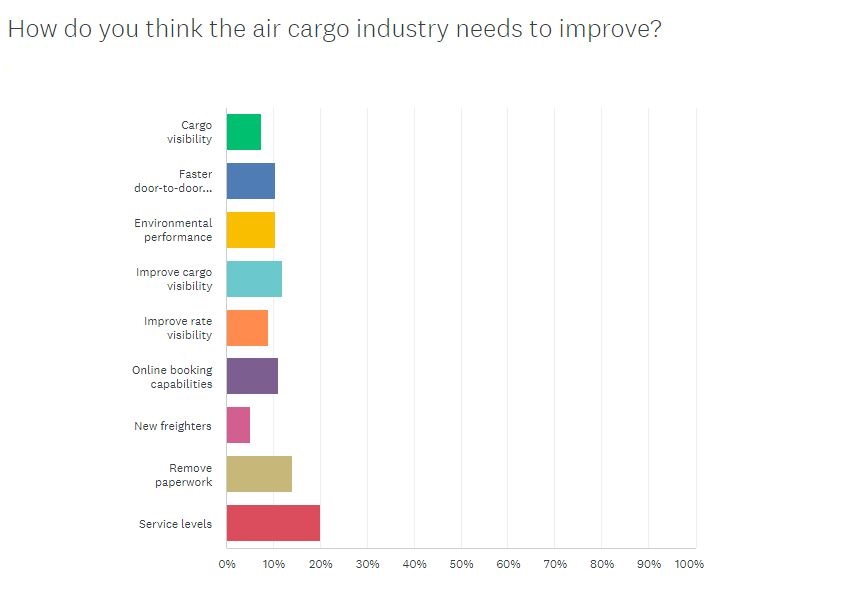

The survey also considered how the industry should improve, with service levels coming top of the pile (20.2%) ahead of removing paperwork (14.2%) and improving cargo visibility (11.9%).

Source: Air Cargo News

“The biggest problem is on the import side,” said one respondent. “With the Ground Handling Agents reporting to the carriers, and the carriers only truly interested in exports, this leaves little incentive to improve service once cargo has landed.

“In some cases, it takes longer to make freight available to the consignee, than it does to fly it from the far reaches of the world.”

Another would like to see improved rate visibility to help move the industry from one based largely on price negotiations to one based on service level conversations.

Going green

Source: Air Cargo News

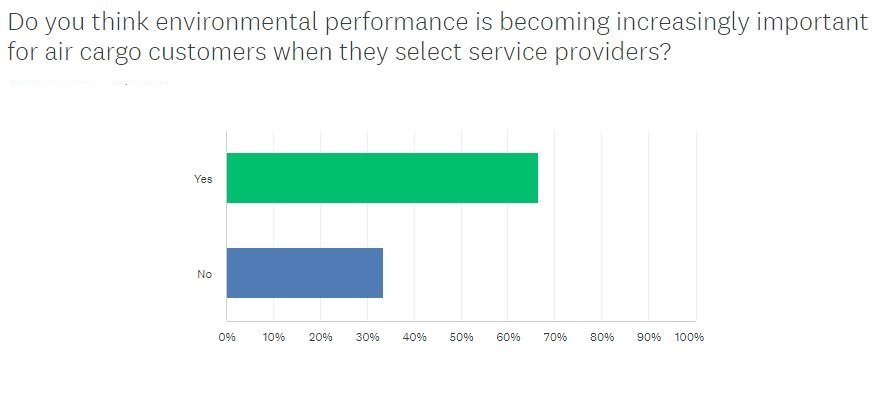

Another big topic of the moment is air cargo’s environmental performance and the airline industry’s ambition to reach net zero emissions by 2050.

Asked whether environmental performance was becoming increasingly important for air cargo customers when selecting providers, the majority (66.4%) felt it was.

“Although the environment is very important, I still strongly believe that the drivers are time and money,” said one respondent.

“[Air cargo is] still a couple of years behind other industries but [the environment] will become a more and more important factor for customers,” added another.

Someone else pointed out that increasing environmental regulation was helping drive demand for lower emissions operations.

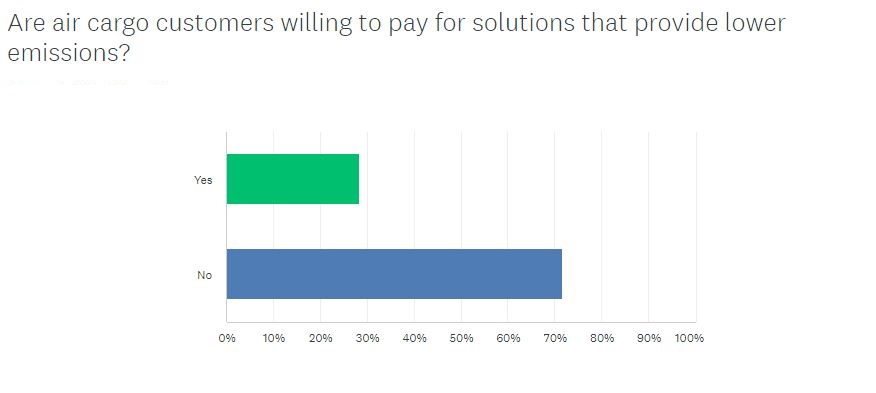

The big question though is whether customers are willing to pay for improved environmental performance.

Here, most respondents (71.6%) said that customers didn’t want to pay.

“The majority are not [willing to pay] but there are a few in the very small minority. Still a lot of talk with little action,” said one respondent.

“[They] want to feel they’re doing the right thing but don’t want to pay,” added another.

Source: Air Cargo News

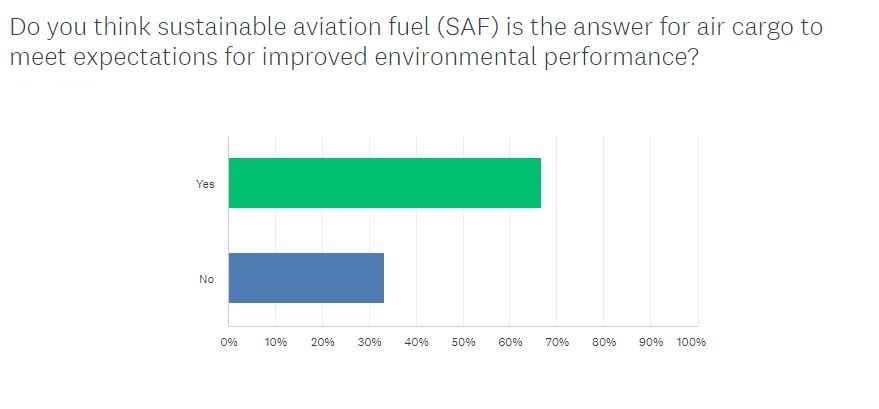

The final question asked whether sustainable aviation fuel (SAF) is the answer for air cargo to meet expectations for improved environmental performance.

Most respondents (66.7%) felt SAF would play an important role, although written responses were more nuanced.

Participants pointed out that SAF was part of the answer but other options, such as technological improvements or hydrogen, also had a role to play. It was also pointed out that there are limited SAF resources.

Source: Air Cargo News