Top 20 air cargo hubs: Facing up to a challenging market

01 / 11 / 2021

Source: Hactl

Last year was not easy for the world’s leading air cargo hubs as Covid put pressure on operations. However, the cargo sector continues to invest and is looking ahead to a brighter future.

Covid-19 saw airport passenger terminals turned into ghost towns in 2020, but airfreight kept flowing through global hubs, be it on freighters or preighters.

Global passenger traffic at the world’s top 10 busiest airports nose-dived 45.7% in 2020, according to Airports Council International (ACI) World data, but volumes in the top 10 cargo hubs grew 3% to 30.6m tonnes last year, representing some 28% of global throughput.

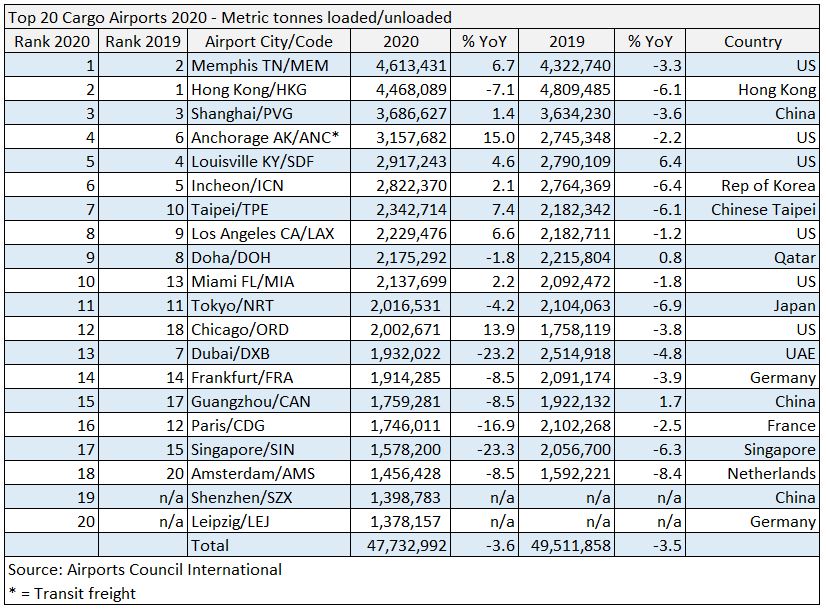

For the top 20 cargo hubs (see chart at end of article), the total 2020 freight volumes were down 3.6% to 47.7m tonnes. Paris airport, in 16th place, saw volumes fall 16.9% last year over pre-Covid 2019 to 1.7m tonnes, while fellow European hub, Amsterdam Schiphol, was in 18th place with an 8.5% decline over prior year to 1.4m tonnes.

Singapore Changi airport saw a 23.3% plunge in 2020 volumes to nearly 1.6m tonnes, while Middle East superhub, Dubai, fell from 7th to 13th place, after its 23.2% decline to 1.9m tonnes last year compared with 2019.

The top two in the premier league of cargo hubs swapped places, with Memphis now in first place at 4.6m tonnes, a 6.7% increase over pre-pandemic 2019. Hong Kong edged down to second place after a 7.1% decrease in volumes to nearly 4.5m tonnes.

Pudong Shanghai remained in third slot with 3.7m tonnes, up by 1.4%. The remaining seven places saw US, Chinese and Middle East hubs swapping places, something to be expected in a pandemic, although there should be a special mention for top of the world hub Anchorage, in fourth place at 3.1m tonnes with the largest top ten volume percentage increase at 15%.

The pandemic still rages but the vaccination programme in the major global economies has seen many key hubs registering an increase so far, for example Hong Kong saw cargo throughput in August record a year-on-year increase of 15.5% to 429,000 tonnes and for the first eight months a 12.4% growth to 3.2m tonnes.

Frankfurt’s cargo throughput maintained its growth trend in August, rising 13.3% to 182,362 tonnes versus 2020, or 5.3% over pre-pandemic August 2019.

Ocean freight port congestion, scattered empty containers and unreliable sailing schedules provided a modal shift bonus for airfreight in 2021.

Facing the challenges

What were the challenges for global cargo hubs in 2020 and what challenges lie ahead, for example a slow return to bellyhold capacity, a rapid rise in e-commerce and political pressure for sustainable air cargo?

Thomas Romig, vice president safety, security and operations air cargo at ACI World said that the pandemic saw a “significant transformation” for airports with “a multitude of changes”.

Says Romig: “The overall cargo capacity, in particular bellyfreight, has been significantly reduced due to air operators not flying their initially scheduled routes. Border restrictions have played a key role in flight reductions, impacting cargo capacity.

“New full freight operations have grown in many hubs. In some cases, these operations have almost taken a delivery truck type of approach, stopping at several airports to load/off-load products along the way. These have compensated the loss of belly freight normally available.”

He continues: “The rise in online shopping – again due to covid restrictions – has given a boost to certain hubs seeing movement of more small packages. This has also generated new challenges, with increases of road traffic – particularly light delivery vans – running the last mile transportation.

“In some cases, there have been challenges in ensuring smooth operations for the shipping of vaccines that require specific conditions and, in some cases, security protocols. Generally speaking, the major cargo hubs have not been affected by this though as they have the protocols and equipment/facilities already in place.”

Wilson Kwong is chief executive of Hong Kong Air Cargo Terminals Limited (Hactl), the hub’s largest independent handler.

“We have seen an increase compared to 2019 and there are several reasons for that: one reason is because the whole industry is still suffering from the lack of capacity due to the absence of the passenger aircraft and the other is that Hactl’s customer profile tends to be more towards freighters, so we are benefiting from that.”

Hactl saw additional freighter calls from the start of the pandemic, with challenges posed by altered flight patterns and changing quarantine requirements for air crew and ground staff.

“We are one of the bigger freighter ramp handlers and it has been a challenging 18 months, but we planned well ahead, and we were very lucky that the team is mainly directly-employed staff.”

Some mainland China airports had to close at short notice because of Covid outbreaks among staff, with some cargo diverted to Hong Kong.

“Additional flights create operational challenges and airport authorities have tightened the vaccination testing requirements for staff working at the airport, specifically those colleagues handling inbound cargo from high-risk countries. It makes it harder for manpower deployment because they must have vaccinations,” says Kwong.

Hactl, celebrating 45 years of operations, acted early to encourage and motivate colleagues to get vaccinated, offering iPhones in a lucky draw, and currently has 92% of staff who have either already had a jab or are booked to do.

“This is higher than the Hong Kong average and I’m proud of that,” says Kwong.

PPE, vaccines and e-commerce

Airfreight was in the spotlight for delivering Personal Protective Equipment (PPE) at the start of the pandemic, and then in delivering vaccines, while also keeping some airlines flying with precious revenues. Will this see airports invest more in air cargo facilities?

Says Romig of ACI World: “In some cases air cargo has been instrumental in ensuring the financial sustainability of the airport, compensating (in part for) the loss of revenues from the decrease of passenger traffic.

“Airports have been interested in finding solutions to diversify their revenue streams – cargo being a good option.

“ACI teamed up with Netherlands Airport Consultants (NACO) InterVISTAS to develop a short cargo strategies guide for airport operators that looks to provide airports with strategic advice on improving or establishing a cargo operation at their airport.”

Consumer behaviour changed radically during the pandemic as people in lockdown, unable to visit shops, went online to purchase goods.

Airports saw significant increases in e-commerce and, for the most part, says Romig, have been able to actively manage the increased demand and cater to the challenges.

“The biggest challenge has been managing the influx of small packages and the ground transportation and logistics which accompany this. Some airports have implemented technologies that allow for flow management of these types of vehicles, others had additional capacity available.

“The reduction in passenger traffic and subsequent reduction in aircraft movements, has provided additional ad-hoc slots for cargo operations. This may evolve once traffic volumes pick-up again.”

Hactl, says Kwong, has never stopped investing in new, more efficient solutions which include a Box Storage System (BSS) and Container Storage System (CSS) at its SuperTerminal 1. It is also looking at robotics handling systems which is a common theme among cargo hubs.

“At Hactl SuperTerminal 1 we have highly automated systems with a box storage system and a container storage system, basically the whole terminal is a gigantic system, but we still have people doing the breakdown and build up on the shop floor.

“There is the growth in e-commerce, of which the size, the shapes and the nature is slightly different from the general cargo we usually handle.”

Hactl has already installed a small-scale robotic system for handling spare parts used in maintenance of its giant handling systems.

Kwong adds: “But that is only a start, and we are looking to introduce further systems like that for our e-commerce handling centre. I’m always looking at solutions to further automate our operations and, Hactl being Hactl, we always want to try something new, but it is also about leadership and taking the industry to the next level. We want to show that this is all doable.”

Kwong recognises that a lack of standardisation remains the ultimate challenge for the air cargo industry. Standardisation allows automation to work best when “you’ve got a whole host of homogeneous products of similar sizes and similar shapes and similar volumes”.

It’s not easy being green

Environmental issues are now firmly on the agenda for airports worldwide. Sustainable Aviation Fuels (SAF) have seen airlines prepare for the environmental challenge ahead. What can airports do on the ground?

Juliana Scavuzzi, senior director, sustainability, environmental protection and legal affairs at ACI World, says that its members have recently committed to Net Zero Carbon by 2050. Swedavia airports have already reached Net Zero.

He adds: “Airports are encouraged to also support airlines and other stakeholders in reducing their own emissions. The Airport Carbon Accreditation also recognizes airports’ engagement with third parties to support them reducing their own emissions.

“Many airports have long standing carbon reduction programmes, focusing on the overall airport’s carbon footprint. These have been in place prior to the pandemic and sustained throughout.

“In some cases, these programmes include incentives or other mechanisms helping to accelerate the adoption of ‘green’ ground service equipment (GSE).”

ACI has a tool to support developing the business case for the environmental and economic benefits of reducing the use of the auxiliary power unit (APU) by the introduction of electric ground energy systems while the aircraft is at the gate.

Adds Scavuzzi: “Airports can facilitate the commercial deployment of SAF by offering it onsite. Currently 25 airports worldwide offer SAF either continuously or through batches.”

ACI World conducted the long-term carbon goal study and also produced a white paper on sustainable energy sources for aviation.

It provides relevant information and identifies potential implications on airport infrastructure and operations resulting from the adoption and promotion of alternative fuels.

Hactl’s Kwong, who is also chairman of the environment & sustainability committee at the Hong Kong General Chamber of Commerce, recognises the role of SAF for airlines but says that terminal operators must look for solutions to minimise energy consumption on the ground.

“Typically for any operations in any building it consumes electricity in several ways: the air-conditioning systems and the lighting etcetera that is why we have been doing a lot to enhance our efficiency through what we termed as the Green terminal programme.

The programme looks at minimising energy consumption through more efficient use of lights and air conditioning, banning plastic straws and water bottles, plus installing solar panels on the roof.

“Not all ground GSEs can be electric at this point and even when they are, operators are constrained by charging points. This is an issue that industry should look at, not just from Hactl’s perspective but from that of the whole airport.”

The world’s top 20 cargo hubs proved themselves in 2020 and beyond but airport operators and their tenants still face big issues around sustainability and preparing for a post-pandemic aviation sector.