Top 20 Cargo Airports: Hong Kong leads the way in a tough 2022

03 / 11 / 2023

Source: Shutterstock

In the wake of Covid-19, other challenges are still hampering air cargo growth. But some of the world’s busiest airports are bullish nonetheless, and are backing their vision for the future with substantial investments (see the top 20 table at end of article).

Figures published by Airports Council International (ACI) World in July indicated a fall in 2022 air cargo volumes compared to 2021.

According to ACI World director general Luis Felipe de Oliveira: “In 2021, volumes were up 15.4% compared to 2020, and then 2022 was down 6.7% on 2021.

“The reduced impact of the pandemic, less use of capacity to transport vaccines and other Covid-related supplies, trade tensions and war all affected the 2022 result. Our members recorded a total of 117m tonnes of air cargo in 2022 – not so different from the 120m recorded in 2019.”

Indeed, the 2022 figure is just 2.6% lower than the total volume flown in 2019, showing that traffic is almost at pre-pandemic levels.

Number one

Top of the rankings was Hong Kong International Airport (HKIA), which handled 4.2m tonnes of cargo last year – a drop of 16.5% compared to 2021.

North America and Southeast Asia were the biggest two air cargo markets for HKIA in 2022, accounting for 19% and 17% of the total volume, respectively.

A spokesperson for Airport Authority Hong Kong (AAHK) says: “In 2022 the overall air cargo volume was impacted by global uncertainties including the ongoing geopolitical tensions and disruptions to trade and supply chains. However, we remain confident of long-term future growth in the air cargo sector.”

To meet both passenger and cargo demand, sustain growth and retain its position as the world’s busiest cargo airport, HKIA is expanding to a three-runway system (3RS).

The 3,800m long new runway came into service in November 2022, while other 3RS works are scheduled for completion in 2024.

The expansion will enable HKIA to handle an annual cargo volume of around 10m tonnes, according to AAHK.

Furthermore, HKIA is the preferred international cargo gateway for the Greater Bay Area (GBA), handling about three-quarters of the region’s international air cargo.

“To further enhance connectivity between HKIA and the GBA, a novel sea-air transhipment model has been introduced,” says the AAHK spokesperson.

This includes a new logistics park in Dongguan, a manufacturing hub in the GBA, and a new airside intermodal cargo pier at HKIA.

At the Dongguan logistics park, customs clearance, security screening, palletisation, cargo acceptance and other services for Mainland China exports can be completed before goods are shipped to the cargo handling facility in the restricted area of HKIA by sea, for air transhipment to worldwide destinations.

Imports to China can be shipped directly from the HKIA restricted area to Dongguan.

“Compared to the traditional road freight mode, the new transhipment model could save 50% of the cost and one-third of the processing time,” the AAHK spokesperson explains, adding: “The pilot scheme has been operating smoothly, and we are targeting to complete the development of the permanent facilities by 2025.”

Hubs

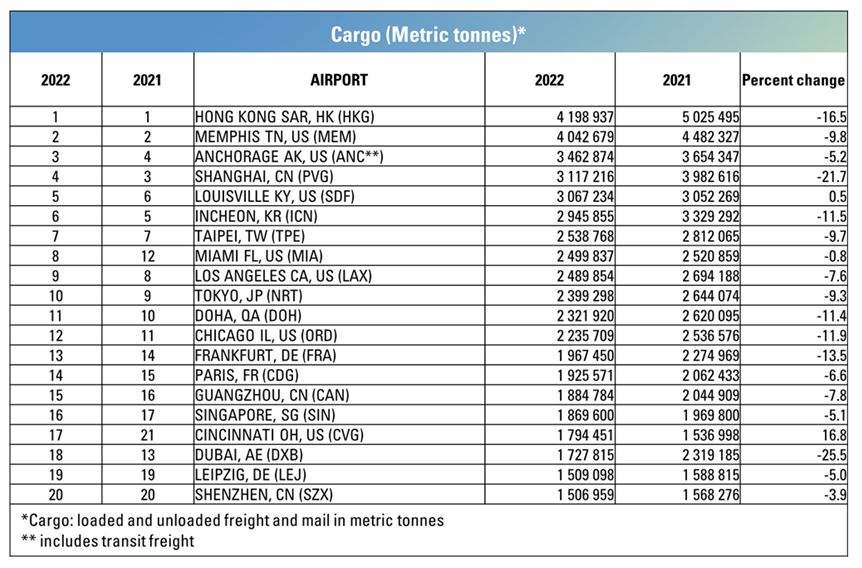

ACI World noted that air cargo traffic is concentrated mostly amongst major airports, with volumes in the top 20 representing around 42% (49.5m metric tonnes) of the global total.

“Usually, cargo is concentrated at hubs,” Oliveira says. “For instance, Memphis has FedEx, Louisville has UPS, and both Hong Kong and Cincinnati have DHL.”

Cincinnati/Northern Kentucky International. Source: RDNichols / Shutterstock.com

Cincinnati/Northern Kentucky International airport (CVG) is home to both DHL Express’ Global Superhub for the Americas and Amazon’s primary US hub.

“There’s a clear link between e-commerce demand and the use of Cincinnati airport,” Oliveira says.

Indeed, CVG rose four spots to 17th position in the ACI World air cargo rankings for 2022, with volumes up by 16.8% versus 2021 – the largest growth among the top 20 airports.

CVG spokesperson Mindy Kershner said: “Air cargo at CVG continues to grow, with CVG being the fastest-growing cargo airport in North America. Cargo has grown 150% over the last five years.

“This year, cargo tonnage moved through CVG is up 12% as of August. There was a new cargo tonnage record for the month of August.”

Recently, DHL announced plans to invest more than $192m in capital improvements at its CVG hub, including the construction of a new maintenance hangar.

Amazon Air, meanwhile, continues to grow at its $1.5bn primary US hub there.

At HKIA, the expansion of DHL’s Central Asia Hub was completed in 2023, boosting its annual handling capacity by 50% to over 1m tonnes.

In addition, a logistics centre developed by a joint venture led by Cainiao Network, the logistics arm of Alibaba Group, is commencing operation this year.

The centre, with an estimated gross floor area of 380,000 sq m, will be equipped with cutting-edge robotics and advanced technologies, AAHK said.

The facility will be Alibaba’s smart hub in Asia and is anticipated to add 1.7m tonnes of cargo to HKIA’s annual throughput.

“We have seen the growth trend of e-commerce and express air cargo during the pandemic and expect the momentum will continue,” the AAHK spokesperson says.

While confident of continuing e-commerce demand, CVG is also seeking to keep diversifying and growing its cargo operations by developing extra cargo handling facilities.

These include the airport’s North Cargo Village project.

Kershner explains: “DHL and Amazon operations represent express shipping. As we work to grow general airfreight activity – more of your large parcels, high-value goods that aren’t as time sensitive – we are working with freight forwarders, developers and other organisations who might be interested in locating on the north end of our campus.”

For example, Burrell Aviation announced earlier this year that it would develop an 80,000 sq ft facility with airfield access to handle general air cargo shipments at CVG.

Plus: “FEAM Aero is building a second maintenance hangar for widebody jets serving many of the cargo airlines doing business at CVG, and Epic Aviation – a Florida-based private flight school – will open an aviation maintenance academy – hangar and classroom space – at CVG in 2024,” Kershner confirms.

CVG is also looking into advanced air mobility and vertiport planning, she adds.

Among other notable results in the ACI World top 20 rankings was Louisville Muhammad Ali International Airport.

Home to UPS Worldport, the gateway achieved a 0.5% year-on-year increase in its cargo throughput in 2022, processing 3.5m tonnes and climbing from sixth to fifth in the world.

The gateway with the most dramatic fall in volumes was Dubai International (DXB); with cargo down 25.5% to 1.7m tonnes, it slipped from 13th to 18th position.

Dubai International. Source: Karol Ciesluk / Shutterstock.com

The airport attributed the result to “the moving of all major freight operators back to Dubai World Central (DWC) and the return of pax-freighter aircraft back to passenger operations during the year”.

DXB’s results so far for 2023 show a continuing decline, with volumes down in the first half by 6.2% to 853,500 tonnes.

Fourth-placed Shanghai also suffered, its cargo throughput dropping 21.7% to 3.1m tonnes.

The long-running impact of the pandemic, which largely shut down manufacturing in the airport’s catchment area, appears to have been the main factor in the result, although volumes did pick up over the course of 2022.

Looking ahead, Oliveira expects to see the new iGA Istanbul Airport among the world’s top 20 cargo gateways in the coming years as it gains more passenger flights.

He also points out: “From 2024, FedEx will have a hub there, and that will make a big difference to the airport’s cargo throughput.”

The new global air transit facility will occupy a 25,300 sq m site – more than double the size of FedEx’s existing operation in a shared third-party facility – and will separate parcel and freight processing for greater efficiency. It is scheduled for completion by November next year.

Kadri Samsunlu, chief executive of iGA Istanbul Airport, says: “The fact that FedEx has chosen to locate its new global air cargo facility on our site, reflects iGA Istanbul Airport’s position as a strategic super hub, not only for passengers, but also for the cargo and logistics sector.”

For 2023, ACI World anticipates a year-on-year drop of 6-8% in cargo traffic – not because of a reduction in demand per se, but because of the supply chain disruption, war, airspace constraints and other tensions that are affecting trade.

“But volumes will increase and we expect them to reach 2019 levels in 2025. The future is bright for air cargo,” Oliveira affirms.

Waking up

Oliveira notes that according to IATA, air cargo accounts for 1% of global trade by volume, but 35% by value. As such: “It’s very important for the global economy because of the value of the goods,” he says.

“Air cargo is also a sign of economic growth: if we see a rise in air cargo, that’s a sign that economic growth is coming.”

He is confident that airports are “waking up” to air cargo.

“They are realising it’s an important part of their business and they need to invest in it. Especially when there’s financial stress, they have to diversify their sources of revenue, and cargo is an important one.”

However, it is not a given that every airport will be a successful air cargo hub.

For example, Oliveira says: “Most airports are already engulfed by cities but those elsewhere could grow. And you have to look at network development planning: for example Louisville and Istanbul offer connectivity that makes air cargo faster and more efficient. The hub and spoke model is key, and you have to look at the flow of goods.

“Airports also need to invest in data to make air cargo more efficient and reliable,” he went on. “With data and facts, you can take the right actions to invest correctly.”

Other factors that would help cargo airports thrive in the future include collaboration from governments to ensure the free flow of goods around the world, and the use of technology to supplement a human workforce that is already struggling to keep pace with the growth of the air cargo industry, Oliveira concludes.