Growth gap between passenger and air cargo widening

05 / 03 / 2015

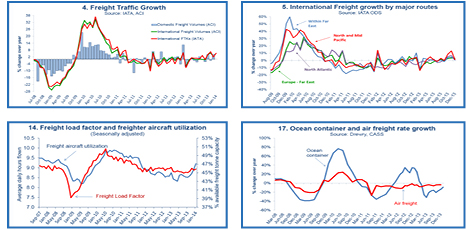

PASSENGER volume growth is outpacing air cargo, with a "big gap" emerging in the last three years as onshoring has stifled international trade volumes.

IATA chief economist Brian Pearce said that air cargo’s role as a lead indicator for passenger volumes has broken down since 2010, as witnessed by a ‘dramatic divergence’ in revenues of US$20bn in 2013.

While airfreight has historically performed well at the peaks of economic growth and badly in the troughs, air cargo volumes have flatlined since 2010 as passenger traffic grew strongly.

Pearce told the IATA World Cargo Symposium in Los Angeles that onshoring – sourcing goods locally – was a key factor in this recent trend, but not the only one.

The average 2.5 ratio in favour of international trade versus domestic production has stopped, with Pearce calling it "as critical an issue" as mode shift to ocean freight.

The question for the air cargo industry, observes Pearce, is whether this trend continues or is ‘a temporary blip’.

Onshoring has also been accompanied by trade protectionism, a theme raised by several speakers at the conference, with many rallying the industry to lobby against ‘beggar thy neighbour’ policies.

Rising labour costs in China have accelerated the onshoring process but the upside is that a larger and richer Chinese consumer base could fuel longer term demand for air cargo.

In addition, the US is now far less reliant on imported energy, a transformation, which could see a revival in US manufacturing, again a potential dampener for one of the key air cargo markets.

But while ocean freight has taken its slice of the traditional air cargo market, Pearce says the integrators secured the ‘top end’ of the airfreight business too.

Aviation fuel costs have remained high for the last three years and "look set to stay" for the next year, says Pearce, who adds the issue of climate change and carbon neutral transport growth are important topics for the air freight industry.

Referring to the supply side challenges, essentially the increase in bellyhold capacity in freshly delivered larger and more fuel- efficient passenger aircraft, the airfreight industry has seen asset utilisation stabilise but cargo yields soften.

Despite the ‘challenge to profitability’ Pearce says that there were ‘positive signs’ for air cargo, adding that the industrial production cycle is ‘looking good’ alongside growing business confidence, which is usually a good indicator of future RTKs, albeit with a few ‘false dawns’.