Asian cargo monthly: A bumper year for Chinese carriers

24 / 01 / 2018

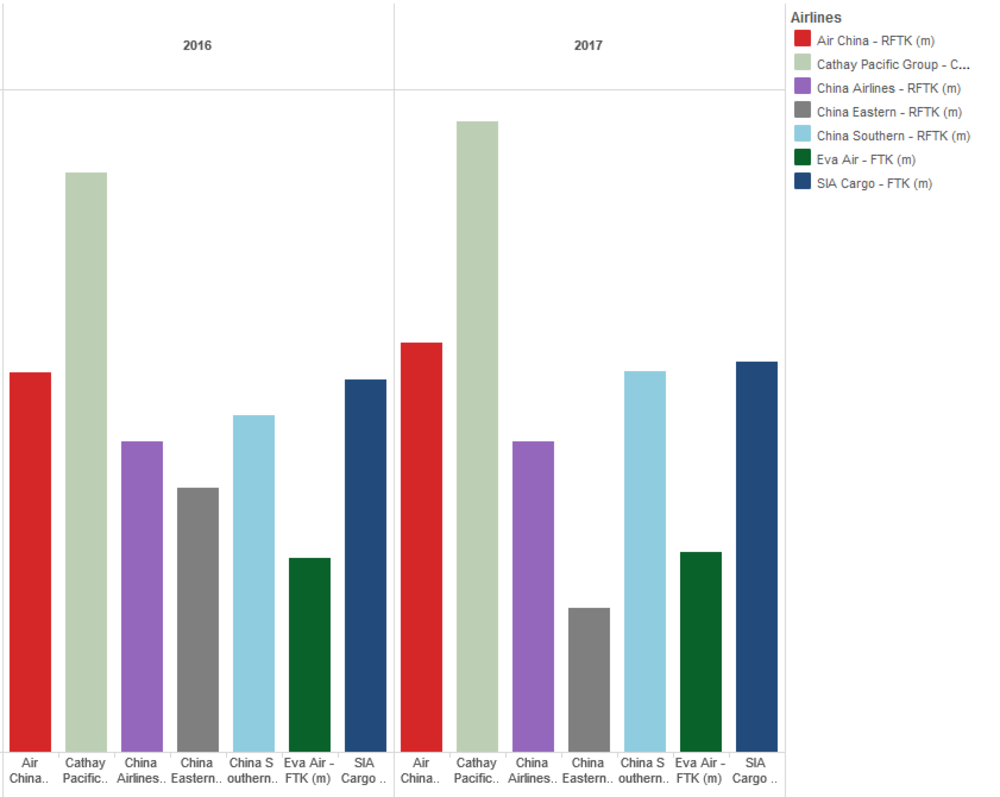

Asian airlines enjoyed a strong 2017, with several carriers reporting their best cargo performance over recent years.

The region’s largest cargo carrier, Cathay Pacific, saw cargo demand increase by 9% year on year to reach 11.6bn cargo and mail revenue tonne kms.

This is the carrier’s busiest year for freight since Air Cargo News records begin in 2011, while it is also the largest year-on-year percentage increase registered by the carrier since 2014.

The year ended strongly for the carrier – with a 9.2% cargo traffic improvement in December – despite some concerns that growth levels could weaken as the year progressed.

Cathay Pacific director commercial and cargo Ronald Lam said: “Cargo’s strong momentum continued well into December, with volumes growing well ahead of capacity. We were able to sustain a high load factor and high yield during the month.

“As a result, revenue efficiency gains were observed in all route groups. Not only did our home market of Hong Kong perform well, strong cargo feed from across the network enabled us to achieve an all-time weekly tonnage uplift record in the week ending December 9.

“In terms of the nature of commodities carried, perishables were much in demand in the lead up to the festive season.”

Click on chart below for interactive version

The region’s second busiest cargo carrier also had a bumper year, fuelled by growth in its international routes.

Overall, the airline saw cargo traffic increase by 8% to 7.5bn revenue freight tonne kms, its busiest year ever.

International traffic was up by 10.6%, regional traffic growing 7% and domestic demand slipping by 0.2%.

The growth comes in part from cargo being carried on longer distance routes, reflected by the fact that the weight of freight carried increased by the lower amount of 4.3%. In December cargo traffic increased by 4.2% year on year.

Next up, Singapore Airlines Cargo (SIA) handled 7.2bn freight tonne kms in 2017, up 4.8% on the previous year.

While its growth was at a lower level than some of its Chinese rivals, it is the airline’s best year for cargo since 2011.

In December, the carrier registered a 4.3% increase in demand.

Like Air China, China Southern also benefitted from the growth of its international services as demand for the year increased by 12.6% year on year to 7bn revenue freight tonne kms – its busiest ever year.

International traffic was up by 19%, regional traffic improved by 13.3% and domestic traffic declined by 3.8%.

The growth of its international traffic is reflected by the fact that cargo tonnes carried increase by just 3.7% against 2016 levels.

Meanwhile, the was a 3.6% improvement in demand for the year at EVA Air to 3.7bn freight tonne kms – its first increase since 2012 and best year since 2014 – and China Airlines was up 8% to 5.7bn freight revenue tonne kms for its busiest year.

Read more air cargo data