2014 ‘a challenging year for air cargo’

21 / 03 / 2015

GLOBAL air cargo grew by only 1.4 per cent last year as the whole industry fought its way out of a world recession.

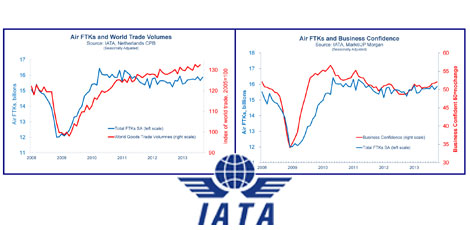

IATA figures show that cargo markets made very slow progress during the first half of the year, but acceleration took root in the latter half of 2013, eventually placing airfreight volumes on a steadily increasing trajectory.

Capacity grew faster than demand at 2.6 per cent and load factors were weak at 45.3 per cent.

Regional performance varied, IATA notes.

Middle Eastern and Latin American carriers reported the strongest growth in demand (12.8 and 2.4 per cent respectively). Asia-Pacific carriers, which have nearly 40 per cent of the global airfreight market, saw cargo activities shrink by 1.0 per cent over the year.

"2013 was a tough year for cargo. While we saw some improvement in demand from the second half of the year, we can still expect that 2014 will be a challenging year,” warns Tony Tyler, the association’s director general.

“World trade continues to expand more rapidly than demand for air cargo. Trade itself is suffering from increasing protectionist measures by governments. And the relative good fortunes of passenger markets compared to cargo make it difficult for airlines to match capacity to demand," he notes.

The fourth-quarter recover saw December global FTKs increase by 1.8 per cent – continuing a positive trend in the latter half of 2013, though it was down from the November figure of 6.0 per cent.

Asia-Pacific carriers saw freight volumes fall back 0.3 per cent in December, declining 1.0 per cent for 2013 as a whole.

The economic performance of the Asia region was patchy, as was growth in trade volumes, although these picked up in recent weeks.

Despite shrinking demand, capacity grew by 0.8 per cent in 2013.

European airlines reported cargo growth of 2.9 per cent in December and 1.8 per cent for the whole of 2013, the best volume performance of the traditional ‘big three’ aviation regions.

Manufacturing indicators suggest that the fourth quarter of 2013 was the strongest quarter for two-and-a-half years, and the outlook, particularly in Germany, is improving, says IATA.

North American carriers’ airfreight volumes contracted 0.5 per cent in December and fell by 0.4 per cent for the whole of 2013. Indicators of business activity in North America have shown some improvement in recent months, but remain below the levels seen at the start of 2013.

Despite the woes, Middle Eastern carriers continued their strong growth, expanding FTKs by 13 per cent in December and by 12.8 per cent for 2013 as a whole.

The Middle East has benefited from improving economic conditions in Europe as well as solid growth in domestic Gulf economies. Middle Eastern carriers also captured a significant share of the increase in the volumes out of Africa.

Latin American airlines’ freight volumes fell 5.0 per cent in December, but for 2013 as a whole, increased by 2.4 per cent – a slower pace of growth than in 2012, largely reflecting sluggish growth in Brazil. However, there have been signs of a steady pick-up since the third quarter of the year.

African airlines saw their freight volumes rise 1.7 per cent in December and grow 1.0 per cent for 2013 overall. African volumes, after a strong start to 2013, suffered from a mid-year lull, which continued into the second half of the year, with weakness in major economies like South Africa as well as a slowdown in regional trade dampening demand.

"The dynamics in which the air cargo industry operates are changing, but air cargo’s basic value proposition remains the same. Customers still need speed, quality, reliability and efficiency. And we need to get better at delivering it through improved technology and modern processes,” Tyler points out.

“This will be a year of change for air cargo. A key measure of success will be in passing the tipping point on e-airwaybill implementation. That will lay the foundation for further improvements for a modern paperless air cargo industry that can only be achieved by aligning all stakeholders—including governments—in a common vision," he adds.

IATA’s World Cargo Symposium in Los Angeles, March 11-13, will focus on demonstrating how innovation can transform the industry to deliver value. Up to 1,000 delegates are expected to attend, with issues such as e-freight and the Cargo 2000 (C2K) quality management benchmark high on the agenda.