Asian cargo monthly: Carriers see demand grow in August

25 / 09 / 2018

Asian air cargo demand continued its “good momentum” in August but growth is expected to flatten in September as a result of harsh weather conditions.

The latest monthly cargo traffic reports from carriers based in the region show that demand growth is tracking roughly in line with performance over the first eight months of the year.

Cathay Pacific Cargo was one of the better performing carriers as it saw August traffic increase by 7.4% year on year to just over 1bn revenue tonne kms.

This compares with growth over the first eight months of the year of 6.6% compared with the same period in 2017.

However, the outlook for September’s figures was not quite so positive.

Cathay Pacific Director Commercial and Cargo Ronald Lam said: “Our cargo business also continued its good momentum in August.

“Tonnage grew ahead of capacity, which was driven by strong transhipment volumes across our network. We saw good growth among the pharmaceutical and perishable segments.

“However, the favourable currency trend that we have enjoyed so far this year is reversing rapidly. Besides, our performance in September is set to be negatively impacted by the significant typhoons that disrupted our operations in both Japan and Hong Kong, especially our cargo business which is in its seasonal peak.

“We are also closely monitoring external factors that have the potential to impact global trade.”

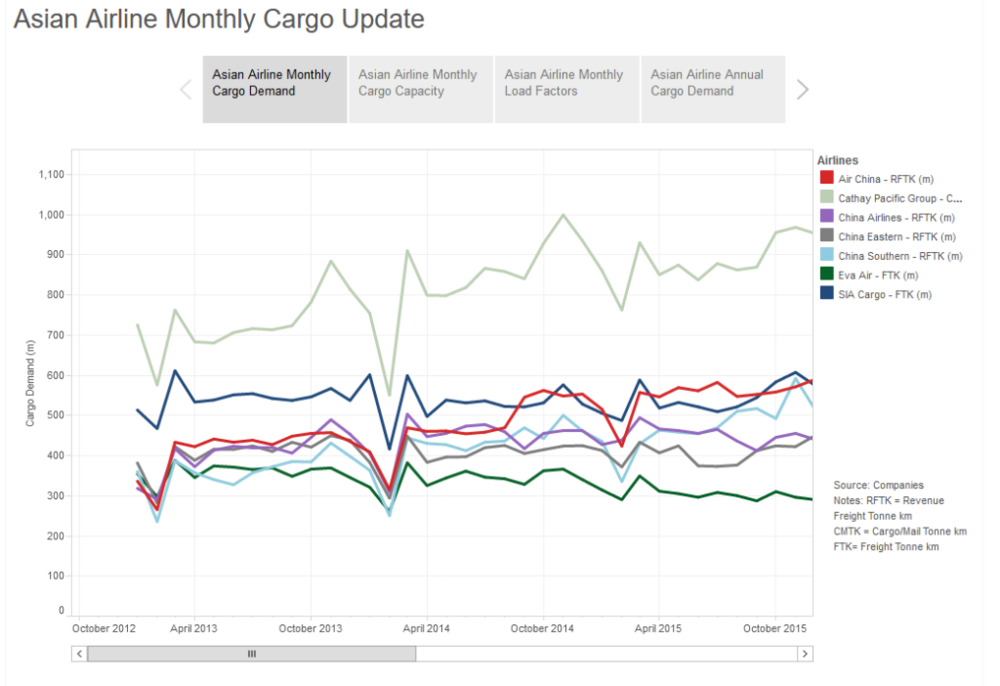

Click on chart for interactive version

The carrier also saw its cargo load factor for August improve to 68.4% from 65.5% last year as demand growth outstripped capacity additions.

Air China saw its cargo traffic for August increase by 6.1% year on year to 680m revenue freight tonne kms, which is slightly behind its growth over the first seven months of 7.6%.

The largest jump in traffic came from its international business, while there was a smaller increase for domestic traffic and a decline for its regional cargo. Its August load factor reached 59.2% against 58.7% last year.

China Southern continued its good run of form for cargo growth as it registered an August increase of 15% year on year to 660m revenue freight tonne kms. This compares with growth over the first eight months of 7.5%.

The demand growth is a reflection of capacity additions, which saw cargo space increase by 16.2% year on year for the month.

As a result, the carrier’s cargo load factor for August slipped to 53.2% against 53.6% last year.

At China Airlines cargo traffic for August increased 2.8% year on year against year-to-date growth of 3.7%, at China Eastern there was a 6.1% increase for the month compared with 6.5% over the first eight months and Singapore Airlines registered an August increase of 0.9% against 0.3% for the year so far.

The only airline to register a decline was Eva Air, which saw demand slip by 6.4% year on year in August.

Read more air cargo data news