Parcel volumes to grow 17%-28% a year says new report

11 / 09 / 2017

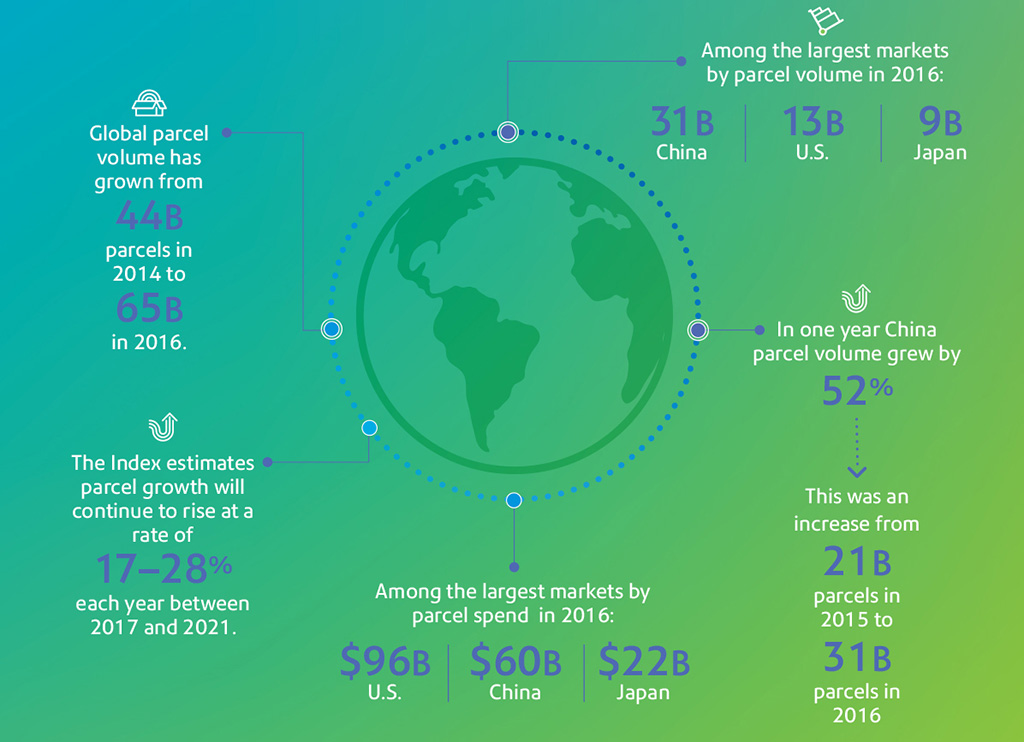

Global parcel volumes surged 48% between 2014 and 2016 and are set to continue growing at double-digit rates, according to the second annual Parcel Shipping Index from technology company Pitney Bowes.

Annual parcel volumes increased from 44bn to 65bn up to the end of 2016, and the growth curve shows no signs of slowing down, with the index estimating that parcel shipments will continue to rise at a rate of 17%-28% each year between 2017 and 2021.

The index measures parcel volume and spend for business-to-business, business-to-consumer, consumer-to-business and consumer consigned shipments with weight up to 31.5 kg (70lbs).

The index looks at 13 major markets, including: Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Norway, Sweden, the UK and US.

China, an addition to this year’s index and by far the largest market examined, grew parcel volume by 52% in one year, increasing from 21bn parcels in 2015 to 31bn in 2016.

Said a Pitney Bowes spokesperson: “But even when excluding China’s prolific volumes, the index forecasts a strong and accelerating pace of growth in parcels throughout the world.

“On average, the other 12 major markets studied have grown 4.3% annually since 2012 and are projected to grow 4.5%-5.4% annually through 2021.”

The US, at 13bn, and Japan, at 9bn, were also among the largest markets by parcel volume. In terms of investment, the US ranked highest, spending $96bn on parcel shipments, followed by China at $60bn and Japan at $22bn.

Lila Snyder, executive vice president and president, global e-commerce, Pitney Bowes, said: “The continued rise of ecommerce globally is keeping the parcel shipping market strong through 2021 as consumers are increasingly looking to online shopping for convenience, price and availability of products from around the world.

“As consumer expectations continue to rise, shipping technology and service providers will need to help retailers and marketplaces meet those demands.”

Results from the Parcel Shipping Index point to rapid growth and last mile delivery challenges. The report concludes that new trends and emerging technologies, such as parcel lockers, crowd-shipping, on-demand delivery services, evening and weekend delivery and drones, are impacting the customer shipping experience by shortening delivery times, lowering delivery costs and adding flexibility.

Mark Shearer, executive vice president and president, global SMB solutions, Pitney Bowes, said: “Managing the growing demands and navigating the evolving landscape of parcel shipping can be complicated for organizations of all sizes, from large enterprises to small businesses.

“Digital transformation of a company’s shipping workflow — like the integration of software as a service (SaaS)-based multi-carrier platforms — can help to better enable carrier, timing and cost efficiencies for companies, as well as improve customer experiences through the addition of tracking capabilities, simplifying and streamlining processes for both senders and recipients.”

Full graphics from the Pitney Bowes index can be downloaded here