Asian cargo monthly: Traffic growth slows in March

03 / 05 / 2018

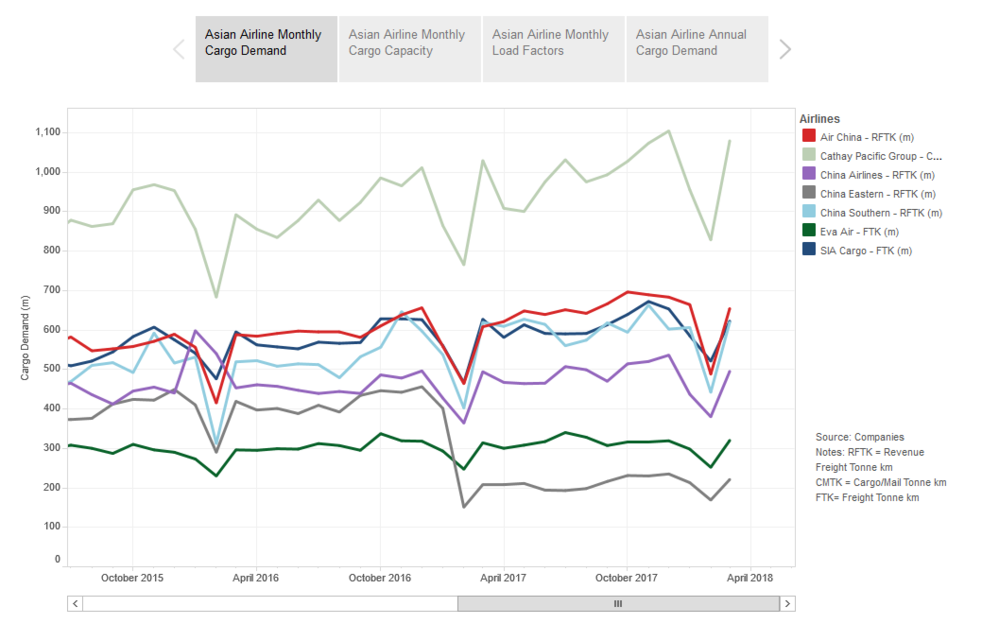

March saw air cargo traffic growth at Asian carriers weaken after a slow pick up after the Chinese New Year and following on from similar trends at their European rivals and major hubs in the region.

The largest cargo carrier group in the region, Cathay Pacific, saw total cargo traffic for March increase by 4.9% year on year to 1.1bn cargo and mail revenue tonne kms.

While this is still a very good growth level, it does represent a slowdown compared with 2017 and also the first few months of the year – over the first three months growth stands at 7.7%.

The airline said pick-up after the Chinese New Year had been slower than expected. It should also be mentioned that March saw tough winter weather conditions in Europe and North America.

Cathay Pacific director commercial and cargo Ronald Lam said: “Cargo revenue continued to track in line with our expectations. We saw a high load factor across the network and improved yield.

“The pick-up in demand from Hong Kong and mainland China post-Chinese New Year was slower than expected, but transhipments from the Indian subcontinent, Europe, Japan and Southeast Asia proved strong.”

Despite the slowdown in growth, the airline group did see its freight load factor increase slightly to 70.7% from 70.3% during March 2017.

Click on chart below for interactive version

The region’s next largest cargo carrier Air China also saw growth slow, with cargo traffic during the month increasing by 7.7% year on year to 653m revenue freight tonne kms.

This lags behind growth over the first three months of 10.6%. Domestic traffic declined, while international and regional demand continued to improve. Its load factor declined slightly to 53.4% from 55.3% last year.

Next up, SIA Cargo registered a small 0.8% decline in cargo demand to 621m freight tonne kms. This compares with growth over the first three months of 4.5%. Its March load factor slipped to 64.7% compared with 67.5% a year earlier.

China Southern, which has been growing rapidly over recent years saw demand remain flat compared with a year ago at 618m revenue freight tonne kms. This compares with growth of 7.1% over the first three months of the year.

Cargo traffic at Eva Air improved by 1.9% during March – in line with figures so far in 2018 – and China Airlines recorded a 0.2% increase compared with growth of 2.1% over the first three months.

The slowdown in demand growth is line with performance elsewhere; Changi Airport and Hong kong, the world’s largest cargo hub, both reported declines in cargo volumes during the month while IAG, Air France and Finnair also saw cargo traffic dip.

Read more air cargo data news