Shippers have been reshuffling their supply chains since the most recent tariff unrest began and freight forwarders have had to adjust to the new business landscape.

After confusion in the first quarter, to a wait-and-see approach in the second quarter, many shippers paused shipments during the second quarter to better understand what the continued deluge of tariffs means for their supply chains.

“Some customers have paused or reduced their purchases from suppliers in China in order to reduce their tariff exposure, causing ocean bookings out of China to decline in Q2,” CH Robinson chief executive and president Dave Bozeman told analysts in April.

Indeed, after front-loading shipments ahead of the 2 April announcement of reciprocal tariffs, many shippers paused shipments to draw down existing inventories, which, according to shippers, were enough to carry them for at least two months.

However, the tariff rollercoaster took off again. Seven days after the reciprocal tariffs announcement, the US government announced a 90-day pause for most of the reciprocal tariffs, and then a couple of weeks later announced that tariffs on China would be lowered from 145% to 30%.

With the softening of Chinese tariffs and the 90-day pause, shipping between China and the US appears to be picking up, according to Hapag-Lloyd’s chief executive, Rolf Habben Jansen.

He told analysts in mid-May: “We have seen over the last couple of days that bookings have been up more than 50% compared to what we saw over the last four weeks, and they are also up in double-digit percentages compared to the period before the tariffs.”

These shipments are likely those that were originally paused by shippers. How long the boon in shipments lasts beyond the 90 days remains to be seen, but it’s expected that shippers will hit the pause button again if there is another adverse change in tariffs.

For forwarders, this wait-and-see approach by shippers, of course, will impact their revenue and volume, particularly on trade lanes that are most impacted by tariffs, such as China to the US.

But trade lane shifts are occurring and perhaps forwarders’ Q2 revenue and volumes will not be as negatively impacted as once feared.

Kuehne+Nagel's (K+N) chief executive Stefan Paul told analysts during the company’s earnings call on 24 April: “There is a clear shift into Southeast Asia. Whether it's 1:1 for the second quarter or there is a slight decrease in volumes, we cannot yet confirm. But the pattern shows that it is almost equal and that the volume will not collapse."

The reconfiguration of supply chains is becoming more complex, which, in turn, “significantly increases logistics costs” and is “good for us”, according to DHL Group’s Tobias Meyer.

Relationships between forwarders and shippers are even more important as shippers diversify sourcing locations beyond China. Forwarders often serve as trade consultants and move alongside shippers as shipping patterns change.

As noted by CH Robinson’s Bozeman: “Prior to the pandemic, approximately 35% of our ocean and air volume in Global Forwarding was generated from the China to US trade line. In 2024, that percentage declined to less than 25% due to higher growth in trade lines serving Europe, Southeast Asia, Oceania, and India.”

In addition, forwarders are valued for their customs knowledge and expertise.

“The constant changes in trade regulations since the beginning of 2025 are adding complexity to the customs declarations process, making compliance with regulations increasingly challenging,” noted Expeditors International's chief executive Daniel Wall in the company’s first quarter earnings 8 May press release.

CH Robinson’s chief financial officer Arun Rajan further noted that the company had seen “an increased interest with our customers” regarding customs activity.

As forwarders strive to maintain strong relationships with their customers during this turbulent time, they are also finding that their own market is changing.

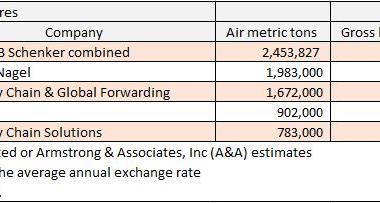

The biggest change, perhaps, is DSV and DB Schenker officially became one entity in April, after receiving the last of the required government approvals.

“With this acquisition, we become a world-leading player in global transport and logistics, at a time when global supply chains are more in focus than ever before, and our customers need a reliable and agile global network of services and products,” DSV Group chief executive Jens Lund said in an 30 April press release.

While the DSV-DB Schenker acquisition is the largest, there are other forwarding acquisitions that are targeting niche services and new geographies as a result of global trade changes.

Among the other forwarder acquisitions during Q2 are:

-

AIT Logistics’ acquisition of Miami-based GSDMIA, Inc was achieved to enhance AIT’s trade lane support between Asia, Europe, Latin America, and the US.

-

CEVA Logistics, a subsidiary of the CMA CGM Group, acquired Turkish 3PL and forwarder, Borusan Tedarik. The acquisition will expand CEVA Logistics’ reach into Turkey.

-

Toll Group acquired Transolve Global, a specialist in international freight forwarding of wine, bulk liquids, and perishables.

-

Mullen Group acquired Cole Group to expand its capabilities in brokerage, forwarding, and trade consulting.

As forwarders help shippers manoeuvre a quickly changing global trade landscape, forwarders are also finding their market changing through acquisitions.

The DSV acquisition of DB Schenker has propelled DSV to the top of the largest freight forwarders' lists, but other acquisitions within the freight forwarding market are expanding forwarders’ capabilities and geographic reach to assist shippers in their supply chain reconfigurations.