Prestwick's rapid pivot to e-commerce handling has seen China Southern, Air China Cargo and Beijing Capital launch scheduled services

E-commerce has been a driving force at Glasgow Prestwick Airport (PIK) as it strives to grow its air cargo volumes and move up the UK airport ranks.

While e-commerce shipping has been under scrutiny since the end of the de minimis exemption in the US and subsequent moves to end the exemption in Europe and the UK, the Scottish airport has only seen a positive business impact, according to Nico Le Roux, Prestwick’s business development director.

From only launching its first e-commerce flight at the end of last year, to accommodating new scheduled services from three e-commerce focused Chinese airlines this year, Prestwick may be a latecomer when it comes to e-commerce, but in such a short space of time it has fashioned itself as an e-commerce handling hub.

“E-commerce volumes are far outperforming general cargo volumes at the moment,” says Le Roux.

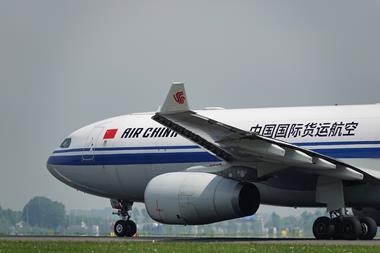

China Southern Air Logistics, Air China Cargo and Beijing Capital Airlines all began scheduled cargo services this year, with plans to increase frequencies.

In June, Air China Cargo began a three-times-a-week scheduled freighter service from Guangzhou.

Then, from November, the airline increased frequencies from four to eight flights a week.

As well as this development, in May, China Southern Air Logistics began scheduled cargo flights to the airport from Guangzhou, with four flights a week initially and plans to increase to a daily service.

Beijing Capital Airlines, a member of Hainan Airlines Group, also launched a regular freighter service in October that linked Prestwick with Zhengzhou Xinzheng International Airport (CGO).

The extra flights have clearly made a big impact on the airport's cargo volumes. This year, between April and September, volumes reached 17,891,118 kg, compared with 4,890,120 kg for the same period in 2024 and 5,403,693 kg in 2023.

Le Roux is hopeful that other airlines will follow suit while demand is high. He says: “The demand out of China is there. Especially during the peak. The demand far outstrips the supply that’s available.”

One of the attractions of Prestwick is its ability to offer a six-hour turnaround time, a timeframe that appeals to fast-moving e-commerce platforms such as TEMU, Shien and Tiktok.

Le Roux explains that it has a different operating model from some other airports, where freight arrives, gets transferred to a ground handling agent, then to a broker warehouse for final deconsolidation before it gets handed over to the last mile provider.

At Prestwick, says Le Roux: "The freight comes off the aircraft, goes to our own bonded warehouse on the airport, and six hours later, we hand it over to the last mile provider”.

He stresses: “It’s much faster than other airports.” He points out there’s also no congestion and very short taxi times.

Shifting supply chains

Demand for e-commerce at Prestwick has been greatly aided by supply chain shifts in the market. The US government’s move to end the de minimis exemption for China and shake up tariffs this year saw e-commerce supply chains shift from China-US to China-Europe, which proved to be a beacon of light for Prestwick.

“The strategy that we implemented took about a year to come to fruition, and I think the catalyst for it coming to fruition was the rate increases in the US,” says Le Roux.

“Because we got the same message over and over again, carriers want to fly to Prestwick, but they have no capacity available to fly the goods. And as soon as that capacity was freed up by not going to the US, we saw an increase of capacity coming into Prestwick.”

Although e-commerce trade flows from China to the US have recovered, Le Roux is confident e-commerce shipments will continue to fill up capacity on the freighters flying into the airport.

China Southern Air Logistics and Air China Cargo only import e-commerce into Prestwick currently, while Beijing Capital Airlines sells approximately 85% of its capacity to e-commerce platforms, with the other 15% usually snapped up by shippers transporting general cargo, says Le Roux.

E-commerce has also recently been dominating inbound chartered flights at the airport. “A lot of the charters that we have seen lately, again comprise e-commerce, coming through flights from China," says Le Roux.

Though he adds that on the whole, there is more fluidity with the types of shipments on charter: “There’s some regular streams that we have. We know we are going to have two flights a month on dangerous goods, but the rest is very ad hoc.”

Perishables problem

Meanwhile, exports include pharmaceuticals, whisky and seafood. Pharma exports are healthy. Most shipments that Prestwick handles are moved out of Ireland, across the Irish Sea and are then flown out of Prestwick directly to China, says Le Roux.

But seafood exports have faced challenges. In September, Prestwick launched a seafood export service aimed at China and mainland Europe consumers. This is facilitated by a £1m investment in equipment and a dedicated cool chain team.

There’s plenty of seafood to export – Prestwick is close to a number of fish farms as well as wild fishing areas. The Marine Management Organisation said that in 2024, UK vessels landed 745 thousand tonnes of fish, up 4% year on year, while Scotland itself accounted for over 60% of the total value of UK seafood exports.

But regulations in China have resulted in a prolonged process of getting seafood exports from Prestwick into the country, meaning it isn’t feasible to keep the fish fresh.

“When we initially did a soft launch of the service, there was a lot of support from the industry,” says Le Roux. “Since then, there have been some regulatory changes in China, so we saw a slowdown, especially of the salmon exports, because there’s an issue from the regulatory side in China for the clearance. We hope to get that resolved very soon.”

After the issue is resolved, Prestwick expects to see weekly shipments of live product going to China.

Beyond China, Le Roux says Prestwick will work on growing business with India. “Next year, on the back of the UK-India free trade agreement, we’re going to focus on India.

“We think the Indian market has huge potential. At the moment, there are very limited pure freighters flying out of India directly into the UK.

“There’s a lot of pharma coming into the UK, as well as medical equipment and garments. So the inbound loads should be healthy."

Looking at exports, he says: “India is the biggest consumer of Scotch Whisky in the world, we can play a part there. And the Scottish Salmon Association is very keen to relaunch India and grow that market.”

How reliable is e-commerce?

The topic of e-commerce volumes versus value has often cropped up in the industry, so a fair question is how profitable this 'bread and butter' core service really is.

And the vertical could also be under threat by changes to de minimis in mainland Europe and the UK.

While the shift of e-commerce volumes from China-US to China-Europe was a massive boost to Prestwick, the EU and UK now plan to end the de minimis exemption, with temporary measures implemented by the EU from next year.

Flexport, for one, has recently said it doesn’t anticipate the EU regulations will “significantly change the picture” given consistent consumer demand for e-commerce and the bounce back of volumes from China to the US.

The longer term shift of supply chains from China to Southeast Asia also doesn’t unsettle Prestwick.

Le Roux is of the opinion that manufacturing won’t move en-masse. He predicts that for next year, “there will be some shifts, but not all production will move”.

But on the subject of e-commerce not always being a particularly profitable vertical, Prestwick’s ability to offer in-house services, including ground handling, warehouse handling and fuel from its fuel farm, enables it to diversify revenues.

“We offer all the services in-house, so we’re staying right in the middle of all the revenue streams," says Le Roux.

In any case, for Prestwick, the vertical’s core value is in helping it up its cargo game and climb the ladder in terms of volumes.

Prestwick is all too familiar with operating challenges, having had a troubled history.

Previously owned by New Zealand company Infratil, the airport had been losing money and was bought by the Scottish government for £1 in 2014. Then, in 2017, the airport aimed to go back to private ownership, but this hasn’t yet happened.

The UK airports market is well saturated and Prestwick has plenty of competition, namely East Midlands, Birmingham and Stansted, but Le Roux believes that e-commerce will help it move up the rankings.

“In the UK context, we are a secondary, possibly third-tier airport. But that will change on the back of e-commerce traffic. If the business continues as it is, we will move up the ranks to be at least in the top 10.”

The airport’s location on the west coast of Scotland, alongside the Firth of Clyde and with views out to the Isle of Arran is also an advantage.

Prestwick sits within an over 800-acre estate surrounded by A roads, so expansion is not a battle with regulators, nor is noise and pollution impact on local communities a concern. The airport is therefore able to operate 24/7.

“We’ve got no noise or nighttime restrictions, because of our location right next to the sea," points out our Le Roux. "Air traffic control will route aircraft coming in and taking off over the sea to minimise the noise impact and because there is no congestion, you don’t have problems with aircraft using fuel before they can land or take off."

Despite being optimistic about opportunities and its belief that it will maintain current volumes in 2026, Prestwick is still apprehensive about the global economy and what next year might bring.

“World trade will dictate where we end up next year. The US does have a major impact on the airport and business in the next few years will be impacted by approaches to taxation and tariffs.”