High rates in the air cargo industry are caused by bottlenecks in ground handling capacity rather than aircraft capacity constraints.

This is according to Niall van de Wouw, co-founder of CLIVE Data Services and now chief airfreight officer at Xeneta, who explained in a TIACA Economics4Cargo airfreight update on June 16 that these bottlenecks are caused by shortages of cargo handling staff and truck drivers.

“As a result of that, it's still quite difficult to get your goods from A to B by air." Shortages, bottlenecks and uncertainty are keeping "rates at a high elevated level", he said.

He said Covid regulations could further impact on staffing shortages. “Therefore bottlenecks are being created in the supply chain and rates not declining as fast as one would expect purely based on the load itself."

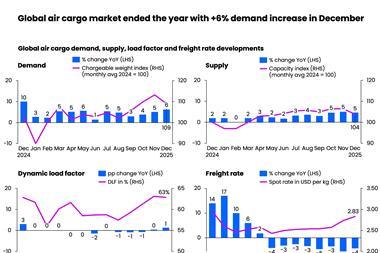

Global economic uncertainty alongside low but rising interest rates and high inflation are “starting to bite air cargo volumes”. Comparing May to April, rates are starting to soften and volumes are slowing.

Rates are still more than plus 130% on pre-Covid despite demand declines. However, the situation is easing: the rates in March were 20% higher than they were 2021 and now they are 16% higher, said van de Wouw.

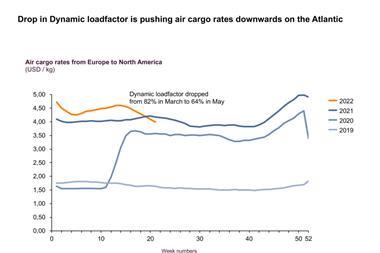

“We saw rates really jump from Europe to North America during the Covid period, with load factors up into the mid 80% but now they’ve gone much lower and therefore drastically changed dynamics of the market."

Now belly capacity has increased with the return of passenger flights there is 4% more capacity now on a global level than in 2021.

“Especially since late March, early April, when airlines introduced their summer schedule, we see much more capacity,” he said.

The dynamic load factor is below pre-Covid levels and there has been a softening of the market. The load factor was initially pushed up when the pandemic started and capacity was cut dramatically. Where passenger capacity has returned, load factors have dropped, but this varies globally.

“In May, we saw more around the 60% mark. While last year it was very high, it was 69%,” said van de Wouw.

“It has really come down in the last few weeks. This is mainly because of increasing capacity, but also weaker demand.

“What really stands out is the Atlantic. If we look at North America, to Europe, the dynamic load factor is 20 percentage points lower than it was in the same month last year. Europe to North America is even weaker at minus 24%.

“In most parts of the world there are still constraints, especially if you're looking at Asia Pacific, because passenger travel has not returned just yet. But for the Atlantic there is much more travel between Europe and North America. Then we see that load factors are dropping rapidly and rates start to decline.

“We see load factor across the Atlantic decline from 82% to 64%. And the question is, how far will this line drop?" He reiterated: "Even though there is more capacity in the marketplace, I do forsee more bottlenecks arising or likely to arise in the next few weeks and months. And I think that's a resource issue of staff.”

On the subject of how the return of belly capacity, and higher fuel charges, will impact freight forwarders that have taken their own capacity, he said he “wouldn’t be surprised” if freight forwarders have looked into the terms and conditions of contracts to check their obligations and how they can exit agreements if needed.

“With more capacity coming into the market, and rates dropping, they will feel that pain, and they will feel that they will be less competitive than their peers, who could procure much lower rates. They will start looking into how to rid of it, deploy it differently or share the risk. Because, in essence, freight forwarders are not asset owners."