Air cargo demand rose 6% in December, closing 2025 with 4% annual growth, but spot rates fell 4% and analysts expect slower 2-3% expansion in 2026

The air cargo market ended 2025 on a high but the outlook for the coming 12 months is less rosy as e-commerce volumes look set to come under further pressure.

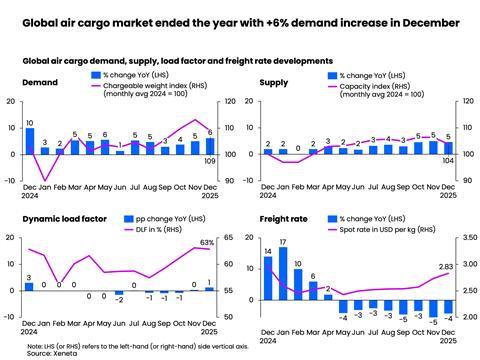

Figures from data provider Xeneta show that air cargo demand increased by 6% year on year in December and was up by 4% for the year overall.

Meanwhile, capacity was up 5% year on year in December and the dynamic load factor for the month improved by one percentage point against a year earlier to 63%.

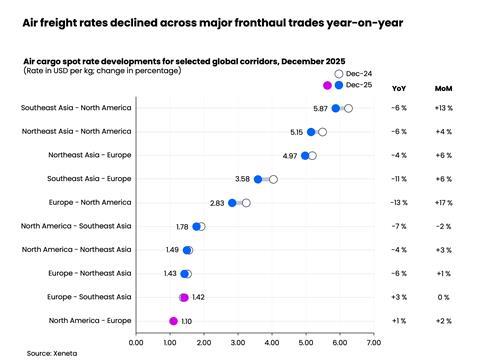

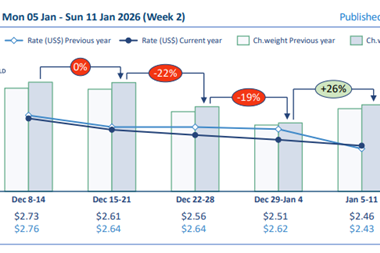

However, pricing did not keep up with demand and the average airfreight spot rate for the month declined 4% against December 2024 to $2.83 per kg.

Declines were led by a 13% year-on-year fall on the westbound transatlantic trade, an 11% fall from Southeast Asia to Europe and a 6% fall from Southeast Asia to North America.

Xeneta said that air cargo’s demand performance reflected shippers’ willingness to shift away from other modes to the speed and reliability of air cargo during times of disruption and economic uncertainty as a result of US tariffs.

However, for the coming year, Xeneta is expecting volume growth to moderate, with an increase of 2-3% expected.

"With many questions remaining over trade, and geopolitical tension adding a further layer of uncertainty, I personally think something has to give in 2026 from a volume perspective – and that means there’s going to be more in it for shippers in terms of lower rates,” said Xeneta chief airfreight officer, Niall van de Wouw.

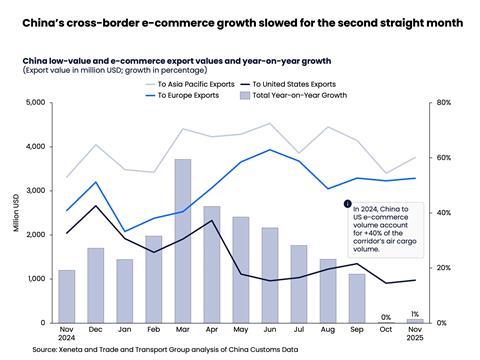

Xeneta said that what happens next will be “heavily influenced by e-commerce”, with shippers in China, Europe and elsewhere facing higher delivery costs.

"One of the tailwinds for air cargo demand growth in 2025 came from investment linked to the development of artificial intelligence solutions,” said van de Wouw.

"This supported flows of high-value goods and is expected to continue. In contrast, the less buoyant forward-looking signals for e-commerce, particularly Chinese cross-border e-commerce exports, are worrying.”

The company pointed out that Chinese customs data shows low-value and e-commerce exports in November rose by just 1% year on year, after flatlining in October.

"Exports to the US represented the brunt of this decline, plunging 52% year on year in November after a corresponding 51% fall in October, the steepest declines on record," Xeneta said.

The data provider said that e-commerce platforms were this year facing increased tax reporting requirements in China with costly fines if data deadlines are missed.

Meanwhile, the European Union in December agreed to introduce a €3 customs duty per item on e-commerce parcels valued below €150 from July 2026. Countries including Japan and Thailand have also discussed or announced new rules commencing in fiscal 2026.

Consequently, e-commerce volumes are likely to grow at a slower pace in 2026, said Xeneta, but still faster than the general airfreight market.

“Air cargo’s e-commerce volumes are also likely to be impacted by declining consumer purchasing power as they face higher prices for more essential everyday items, making consumers more mindful of how they spend their money,” van de Wouw said.

“When I look at the biggest risks this year, right now I would say it’s more likely we will see something that will put a stopper on the level of airfreight growth we have seen in the last two years.

"Overall, the market has been relatively stable, but we are entering a phase when shippers will be looking for better rates and demand may deteriorate in the first quarter of the year.”