Air cargo has continued its recent strong performance in the first weeks of January despite expectations that volume growth will slow as the year continues.

Figures from data provider WorldACD show that in the first full week of 2026 (ending 11 January), air cargo volumes increased by 5% compared with the same week in 2025, although the company also pointed out that 2025 got off to a slow start.

"Preliminary figures for week two point towards a resumption of some of the broad trends experienced in 2025, in which cargo tonnages rose by an average of +4% across the full year,” WorldACD said in its weekly market update.

"It’s worth noting, however, that 2025 began relatively slowly, with year-on-year growth averaging 2% last January and February, and therefore early signs of year-on-year growth in 2026 should be seen in that context.”

The year-on-year demand improvements were led by a 16% increase in the Middle East and South Asia region, while Asia Pacific was up 8% and North America 7%.

However, the data provider warned that the performance of the Middle East region - and the wider air cargo market - is uncertain, given the gradual return of container shipping operations through the Red Sea.

"Some container shipping services have been returning in recent weeks to the Red Sea route via the Suez Canal, with Maersk this week the latest to announce a limited resumption of services, although volumes remain less than half their level prior to the onset of attacks by Houthis on shipping more than two years ago.

"Returning capacity to that market is likely to be a factor for air cargo, which has seen higher volumes from that region in the last two years, although the latest tensions between the US and Iran highlight continuing instability in that region that is likely to limit or slow down a full return to pre-2023 supply chain patterns."

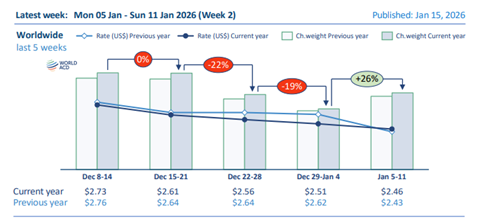

Volumes were also up compared with a week earlier, increasing by 26% compared with the opening week of the year, following on from 22% and 19% declines in the previous weeks.

“The strong rebound in week two can be seen across all origin regions except for Africa,” WorldACD said.

Capacity also continued to recover in week two as freighter aircraft returned to service. Overall cargo capacity is now down around 7% from the mid-December peak.

While volumes and capacity have been ramping back up since the start of the year, rates have been trending downwards.

"Average worldwide rates slipped downwards by a further 2% week on week to $2.46 per kg. That’s around 10% below their average level in mid-December, but it’s slightly above (1%) the $2.43 full-market average rate this time last year," WorldACD said.