Early December data shows air cargo spot pricing up 3% week-on-week to $3.01 per kg, with Africa leading gains at 11% while global volumes edge higher

Source: Jaromir Chalabala/Shutterstock

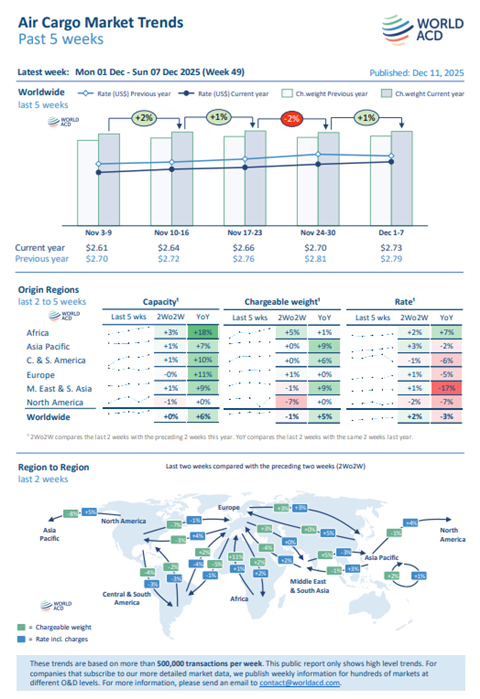

Early December data from WorldACD shows that air cargo spot market pricing was on the up in the first week of December, although this year’s peak season has been less “spiky” than recent years.

Figures from the data provider show that international spot rates in the first week of December (week 49) increased by 3% compared with the last week of November to $3.01 per kg, as is to be expected during the end-of-year peak season.

The increase was ”led by an 11% week-on-week rise from Africa origins, a 6% increase from Europe, and a 4% increase from Asia Pacific origins,” WorldACD said.

On the other hand, ”spot prices from Central & South America (CSA) dropped by 7% week on week, mainly because of the end of the cherry air export season from Chile, from where cherry exports – mainly to China – had driven up rates in recent weeks”.

Drilling into spot rate performance out of the Asia Pacific region, prices from China to the US continued their recovery in week 49 after what has been a turbulent year as a result of tariff policy emanating from the White House.

Rates between China and the US increased 8% week on week to reach their highest level of the year at $6.82 per kg, which is also slightly above last year’s levels.

"For the wider Asia Pacific to the US market, spot rates in week 49 increased by an average of 6%, week on week to $6.32 per kg, mainly driven by those rate rises from China and a big spike in spot rates from Japan (26%)," WorldACD said.

Despite the spot rate increase, volumes between Asia Pacific and the US were flat on a week earlier, although performance varied from country to country.

Tonnnages to the US from China, Hong Kong, Japan and South Korea were "well up on their levels of the previous week", but volumes from Thailand and Malaysia were "significantly down".

Asia Pacific to Europe markets saw the average spot rate increase by 5% week on week to $4.65 per kg, mainly driven by rate rises from Japan and Southeast Asia origin countries Thailand, Malaysia and Singapore.

"Volumes were slightly up [week on week] for Asia Pacific to Europe (1%) with mainly Japan, South Korea, Vietnam and Malaysia volumes up, and tonnages ex-Thailand down," WorldACD said.

"On a worldwide basis, tonnages edged up slightly (1%) from week 48 to week 49 – despite a small drop (1%) in volumes from Asia Pacific origins which, as usual, have been the biggest driver of the end-of-year ramp-up of demand and pricing, even if this year’s ‘peak season’ has been less spiky than some," the data provider added.

The small worldwide tonnage increase in week 49 was almost entirely driven by the recovery of US tonnages from the effects of Thanksgiving the previous week.

Tonnnages are also ahead of last year's levels. WorldACD said: "It is important to note that global tonnages are around 5% higher than this time last year, with big year-on-year growth from Asia Pacific (+9%), CSA (+8%), Middle East & South Asia (MESA, +6%) and North America (+4%) origins."

While demand is up compared with a year ago, spot rates moved in the opposite direction.

"Compared with last year, worldwide spot rates are down by an average of 6%, year on year, with significant declines from all the main origin regions apart from Africa," WorldACD said.