President Trump's threat of new 100% tariffs on Chinese imports has driven urgent demand for airfreight capacity from China to the US

Tariff uncertainty has seen high air cargo demand, constrained capacity and rising rates out of North China to the US this month, despite the shift of volumes from China-US to China-Europe that emerged this year.

The latest global logistics update from Flexport highlighted that increased demand out of China to the US is being driven by concerns over President Trump's threat to impose a new 100% tariff on China beginning 1 November, on top of existing tariff measures. The 90-day U.S.-China tariff truce is set to expire on 10 November, although it may be extended.

"The China-US airfreight market remains under significant pressure, with no indications that it will ease in the near term. Despite earlier expectations for post-holiday (Golden Week) stabilisation, capacity remains constrained as strong demand from the technology and e-commerce sectors absorbs nearly all available space. Current conditions are expected to persist in the coming weeks," said Flexport.

The logistics company added: "Recent discussions surrounding potential new US tariffs on Chinese imports are further straining the already-limited market and driving a short-term surge in demand.

"Even though implementation remains uncertain, the announcement has prompted many importers to expedite shipments to secure space ahead of the proposed implementation date of November 1."

Flexport stressed that demand is expected to remain firm throughout late October, and this demand, combined with restricted capacity, is likely to keep rates high until additional capacity becomes available or shipment volumes ease.

Looking at the South China airfreight market, Flexport said overall capacity has returned to normal following China's golden week, but there is heightened demand, especially from the e-commerce sector, which continues to take up a significant share of available capacity.

Meanwhile, recent US-China tariff developments have driven a sharp increase in airfreight rates.

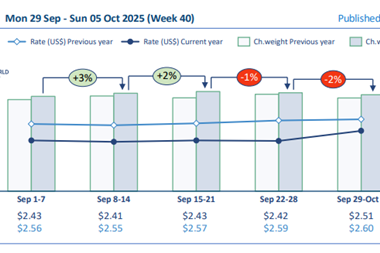

Figures released this week from TAC Index show that rates out of China were higher week on week to the US.

"The rise came as we normally enter the typical peak season cycle period, though sources suggested rates were also perhaps boosted by some switching to air freight following disruption in ocean shipping – especially on Transpacific routes – after China retaliated against US docking charges with new charges of its own on US-owned ships," TAC Index said in its market summary.

The heightened demand from China to the US comes as recent WorldACD figures show the Chinese airfreight market is shifting away from the US in favour of Europe as a result of new trade and tariff policies.

The data provider also recently said that air cargo volumes from China and Hong Kong to Europe bounced back quickly following September’s Super Typhoon Ragasa, but demand patterns to the US were “less clear” as has been the case for several months.

Figures from consultant Aevean also show that there has been a drop off in e-commerce volumes from China to the US since the de minimis exemption for China ended in May, while China to Europe e-commerce volumes are up.

Additionally, US tariffs have also seen air cargo volumes from China to the US decline; volumes to the US from other locations have risen rapidly, led by the likes of Taiwan and Vietnam.