Carrier's U-turn on FAL and MEX services returning to Cape route could erode shipper confidence in schedule reliability, Xeneta analyst warns

Source: Romanchini/shutterstock.com

Container shipping line CMA CGM's decision to reverse plans to return three of its scheduled services to the Suez Canal could undermine shippers' confidence in shipping lines.

The Marseille-headquartered shipping line had last year been the first major carrier to announce plans to return scheduled services to the Suez Canal rather than around the Cape of Good Hope.

However, in a press release, the shipping line announced that its FAL 1, FAL 3 and MEX Asia-Europe services would return to the longer route because of "the complex and uncertain international context".

They had been utilising the Suez Canal on the eastbound leg.

"The CMA CGM Group is constantly and closely monitoring all potential impacts on its operations,” the carrier said.

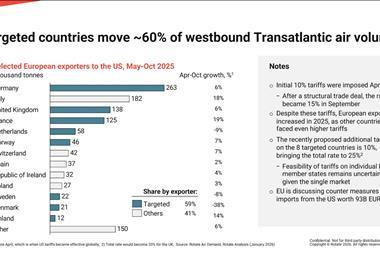

Since 2024, the air cargo industry has benefited from container shipping lines needing to sail around the southern tip of Africa on their way to Europe, rather than through the Suez Canal, which has extended transit times from Asia by weeks.

The decision to take the longer route was fuelled by conflict in the Middle East and, in particular, the threat of missile attacks on vessels in the Red Sea.

Destine Ozuygur, senior market analyst at Xeneta, said the reversal could undermine shippers' confidence in shipping lines.

“Shippers crave predictability in supply chains. Carriers taking the decision to return to the Red Sea then reversing that decision - even if it is done for important safety reasons - still risks undermining confidence in schedule reliability and eroding trust in partnerships,” he said.

Ozuygur warned that this unpredictability could spread across services and carriers.

“Unpredictability is toxic for supply chains," he said. "Shippers want certainty over when containers arrive at port, even if that means longer transit times around Cape of Good Hope."

In contrast, Maersk Line last week announced the return of its MECL service from India to the US east coast to the Suez Canal route.

Earlier this week, WorldACD said that the return of shipping lines to the Suez Canal would play a role in air cargo performance in 2026.

"Some container shipping services have been returning in recent weeks to the Red Sea route via the Suez Canal, with Maersk this week the latest to announce a limited resumption of services, although volumes remain less than half their level prior to the onset of attacks by Houthis on shipping more than two years ago," WorldACD said.

"Returning capacity to that market is likely to be a factor for air cargo, which has seen higher volumes from that region in the last two years, although the latest tensions between the US and Iran highlight continuing instability in that region that is likely to limit or slow down a full return to pre-2023 supply chain patterns."

At present, another of CMA CGM's services, Indamex, also from India and the US east coast, is still scheduled to utilise the Suez Canal.

“There has not been a CMA CGM announcement on the INDAMEX service, but shippers will look at the decision on FAL and MEX services and fear containers will be arriving later than planned," said Ozuygur.

"Do shippers plan for a transit time of 40 days or 36 days? What impact does this have on warehousing or detention and demurrage fees?

“Multiply this uncertainty across all services and carriers and the risk of widespread disruption becomes clear.”