Carriers' delivery-as-promised score fell to 62.7% as US tariff changes, network realignments and peak season pressures strained operations

Photo: Jaromir Chalabala/ Shutterstock

Air cargo reliability declined last year as airlines reshuffled capacity in response to tariff and trade developments, according to a new report by CargoAi.

The online booking portal provider monitored airline performance using a standardised Delivery As Promised (DAP) methodology based on whether a shipment is Notified for Delivery (NFD) within six hours after the planned arrival.

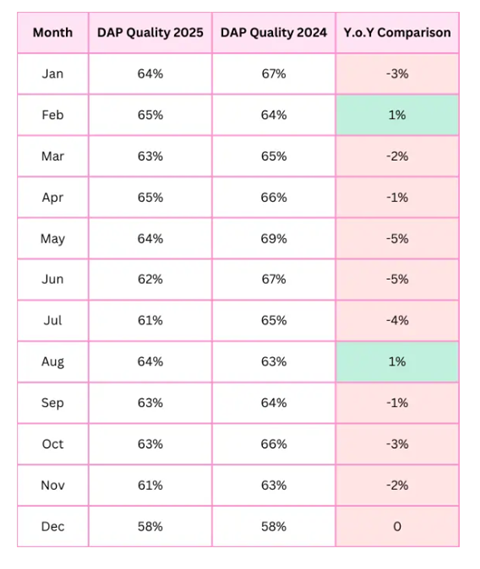

Last year, airlines’ monthly DAP score was lower than the level reported in 2024 in nine out of 12 months, with December matching the prior year’s performance. Improvements of 1 percentage point were recorded in February and August.

The worst performing months in terms of year-on-year comparison were May, June and July, which recorded percentage point declines of 5 points, 5 points and 4 points respectively. The overall score for the year was 62.7%.

Explaining the drop-off in reliability, CargoAi said it was likely related to trade policy changes, capacity realignment, ground handling bottlenecks and peak season pressures.

“US de Minimis tariff reform (mid-year) caused a sharp disruption in Asia–US e-commerce flows, pushing reroutes and delays," the company said. "Carriers had to re-optimise networks and adjust allocations, leading to delivery volatility in May–July."

CargoAi added: "Major airlines reshuffled capacity on the Transpacific & Europe lanes in response to changing demand. While helpful mid-year, these changes introduced network instability and recovery lags."

The data provider added that strain on ground handling agents, especially during peak months, was a leading cause for delays at key airports. Labour shortages, limited apron space and operational congestion could also have affected performance in the fourth quarter.

This year's rise in peak season volumes also had an impact on performance, CargoAi said, with volumes surging in November and December.

"Airlines struggled to maintain delivery precision under high load," CargoAi said.

As well as looking at overall industry performance, CargoAi also looked at reliability levels for individual trade lanes and airlines.

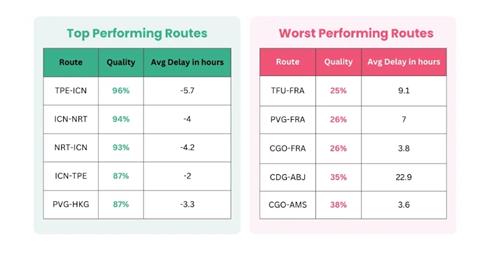

The tech firm said that east Asia corridors, such as Taipei-Incheon, Incheon-Narita and Incheon-Taipei, were amongst the best performing as they benefited from short transit distances, digitised hubs and well-established ground handling coordination.

On the other hand, routes between Asia and Europe, such as Chengdu-Frankfurt, Shanghai-Frankfurt and Zhengzhou-Frankfurt, were the worst performing due to multi-point handovers, customs complexity, and congestion at key European hubs.

The most reliable airlines according to CargoAi were Emirates SkyCargo, TUI, American Airlines, Air China and Royal Air Maroc.