Production bottlenecks and extended passenger aircraft service life are limiting freighter availability, driving up costs and utilisation rates

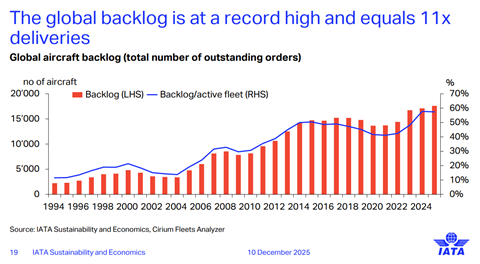

Widebody airfreight capacity is expected to continue to come under pressure in 2026 and the coming years as the backlog of aircraft on order remains at historic highs.

Speaking at a meeting with the media, Julia Seiermann, IATA head of industry analysis, said that the ongoing global aircraft shortage had an impact on the cargo sector last year and the trend is expected to continue.

Seiermann said that aircraft availability remains one of the most significant constraints in the airline industry and for industry growth.

She pointed to statistics showing that the order backlog has now exceeded 17,000 aircraft, which corresponds with nearly 60% of the active fleet and is 11 times the number of aircraft that are delivered each year.

"What this means is that even under the expectation that production and deliveries will accelerate in 2026, which is now the view of analysts, normalisation is unlikely to occur before the early 2030s," Seiermann said.

She said the aircraft production is faced with the challenge of engine availability, longer certification processes and supply chain challenges for aircraft components.

Impact on cargo

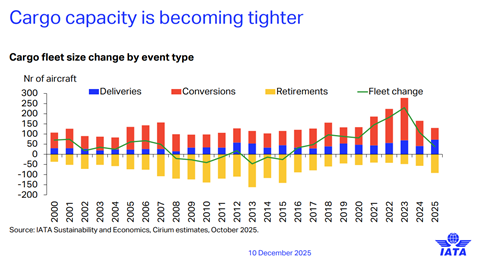

Seiermann added that the number of cargo aircraft being added to the fleet, when deliveries and retirements are taken into account, had fallen in both 2024 and 2025.

She explained that passenger firms are holding onto their older aircraft longer because of the slowdown in deliveries, which is in turn limiting the amount of feedstock available for conversion into cargo aircraft.

This shortage of aircraft and engines is also pushing up the price of the overall conversion. The cost of a GE90 engine used on the 777 has shot up 69%.

According to IBA, the half-life value of the 777-300ER has soared 78% to around $47.6m, up from the 2022 trough of $26.7m in 2022.

"This is due to both a bit of a slow down in new aircraft deliveries but also a steep drop in conversions becuase the airlines that used to convert passenger aircraft after a certain time of service are now keeping them longer and longer becuase they can’t get any new planes and that means that they are not being coverted for cargo use as early as they used to be," she explained.

"To compensate for this, airlines have pushed the utilisation of the fleet to historic highs, and on the cargo side, we see now that the average age of a cargo widebody is 19.6 years."

She said that the higher fleet utilisation and a higher load factor were helping to sustain rate levels, but she added that it also resulted in increased maintenance costs and lower fuel efficiency.

IATA estimates that maintenance costs in 2025 were up $3.1bn, engine leasing costs jumped $2.6bn and the cost associated with larger inventories of spare parts expanded by $1.4bn.

The biggest hit came from extra fuel to run older planes, which added a whopping $4.2bn to collective airline costs.

"At some point, this strategy will reach its limits when aircraft will need to be retired, and then shortages may become even more pronounced."

2026 outlook

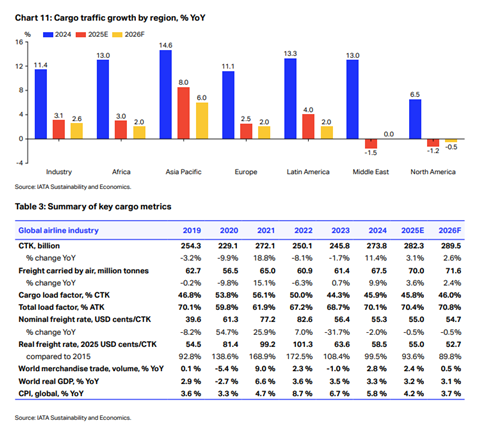

In December, IATA predicted that in 2026 air cargo demand would year on year by 2.6% in cargo tonne km (CTK) to 289.5bn CTK or by 2.4% in tonnage terms to 71.6m tonnes.

The cargo load factor for the year is projected to increase by 0.2 percentage points to 46% - its highest level since 2022.

Despite this increase in load factor, rates are expected to fall by 0.5%. However, the increase in demand will offset the decrease in rates to see airline cargo revenues increase by 2.1% year on year to $158bn.

"For 2026, we expect air cargo demand to continue to expand, albeit at a slower pace than in 2025, in line with softening global trade," IATA said in its recently published global outlook report.

"The slowdown is unlikely to be as pronounced as the general trade deceleration, as air cargo continues to benefit from rising demand for high-value, time-sensitive goods, particularly driven by e-commerce and semiconductors.

"Persistent global uncertainties around tariffs and supply chain disruptions will reinforce air transport’s role as the most reliable mode of delivery."

Demand growth is likely to be led by Asia Pacific at 6%. Other regions should grow around 2%, while the Middle East will stagnate, and North America will edge down by 0.5%.