Flexport has partnered with investment firm BlackRock to expand its financing programme that allows customers to access funding for their supply chain operations.

The partnership will see the forwarder’s financial services arm, Flexport Capital, team up with “funds and accounts” managed by BlackRock to provide up to $250m in financing to customers.

”Through this financing, Flexport is able to offer flexible working capital to its customers for everything from inventory and logistics finance to term loans, asset-based lines of credit, tariff financing, and more,” Flexport said in a press release.

”Flexport customers can also access funding at any stage of the product lifecycle, from supplier pickup to final delivery and beyond, without the complex fees or documentation common in traditional lending.”

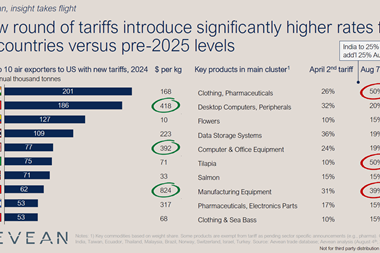

Flexport’s expansion of its financing programme comes as companies are facing the challenge of paying higher tariff bills for goods being imported into the US, which adds extra costs before products are sold.

“Global trade runs on cash flow, and too many great businesses fall behind simply because they can’t fund the gap between when they buy inventory and when they sell it. Together with BlackRock, Flexport Capital offers businesses more access to flexible capital to help them scale,” said Flexport chief financial officer, Stuart Leung.

Since launching Flexport Capital in 2017, Flexport has provided more than $2 billion in financing to its customers, achieving an annualised growth rate of 71% over the past five years.