The administration in Washington appears to be on a mission to cripple the air cargo industry with attacks on its most dynamic and/or lucrative segments.

First it took a sledgehammer to e-commerce with the removal of de minimis exemption from parcels sent to the US from China, a move that triggered cancellations of dozens of freighter charters.

Subsequently Washington extended the end of de minimis to e-commerce shipments from anywhere on the globe.

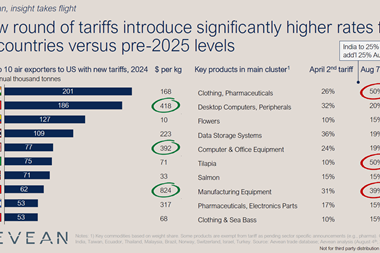

Now the healthcare sector is in the administration’s crosshairs. In early August the US president Donald Trump announced that tariffs would be imposed on pharmaceuticals.

From an initial low rate those would soar to more than quadruple the value of such imports.

“In one year, one and a half years maximum, it’s going to go to 150% and then it’s going to go to 250% because we want pharmaceuticals made in our country,” Trump declared.

The president also announced plans to double the cost of imported semiconductors with tariffs of “about 100%”.

An investigation into semiconductor imports to assess their impact on national security and the domestic supply chain is in progress at the time of writing this column.

Similar investigations have been launched by the US government on other products, including commercial aircraft and jet engines.

These plans threaten vital markets for airfreight and raise question marks over industry developments like pharma corridors involving US gateways.

These plans threaten vital markets for airfreight and raise question marks over industry developments like pharma corridors involving US gateways.

In the space of a few months a buoyant industry has found itself forced to contemplate substantial hits to key revenue streams in the largest market.

Among other things, this nudges airline boardrooms to take a second look at their plans for freighter aircraft.

In conjunction with a scramble for widebody passenger planes it could also prompt aircraft makers to reassess their allocations for cargo and passenger plane production.

The decision of Air Lease, which was in line to take the first A350 freighter, to cancel its order for the aircraft offers additional food for thought there.

Airports – including heavyweights with strong origin & destination flows like Hong Kong and Shanghai Pudong – have made moves to facilitate/stimulate transit flows.

In June Hong Kong International Airport formally launched a digital platform for airlines to find interline partners and collaborate on transfers.

The following month saw India’s Bureau of Civil Aviation Security change the rules to allow cargo transfers without a need for re-screening at transfer airports.