Platform operates on DDP terms with AI-vetted carriers competing in reverse auctions, targeting cost reductions of 15-60% for smaller importers

US logistics technology company AiDeliv has launched to help small shippers secure better rates for China-US air and ocean cargo capacity.

The platform helps small importers overcome the lack the negotiating power of large enterprises. Without transparency or competition in freight pricing, small shippers consistently overpay for routes, compared to bigger shippers or freight forwarders, AiDeliv stressed.

The company's platform combines demand from multiple small businesses into volumes that carriers compete for.

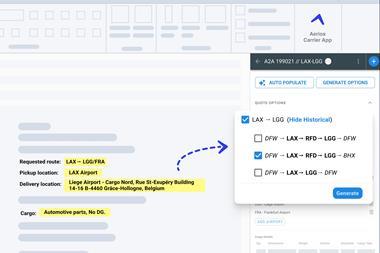

On AiDeliv, freight carriers compete in real-time reverse auctions for cargo. Before carriers see a shipment, the platforms AI technology screens them for route history, customs performance and damage rates, said the company. Only providers with proven track records are able to bid.

AI-vetted carriers on the platform bid in a reverse auction—each offer must beat the last. The winning bid isn't just the lowest price; it's the best offer among carriers already filtered for quality.

AiDeliv's platform is free for shippers and operates on DDP (Delivered Duty Paid) terms—all customs duties, taxes, fees and door-to-door delivery are included in the final bid. Businesses see the exact total cost upfront, with no risk of surprise charges at customs clearance.

Most freight forwarders offer transparent DDP pricing only to large corporate clients with predictable volumes, stated AiDeliv.

Smaller importers have to use DDU (Delivered Duty Unpaid)—uncertain final costs that hit at customs clearance. But the AiDeliv platform automates DDP coordination through its reverse auction exchange, making transparent landed costs accessible to smaller importers.

Longer-term capacity in today's volatile air cargo market is often locked into contracts by forwarders and shippers, and spot rates, especially during peak season can be very high - an option that isn't always viable for smaller shippers.

The end of the de minimis exemption from China to the US also put an end to duty free imports under $800, putting further pressure on the profit of shippers.But although China's e-commerce volumes initially shifted to Europe, China-US volumes have now recovered.

The primary focus of the platform is China to US freight, but the platform also covers routes from China, Vietnam, India, Thailand, Malaysia, and Indonesia to USA, Europe, Canada, Australia, and Japan.

During closed beta testing in Summer and Autumn 2025, the platform processed $600,000 in shipments. Users reported cost reductions of 15-60% compared to their previous arrangements, said AiDeliv.

"Traditional shipping puts small importers at the bottom of the priority list," said AiDeliv founder Vitalii Savryha. "We flipped that. On our platform, carriers have real skin in the game—they compete to get in, and they know that one mishandled shipment could cost them access to the entire network. Your cargo stops being 'just one pallet' and becomes part of something they can't afford to lose."