Photo: Lufthansa Cargo

Lufthansa's cargo and logistics division saw revenue increase 21% year on year in the first quarter of 2025 to €834m, with the help of extra freighter capacity, e-commerce business from Asia and overall robust market demand.

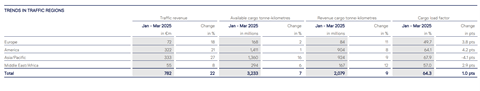

Germany-based Lufthansa Group also reported increased cargo demand, yields and load factor in the first quarter of 2025. Demand increased 9% year on year to 2.1bn revenue cargo tonne km, the load factor was up one percentage point to 64.3% and yields improved by 11.9%.

The company benefited from the arrival of an additional Boeing 777 freighter in the second half of last year, which helped grow capacity by 7% compared with last year in combination with expanded passenger operations.

Additionally, Lufthansa Cargo achieved adjusted earnings before interest and tax (EBIT) of €62m, which was €84m higher than the previous year's EBIT loss of €22m.

”Increased yields and loads supported Lufthansa Cargo’s strong Q1 result,” said Lufthansa in its first quarter interim report presentation.

”Strong demand from China as well as stocking effects ahead of anticipated tariffs in the US have been driving earnings improvement,” added the company.

"Yields increased in all traffic regions except the Middle East/Africa in the first quarter of 2025 and were overall 11.9% higher than in the previous year. Apart from the normalisation of freight rates, the first quarter of the previous year had also been impacted by various strikes," commented Lufthansa Group.

Overall, revenue at the Lufthansa Group increased by 10% year-on-year to €8.1bn due to the expansion of the flight programme, rising yields and strong growth in the Logistics and MRO business segments.

Looking ahead, the Lufthansa Group said it expected trade tensions to potentially impact performance in the coming months.

"The emerging trade tensions between the US and key trade partners such as China and the EU are leading to an increasingly volatile global economic environment," Lufthansa said in its first quarter report.

"Deutsche Lufthansa may suffer potential financial losses due to a more subdued level of demand, or changes in the nature of demand, possible decreases in airfreight volumes, potential rises in costs of materials, aircraft and aircraft parts, currency and commodities price fluctuations, possible tariffs as well as uncertainty on the financial and capital markets and changes on these markets."