Market analyst predicts rate softening will drive contract restructuring as forwarders compete for market share in flattening volume environment

Xeneta has predicted that a market downturn will see airfreight rates drop in 2026, prompting shippers to seek longer-term contracts to their advantage.

Delegates at Xeneta’s recent Ocean and Air Freight Summit in Barcelona were told that capacity is expected to exceed demand next year and this will fuel a decrease in rates and opportunities for shippers to reduce their costs.

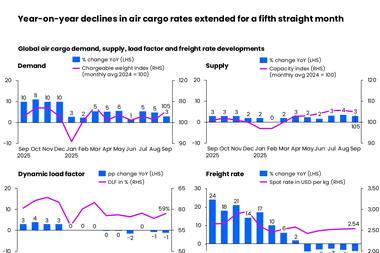

Niall van de Wouw, Xeneta's chief airfreight officer, said: "Just like gravity, the projected 2026 demand and supply growth suggests air cargo rates are likely to come down."

"With demand growth expected to trail capacity expansion, shippers will look to take advantage of the resulting downward pressure on rates by securing more long-term contracts — locking in predictability while the market softens," explained Xeneta.

The analyst added: "At the same time, forwarders will be focused on expanding their market share to sustain growth in a relatively flat volume environment. Together, these dynamics are likely to drive contract rates between shippers and forwarders even lower, adding fresh complexity to commercial relationships."

Xeneta previously said in its September air cargo demand release that, as a result of rate fluctuations, shippers and forwarders are looking to secure longer-term deals.

The company said that in the third quarter, the share of six-month deals increased by 10 percentage points year on year to 22% “timed to expire just after the peak season and ahead of the next annual cycle”.

Changing market conditions could see index-linked contracts become more common, as van de Wouw noted.

"While the post-pandemic market has seen airlines and forwarders become more transactional in nature, the potential for data-driven, flexible contracting models — similar to what’s emerging in ocean freight — could help both sides navigate the next cycle with greater stability and trust," said Xeneta.

Wenwen Zhang, lead for airfreight development and analyses, noted there had been six key factors that shaped air cargo demand in 2025.

She said these were supply chain disruptions, the end of the US de minimis exemption, China + X manufacturing expansion, US import tariffs, US + X consumption trends and AI-related investments.

She further questioned how long airlines could continue to thrive with these market factors at play.